The Monetary Sentinel: Further easing on the cards for the RBNZ

With tariff concerns still around, central banks are expected to remain cautious this week, with only the Reserve Bank of New Zealand forecast to consider further rate cuts, as opposed to Bank Indonesia, Riksbank, and the People's Bank of China, which are anticipated to maintain their current interest rates.

Reserve Bank of New Zealand (RBNZ) – 3.25%

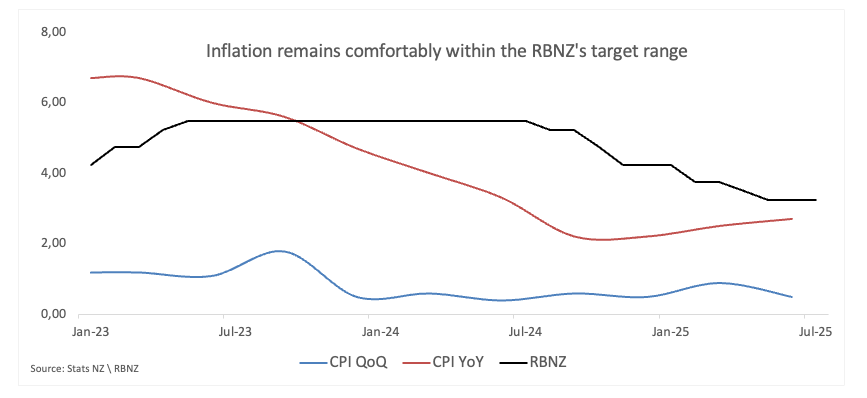

On July 9, as anticipated, the Reserve Bank of New Zealand (RBNZ) maintained the Official Cash Rate (OCR) at 3.25%, while remaining open to additional easing should inflation pressures continue to decrease. The decision came after weighing a 25 basis points cut versus a hold; weak growth momentum and cautious sentiment argued for action, but policymakers opted to wait until August to reassess near-term inflation risks.

An RBNZ survey on August 7 showed Q3 two-year inflation expectations dipping to 2.28% (prev. 2.29%), firmly within the 1%–3% target band. In addition, most respondents expect a cut on August 20.

Meanwhile, analysts see the central bank nearing the end of its easing cycle, with the OCR close to the neutral 2%–4% range. Furthermore, markets are almost fully pricing 25 basis points of easing this month and almost 50 basis points by February.

Upcoming Decision: August 20

Consensus: 25 basis point cut

FX Outlook: Since the yearly peaks past the 0.6100 barrier reached in July, NZD/USD seems to have embarked on a southward trip, closing with losses in four out of the last six weeks and returning to the vicinity of the 0.5900 neighbourhood in the last few days. So far, the key 200-day SMA around 0.5840 continues to hold the downside, and while above this region, the pair is expected to maintain a constructive view.

Riksbank – 2.00%

The Riksbank lowered its policy rate to 2.00% from 2.25% at its June 18 event, citing weaker-than-expected growth and the need to support the economy.

Minutes from that meeting, released in late June, signalled policymakers could ease again before year-end if growth stays soft and inflation remains contained.

Despite the Krona’s recovery, inflation is still above target, and officials expect Sweden’s economy to improve, limiting the urgency for further cuts.

Markets have ruled out a back-to-back move this month but are pricing around 28 basis points of easing by year-end, which should see the benchmark rate drop to around 1.75%.

Upcoming Decision: August 20

Consensus: Hold

FX Outlook: The Swedish Krona (SEK) has been navigating within a sidelined theme for several weeks now, motivating EUR/SEK to somehow stabilise following YTD tops above 11.3000 recorded in mid-July. While the cross trades near to its key 200-day SMA around 11.1800, a surpass of this region in a sustainable fashion should reignite the upside pressure.

People’s Bank of China (PboC) – 3.00% / 3.50%

In early August, the PBoC established a macroprudential and financial stability committee to help defuse financial risks, pledging to keep policy accommodative.

In its mid-year work summary, the central bank said it will focus on resolving key risks — including debt at local government financing platforms — and managing vulnerabilities in specific regions and institutions. It plans to step up risk monitoring, assessment, and macroprudential oversight.

For H2, the PBOC will maintain an “appropriately loose” stance, using multiple tools to keep liquidity ample and guide banks to sustain reasonable credit growth.

That said, investors forecast the PBoC maintaining both its 1-Year and 5-Year Loan Prime Rates (LPR) unchanged in August.

Upcoming Decision: August 20

Consensus: Hold

FX Outlook: USD/CNH is holding steady near the lower end of its yearly range around 7.1800, with traders keeping a close eye on trade headlines and PBoC policy moves. The pair remains below its 200-day SMA (just under 7.2400), leaving room for further downside pressure.

Bank Indonesia (BI) – 5.25%

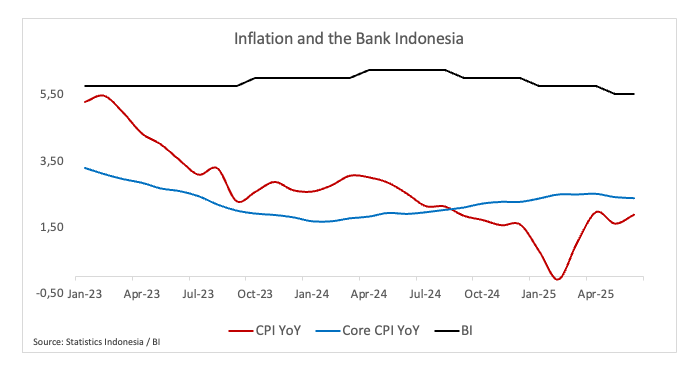

Bank Indonesia trimmed its 7-day reverse repo rate by 25 bp to 5.25% on July 16 — its fourth cut since September—alongside reductions to two other key rates. The move, expected by a slim majority of economists, comes amid slowing global trade and weaker domestic demand.

Governor Warjiyo flagged scope for further easing, citing subdued inflation through 2026, a stable Rupiah, and a weak global backdrop. He said BI is “all out” in supporting growth, including loan expansion.

A revised US tariff deal — announced by President Trump in July — also bolstered the case for easing, with Indonesian exports now facing a 19% levy instead of 32%.

Warjiyo called the deal a boost for exports and the economy, keeping the 2025 GDP growth forecast at 4.6%–5.4%.

Market participants, in the meantime, largely anticipate the BI to remain on the sidelines this week.

Upcoming Decision: August 20

Consensus: Hold

FX Outlook: The Indonesian Rupiah (IDR) appreciated to the area of yearly highs vs. the US Dollar (USD) in the past week, sending USD/IDR to the 16,100 region, where it appears to have met some decent contention. The recent break below the 200-day SMA, just above 16,300, has paved the way for the continuation of the downward trend in the short-term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.