The Monetary Sentinel: Mixed views on rate decisions

With another quiet week for G10 central banks, attention is turning to Poland’s NBP and Malaysia’s BNM. Markets expect the NBP to lean toward further easing, while BNM is likely to hold steady after delivering its first rate cut in five years back in July.

Bank Negara Malaysia (BNM) – 2.75%

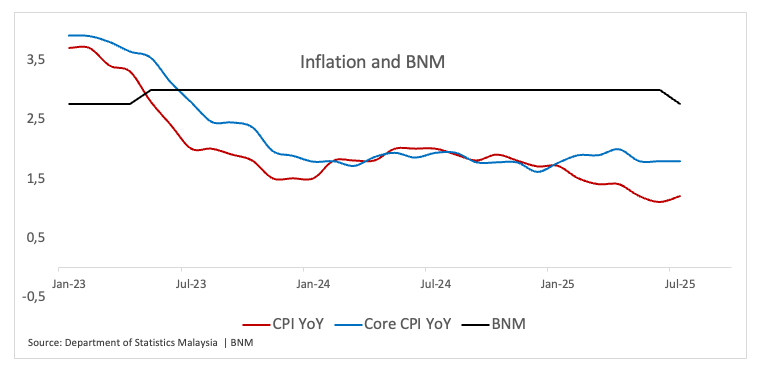

Malaysia’s central bank lowered interest rates for the first time in five years on July 9, cutting its overnight policy rate by 25 basis points to 2.75% from 3.00%. The move, which had been widely expected, comes as global trade tensions weigh on the country’s export-driven economy.

The decision followed closely on the heels of US President Trump’s announcement of a 25% tariff on Malaysian exports to the US, a development that adds fresh uncertainty to the outlook.

BNM said the global growth picture remains clouded by tariffs and geopolitical tensions, which could fuel volatility in financial markets and commodity prices. Despite the resilience of the domestic economy, the central bank cautioned that external risks could hinder growth.

For now, the central bank anticipates that solid domestic demand and exports will continue to support activity. Looking ahead, the bank sees headline inflation in a 2.0–3.5% range in 2025, with core inflation between 1.5% and 2.5%.

That suggests further easing remains on the table if trade headwinds intensify.

Upcoming Decision: September 4

Consensus: Hold

FX Outlook: The Malaysian Ringgit (MYR) has embarked on a consolidative phase in the lower end of its yearly range vs. the US Dollar (USD), with USD/MYR hovering around the 4.2000 region for now. Occasional progress on the trade front is expected to maintain the risk-on trade in place, which should in turn lend support to MYR. Looking at the broader picture, USD/MYR should maintain its bearish outlook while below its 200-day SMA near 4.3500.

National Bank of Poland (NBP) – 5.00%

The NBP surprised markets with a 25 basis point rate cut at its July 2 meeting, bringing its main policy rate down to 5.00%. The move came alongside fresh forecasts pointing to a sharper decline in inflation than previously expected.

The new projections show inflation easing to 3.5%–4.4% in 2025. Price growth is expected to fall further to 1.7%–4.5% in 2026 and 0.9%–3.8% in 2027. Crucially, the bank now expects inflation to return sustainably to its 2.5% ±1pp target range by the first quarter of 2026, earlier than it had projected just a few months ago.

Near-term dynamics are still bumpy: Inflation is seen at 2.9% in Q3 2025, rising to 3.6% in Q4 before easing back to 3.5% in Q1 2026, at the very top of the target band. Meanwhile, inflation is expected to slow to 2.1% in Q4 2027.

Growth prospects look firmer. GDP is projected to pick up to 3.6% in 2025, before moderating to 3.1% in 2026 and 2.5% in 2027.

In the meantime, market participants see around an 80% chance of another quarter-point reduction to the bank’s rate.

Upcoming Decision: September 3

Consensus: 25 basis points cut

FX Outlook: The Polish Zloty (PLN) has been navigating a range-bound pattern since May vs. the Euro (EUR), with EUR/PLN trading above the 4.2600 barrier, slightly above its key 200-day SMA. Furthermore, while above the latter, the cross is expected to face extra downside pressure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.