The NOW Index is in the neutral zone

10/13 Recap: - The S&P opened with a 7 handle gap up and then continued 8 handles higher into a 9:40 AM high of the day. From that high, the S&P dropped 36 handles into a 10:14 AM low of the day. From that low, the S&P zig zagged 41 handles higher into a 2:02 PM high of the day. From that high, the S&P declined 17 handles into a 2:44 PM low. From that low, the S&P rallied 11 handles into the close.

10//13 - The major indices had a mixed to moderate up day with the following closes: The DJIA – 0.53; S&P 500 + 13.15; and the

Nasdaq Composite + 105.71.

Looking ahead – We are now approaching the beginning of about one week of multiple successive change in trend windows. It’s going to get very busy. Usually, we when have this kind of pattern, we get multiple whipsaws with up one day and down the next. Please see the details below.

The NOW Index is in the NEUTRAL ZONE.

Coming events

(Stocks potentially respond to all events).

2. C. 10/14 AC – Mercury 0 North Latitude. Major change in trend Corn, Oats, Soybeans, Wheat.

D. 10/15 AC - Neptune 90 US Mars. Major change in trend US Stocks, T-Bonds, US Dollar.

E. 10/15 AC – Jupiter in Aquarius turns Direct. Major change in trend Copper and Oats.

3. A. 10/18 AM – Mercury in Libra turns Direct. Major change in trend Corn, Oats, Soybeans, Sugar, and WHEAT.

B. 10/19 AM – Helio Saturn 90 Uranus. Major change in trend Coffee and COPPER.

C. 10/19 AC – Mercury Perihelion. Major change in trend CORN, Gold, Oats, OJ, Soybeans, Wheat.

D. 10/20 AM - Full Moon in Aries. Major Change in Trend Financials, Grains, Precious Metals and especially

Sugar and Wheat.

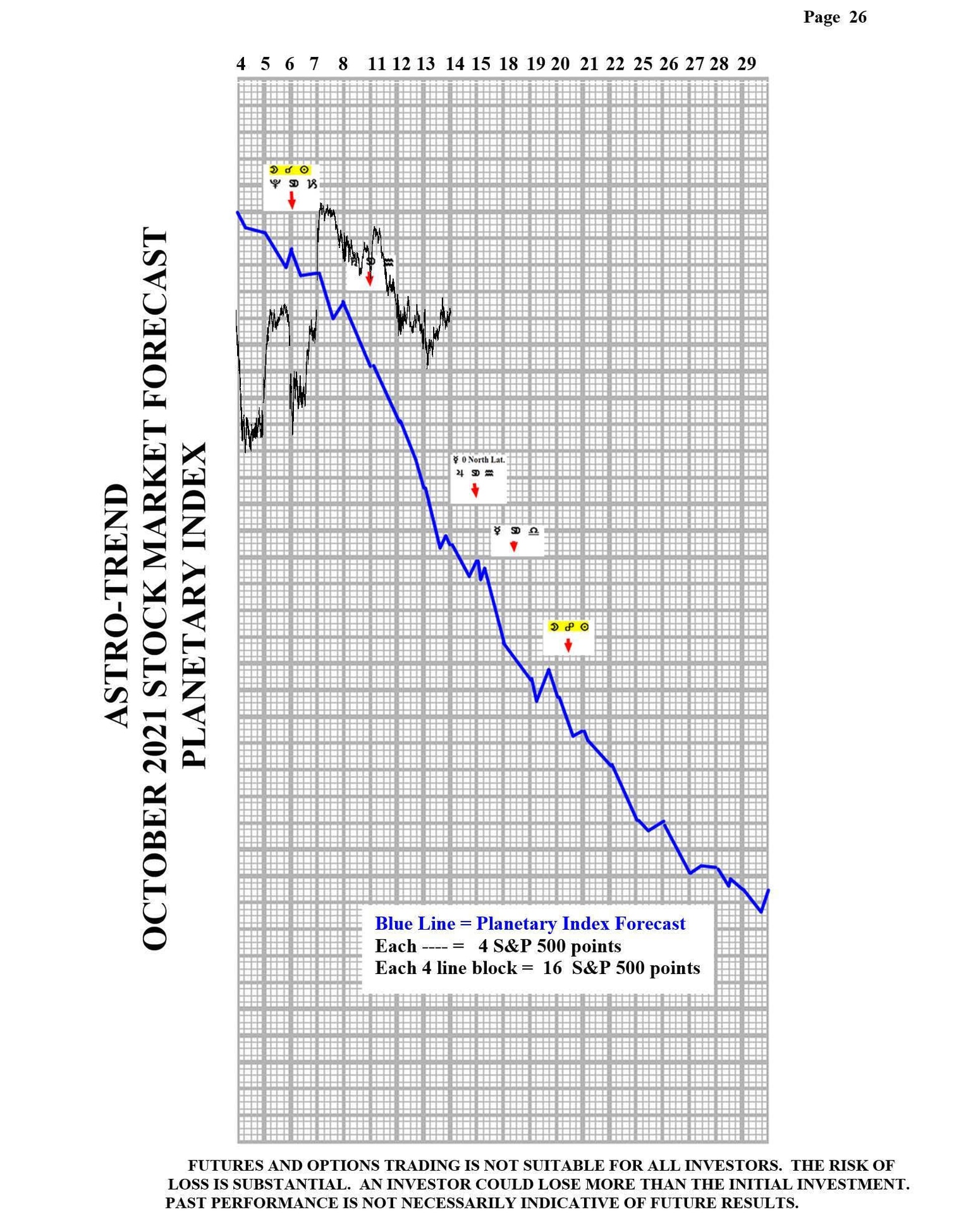

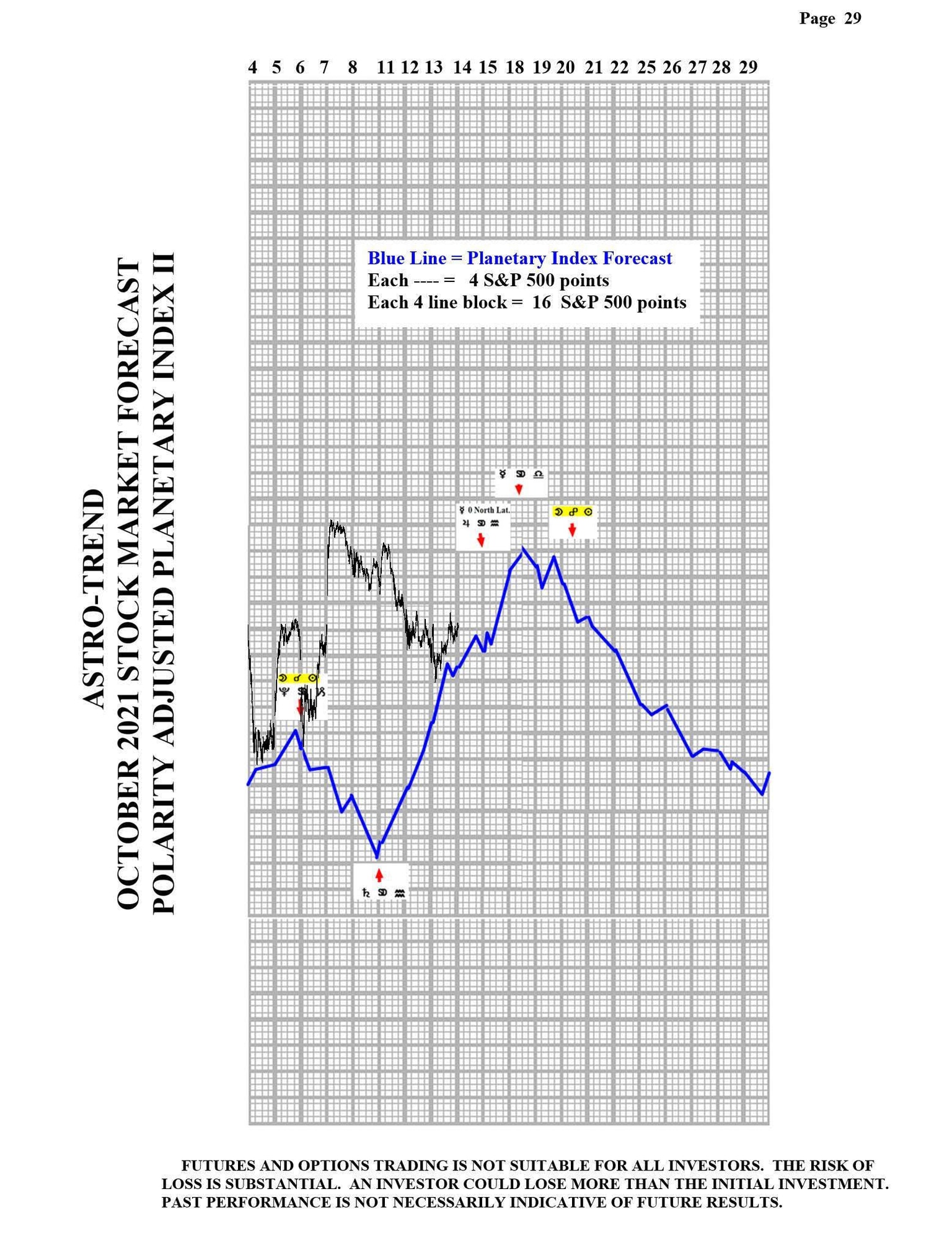

Stock market key dates

Fibonacci – 10/15, 10/18, 10/29.

Astro –10/14, 10/15, 10/20, 10/25, 10/29 AC.

Please see below the S&P 500 10 minute chart.

Support - 4330 Resistance – 4410.

Please see below the S&P 500 Daily chart.

Support - 4330, 4260 Resistance – 4410.

Author

Norm Winski

Independent Analyst

www.astro-trend.com