The Monetary Sentinel: Tariffs and growth outlook bolster a cautious message

A packed calendar of central bank meetings this week will see interest rate decisions from Poland’s NBP, the Federal Reserve, the Bank of England, Norway’s Norges Bank, Sweden’s Riksbank, and Malaysia’s BNM. While the consensus points to no major changes in policy, the backdrop of global uncertainty—particularly around US tariffs—means policymakers are likely to strike a cautious tone. Markets will be watching for any signals on how central banks plan to navigate the shifting economic landscape.

National Bank of Poland (NBP) – 5.75%

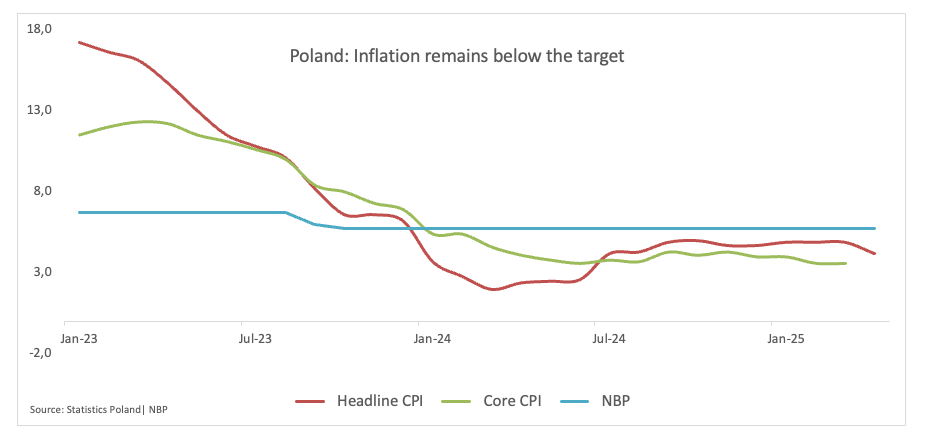

The National Bank of Poland (NBP) held its main interest rate at 5.75% in April but signaled that cuts could be on the horizon. The central bank now expects inflation to decline faster than previously forecast, citing weaker-than-expected data from early 2025.

Following the gathering, Governor Adam Glapiński said that a rate cut could come as soon as May, though any move would depend on the data. He also noted he favours a one-off cut rather than the start of a full easing cycle.

Inflation in March remained at 4.9%, above the NBP’s 1.5–3.5% target, but analysts expect it to slow in the coming months. The NBP has kept rates unchanged since October 2023, but with inflation softening and growth remaining fragile, expectations for a cut later this year are gaining traction.

Upcoming Decision: May 7

Consensus: Hold

FX Outlook: Following recent yearly lows vs. the Euro near 4.3100, the Polish Zloty (PLN) now seems to have emabarked on a range bound theme, with EUR/PLN hovering just above its key 200-day SMA around 4.2600.

Federal Reserve (Fed) – 4.25%-4.50%

April’s US jobs data delivered another upside surprise, with 177K new jobs added and the unemployment rate holding steady at 4.2%. The figures, released just ahead of the Federal Reserve’s May 7 policy meeting, support expectations that the central bank will keep rates unchanged.

Markets had been watching closely for signs of labour market softness amid President Trump’s aggressive trade agenda. While sweeping tariffs announced last month initially unsettled markets, a delay in implementation has calmed some of the volatility.

With inflation still running above the Fed’s 2% target and job growth steady, the central bank is expected to maintain a cautious, data-dependent approach.

Friday’s data gives the Fed room to be patient, but the economic outlook has dimmed—and a return to rate cuts later this year is still on the table if conditions worsen.

Following the report, traders pushed back expectations for the first rate cut to July, up from earlier bets on June.

Upcoming Decision: May 7

Consensus: Hold

FX Outlook: The US Dollar Index (DXY) managed to bounce off multi-year troughs just below the 98.00 barrier, although it is expected to remain under pressure while below its crucial 200-day SMA near 104.40. A sustained breakout of the psychological 100.00 barrier remains key for bulls’ aspirations.

Bank of England (BoE) – 4.50%

The Bank of England is expected to lower interest rates by 25 basis points on May 8, as rising global risks—most notably from US President Trump’s new tariffs—darken the economic outlook. Some economists believe the BoE may soon need to quicken its pace of monetary easing.

Governor Andrew Bailey, speaking in Washington in past days, said the bank was taking the risks from Trump’s trade policies “very seriously,” following a fresh downgrade to global growth forecasts by the IMF.

At home, UK economic signals have turned more worrying. April private-sector activity fell to its lowest level since the 2022 market turmoil triggered by former PM Liz Truss’s fiscal plans. Meanwhile, US output has contracted for the first time in three years.

Inflationary pressures remain a concern. While March UK CPI came in below expectations at 2.6%, it’s still above the BoE’s 2% target—and analysts forecast a rise above 3% in April due to higher energy tariffs.

Wage growth is another constraint: annual pay increases are running near 6%, roughly twice the pace consistent with the inflation target. Business and consumer surveys also show inflation expectations remain stubbornly high.

Upcoming Decision: May 8

Consensus: 25 basis point rate cut

FX Outlook: GBP/USD entered a corrective move following peaks north of 1.3400 the figure in the last week. Further gains, however, remain in the pipeline as long as Cable maintains its business above the 200-day SMA near 1.2850.

Riksbank – 2.25%

Sweden’s Riksbank is expected to leave interest rates unchanged at its May 8 meeting, as officials weigh persistent inflation against the benefits of a stronger krona and a weak growth backdrop.

The Krona has gained more than 6.0% against the Euro since November, a move that should eventually help tame imported inflation—but the impact has yet to fully materialise. With inflation still running above target and growth stagnating, the central bank appears stuck in wait-and-see mode.

Preliminary April inflation data, due the day before the decision, is expected to show core CPIF holding close to March’s 3.0% YoY pace. In addition Q1 CPIF averaged 2.5%, and excluding energy, inflation ran hotter at 2.9%—both above the Riksbank’s 2.0% target.

This persistent tension between price stability and economic support is likely to keep the Riksbank sidelined well into 2025. Its policy update is expected to reiterate recent guidance: rates will remain on hold until clearer disinflation emerges.

Upcoming Decision: May 8

Consensus: Hold

FX Outlook: The Swedish Krona (SEK) keeps its constructive tone so far this year, increasing its appreciation vs. the single currency since February. EUR/SEK now appears within a consolidative range below the 11.0000 barrier.

Norges Bank (NB) – 4.50%

Norges Bank held its key interest rate at 4.50% in late March, maintaining the highest level since 2008 as inflation came in hotter than expected. The decision marks a clear shift from earlier guidance pointing to a cut this spring, with policymakers now signalling that easing will likely begin “in the course of 2025.” February’s core inflation hit 3.4%, well above the 2% target and up from 2.8% in January, prompting concerns that a premature rate cut could reignite price pressures.

The central bank now sees rates at 4.00% by year-end—up from a previous forecast of 3.75%—and has revised its inflation projections higher for both 2025 and 2026. While most Western peers have begun to ease, Norges Bank remains firmly on hold, citing domestic inflation risks as justification for diverging from the global rate-cutting trend.

Despite the tighter stance, businesses remain upbeat, with Q1 growth expectations revised higher. However, the central bank trimmed its 2025 non-oil GDP forecast to 1.2%. The message from Oslo: monetary policy will stay tight until inflation is clearly on track.

Upcoming Decision: May 8

Consensus: Hold

FX Outlook: The Norwegian Krona (NOK) has been appreciating on a persistent basis in the last three weeks, as EUR/NOK seems to have embarked on a correction after April’s YTD peaks past the 12.2000 level. So far, extra losses should meet a solid contention zone around the key 200-day SMA around 11.7300, while the loss of this area could pave the way for a retest of the yearly bottom around 1.1125 (April 2).

Bank Negara Malaysia (BNM) – 3.00%

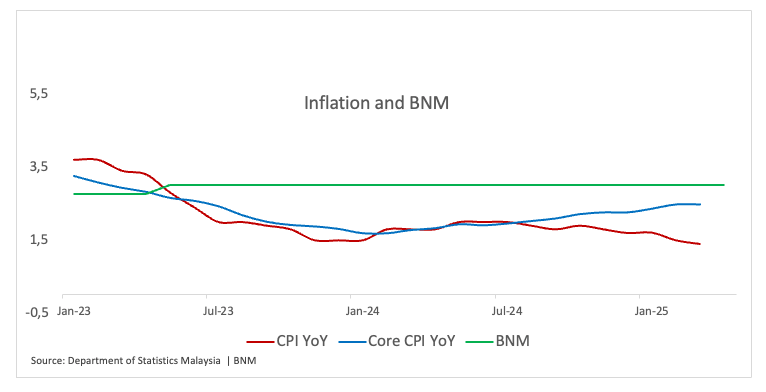

Bank Negara Malaysia (BNM) is likely to maintain its overnight policy rate at 3.00%, as policymakers adopt a wait-and-see stance amid ongoing global trade tensions and policy uncertainty.

While the external environment remains fluid, Malaysia continues to post positive—albeit slower—growth. Risks tied to tariffs and global trade developments have led to a more cautious economic outlook.

Inflationary pressures remain muted due to softer domestic demand, and financial markets are holding steady, giving BNM room to stay on hold while it monitors how global developments affect the local economy.

Upcoming Decision: May 8

Consensus: Hold

FX Outlook: The Malaysian Ringgit (MYR) has been steadily appreciating vs. the US Dollar since early April. Against that, USD/MYR dropped to levels last seen in early October 2024 near 4.2500 on Friday, down for the fifth consecutive week and paving the way for extra losses in the short-term horizon.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.