The Monetary Sentinel: The RBA is expected to lower its OCR to 3.60%

With tariff concerns still lingering, central banks are expected to step in this week to shore up their economies with further rate cuts. Both the RBA and the BoT are seen trimming their policy rates by 25 basis points, while the Norges Bank faces a closer call after its surprise cut in June.

Reserve Bank of Australia (RBA) – 3.85%

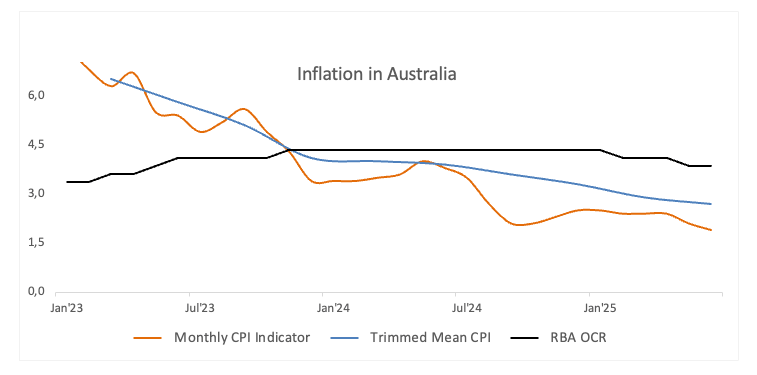

The Reserve Bank of Australia wrong-footed markets on July 8, keeping its OCR at 3.85% instead of delivering the rate cut investors had been banking on. In a rare split decision, six board members backed the hold while three pushed for a cut — a sign the bank is treading carefully as it waits for firmer evidence that inflation is under control.

In her latest remarks, Governor Michele Bullock has doubled down on her “measured and gradual” approach to easing, even after a weaker-than-expected June jobs report. She argued that leading indicators suggest the jobless rate isn’t set to climb much further in the near term, playing down fears that labour market weakness could force a faster pivot.

Bullock also warned that the Monthly CPI Indicator — which she noted can be volatile — hints the Q2 drop in trimmed mean inflation may not match the RBA’s May forecast. The bank currently sees it easing to 2.6% YoY from 2.9% YoY in Q1.

Meanwhile, investors remain convinced the RBA will start cutting on August 12, with futures fully pricing a 25-basis-point move and about 75 basis points of easing over the next 12 months.

Upcoming Decision: August 12

Consensus: 25 basis point cut

FX Outlook: AUD/USD remains mired within its multi-week consolidative range, although with a snail-paced constructive tilt. While above its 200-day SMA around 0.6390, spot should maintain a bullish bias, with the immediate hurdle at its 2025 ceiling near 0.6630 (July 24).

Norges Bank (NB) – 4.25%

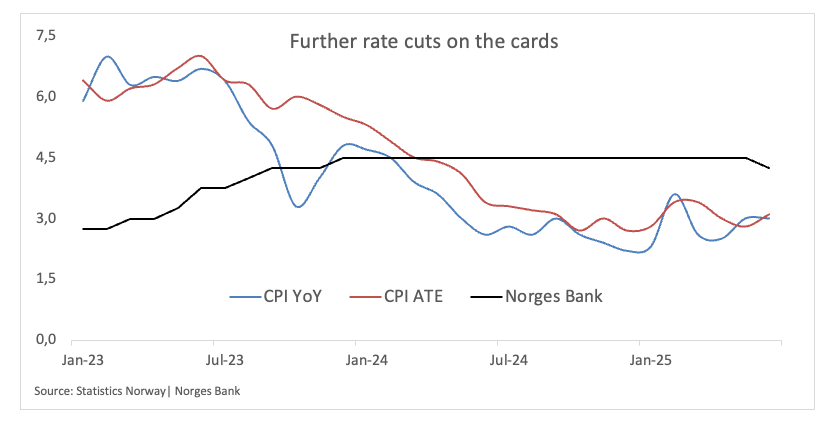

The Norges Bank surprised markets in June by lowering its policy rate by 25 basis points to 4.25%, marking the bank’s first reduction of its rates since 2020. The decision was justified by a more favourable inflation outlook. Furthermore, the NB left the door open to extra rate cuts in the next meetings.

Policymakers admitted that the economic outlook remains uncertain, but their baseline scenario points to further easing in 2025. Governor Ida Wolden Bache went a step further, suggesting that one or two additional cuts could land before year-end, potentially taking the rate down to 4.00% or even 3.75%.

When the central bank meets in August, investors will be looking for clues on how quickly that easing might unfold and whether the longer-term path—currently projecting rates near 3% by the end of 2028—remains intact.

Upcoming Decision: August 14

Consensus: Hold

FX Outlook: The Norwegian Krona (NOK) has been navigating a consolidative range since late June, following a rebound from the 11.4000 region to as high as the 12.0000 zone as investors have been assessing the unexpected rate cut by the NB in June. While above its key 200’day SMA around 11.7130, further upside in the cross should remain on the table for the time being.

Bank of Thailand (BoT) – 1.75%

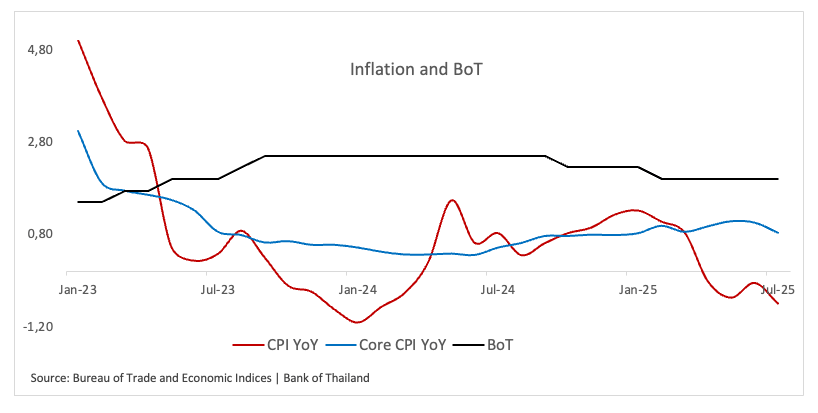

The BoT is heading into its August meeting with mounting pressure to act.

In June, the central bank held rates steady but left the door wide open to cuts if the economic outlook worsened. Since then, the data have taken a turn for the worse: private consumption slipped 0.3% in June from May, exports dropped nearly 5%, and inflation has been negative for four straight months through July.

The headwinds don’t end there. A deputy governor—Roong Mallikamas, a frontrunner to take over as governor in October—warned that growth is set to weaken further in the second half of 2025, citing the threat of US tariffs and fresh domestic political instability. “We do anticipate a marked slowdown,” she told Reuters, calling for monetary policy to remain accommodative.

Economists polled by Reuters expect the central bank to cut its key rate this week, aiming to shore up an economy struggling with soft demand, persistent deflation, and external trade risks. Markets will be watching for signs of how deep the easing cycle could run.

Upcoming Decision: August 13

Consensus: 25 basis point cut

FX Outlook: The Thai Baht’s (THB) monthly slide has gathered pace, with USD/THB pushing toward the 32.30 area in recent days—close to its lowest levels of the year. Despite this latest bout of strength, the Baht remains vulnerable to trade-related uncertainty in the weeks ahead. For now, with the pair still trading below its key 200-day SMA near 32.90, the broader bearish bias stays intact.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.