The 'new' Gold starts to disappoint – What’s next?

Bitcoin is already declining, and miners continue to move higher. Sounds familiar?

It should, if you’ve been following both markets for at least a few years.

Warning signs emerge

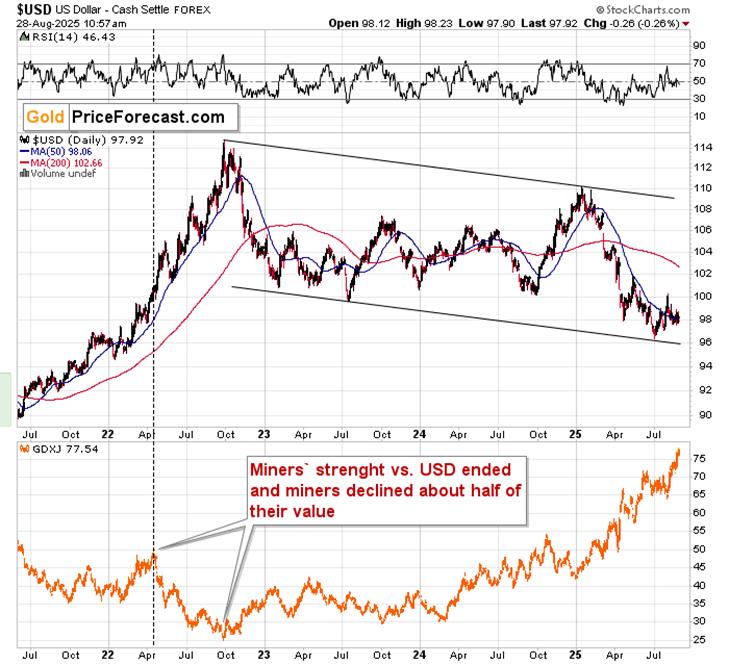

We saw something like that in 2022, when the precious metals market was topping. In particular, miners were strong right before their huge decline.

Of course, it all seemed bullish at that time – gold, silver, and mining stocks were after weeks of rallying and mining stocks were making new short-term highs, outperforming gold and silver.

Bitcoin was taking a breather after a decline.

We see something similar right now. The rally in the miners is bigger while the decline in bitcoin is less profound in percentage terms (it’s quite similar in absolute terms) – but the overall theme is alike. Miners are outperforming while bitcoin is already moving down.

This is important because when that happened in 2022, it heralded declines in all above-mentioned markets.

That’s when miners stopped being strong relative to what was going on in the USD Index and they gave up. Literally – miners gave up 50% of their value in the following months.

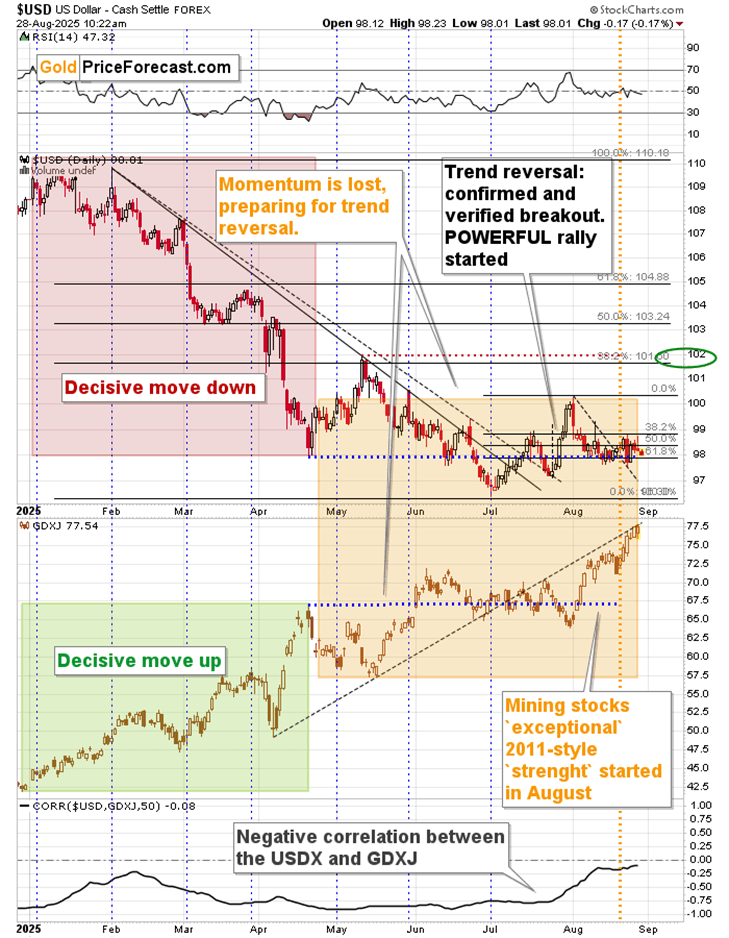

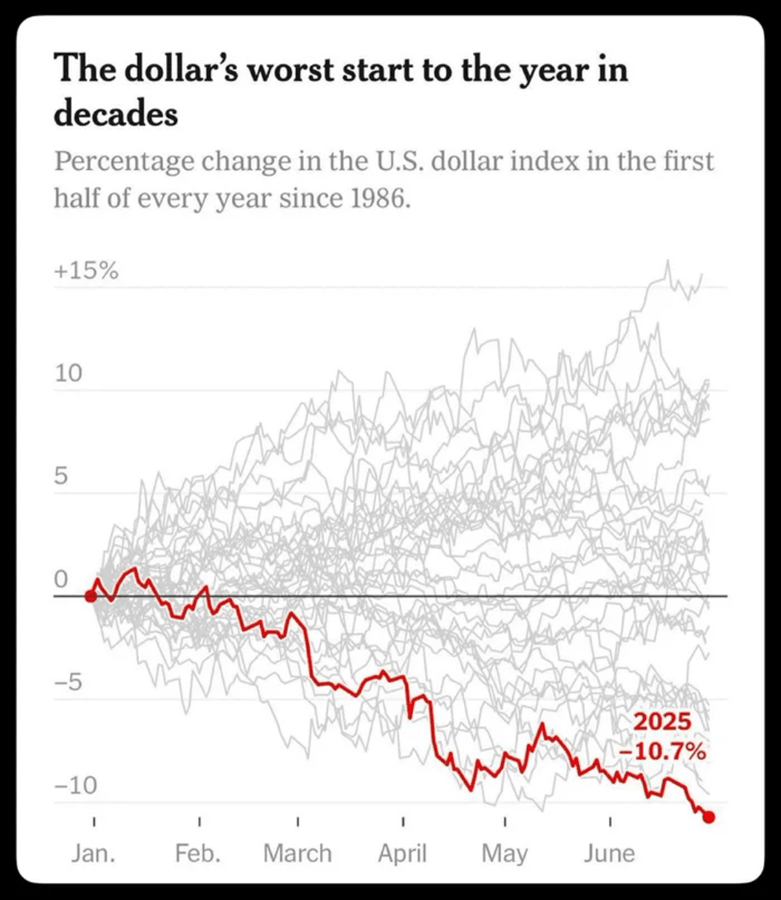

Right now, the USD is still consolidating, but the outlook is clear. The medium-term and short-term breakouts were confirmed and verified. The tariffs are fundamentally bullish for the USD, and yet the sentiment for the latter is at its absolute worst.

While the stock market seems to be at the crossroads, the above is the perfectly bullish combination for the USD.

Not only has the price already declined in an extreme way and is bound to rally if it was only due to mean reversion, but it’s also the case that the fundamental factors are working in its favor, and we also have positive technicals – the breakouts.

The calm before the storm?

As you can see on the previous chart, USD and GDXJ move in the opposite directions in general – the exceptions, like the current one, are short-lived.

All in all, it seems that the rally in the mining stocks and their “strength” are going to be reversed, and that we won’t have to wait too long for that. There are superb trading opportunities in all markets, and but the one in the mining stocks might deliver truly exceptional profits over the medium term, if one is able to withstand the short-term price movement.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any