The Nikkei is in for a very strong seasonal time post the US election [Video]

![The Nikkei is in for a very strong seasonal time post the US election [Video]](https://editorial.fxstreet.com/images/Markets/Equities/stock-certificates-11742678_XtraLarge.jpg)

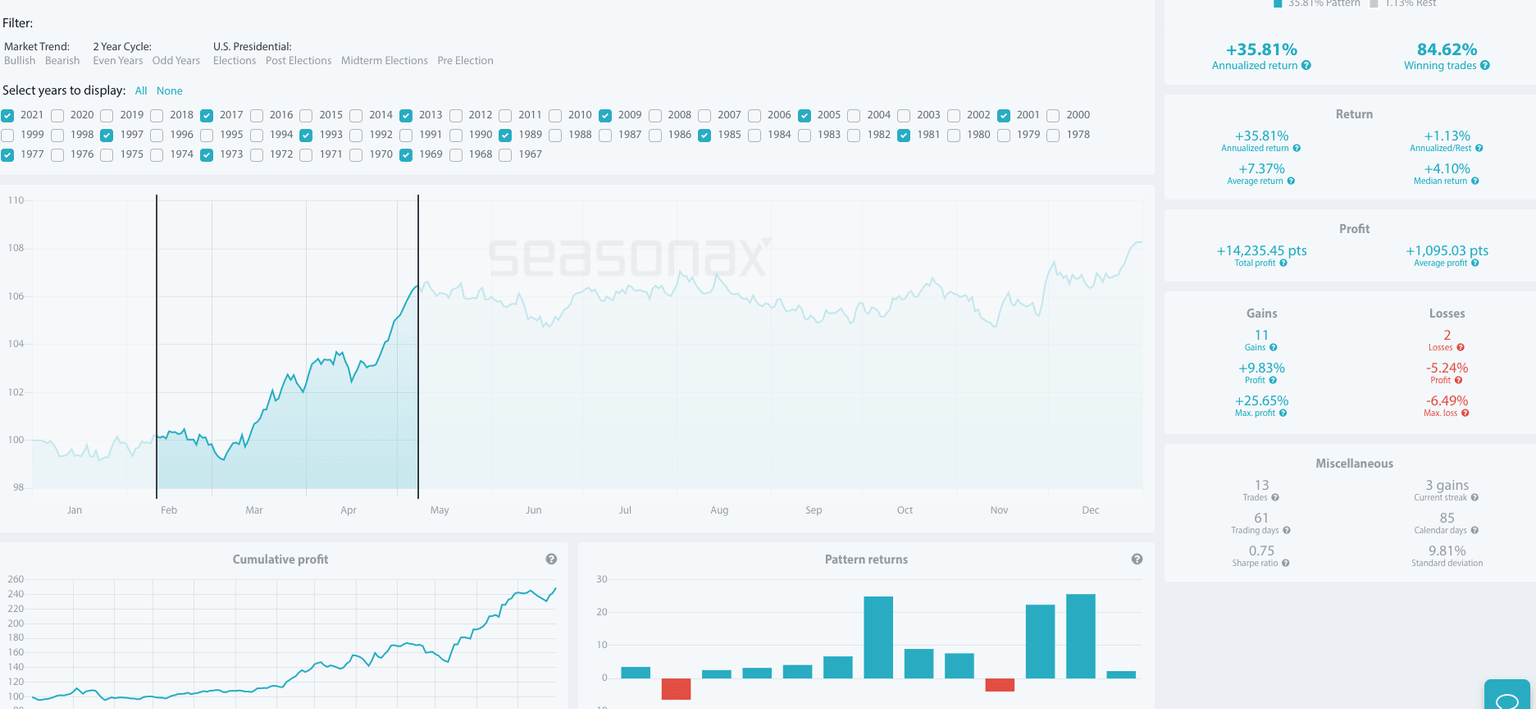

The Nikkei 25 tends to rise strongly post US elections. If you look at the chart you will see that in the last post-elections years (2017, 2013, 2009, etc) going all the way back to 1969 the Nikkei has tended to have very strong gains.

To be precise the gains have been an average of +7.37% and the largest profit was +25.65% in 2013. The year 2009 was also a strong year post Barack Obama’s election with a +20% plus gain. In the 13 election years, there have only been two years that saw falls.

Trading Risks: The main risk to this trade is on a negative risk tone that weighs on stocks.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.