The Monetary Sentinel: Cautiousness should prevail among central banks for now

This week, the Hungarian central bank (MNB), the Bank of Thailand (BoT) and the Bank of Japan (BoJ) are all expected to maintain their key policy rates unchanged in the current environment of heightened uncertainty, almost exclusively stemming from President Trump’s tariffs.

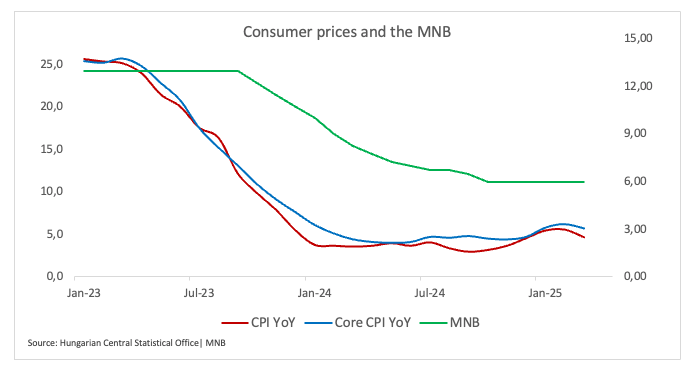

Hungarian central bank (MNB) – 6.50%

Hungary’s central bank is widely expected to leave its base rate unchanged at 6.50% for a seventh straight month on Tuesday, as policymakers confront persistent inflation and mounting economic risks. Analysts forecast only modest easing by the end of 2025, even as Hungary shares the highest benchmark interest rate in the European Union (EU).

New central bank governor Mihály Varga has ruled out near-term cuts after inflation picked up earlier this year. While headline inflation slowed to 4.8% in March, Hungary still posted the EU’s second-highest rate, just behind Romania.

Varga also warned that US tariffs could knock as much as 0.6 percentage points off Hungary’s GDP growth, complicating the country’s efforts to emerge from two years of stagnation.

Adding to the pressure, Standard & Poor’s recently downgraded Hungary’s credit outlook to negative, citing risks tied to trade tensions, shrinking EU funds, and rising debt costs. A full downgrade could follow if fiscal or monetary policy credibility weakens.

Upcoming Decision: April 29

Consensus: Hold

FX Outlook: Following monthly peaks just beyond the 411.00 barrier, EUR/HUF appears to have embarked on a three-week correction that flirted with lows near the 403.00 neighbourhood. The loss of this region could accelerate losses to the April trough of 398.79, ahead of the 2025 floor of 396.16. On the flipside, the resumption of the bull trend could initially send the cross back to its April top of 410.83.

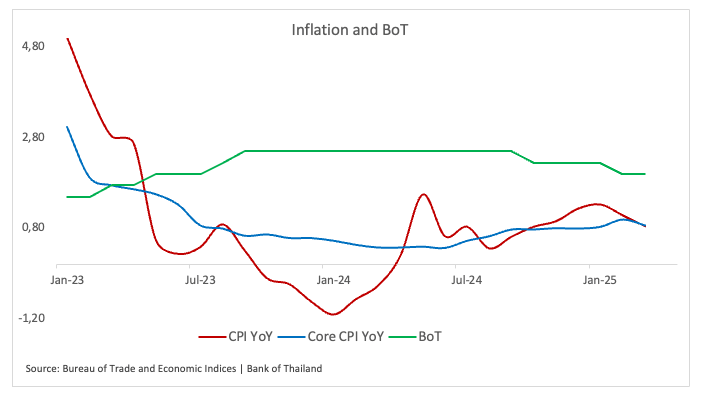

Bank of Thailand (BoT) – 2.00%

The Bank of Thailand is expected to reduce its benchmark interest rate by 25 basis points to 1.75% at Wednesday’s policy meeting, as officials weigh signs of a domestic recovery against persistent global headwinds and incresing risks from US tariffs.

Despite Q4 GDP growth missed expectations, it still marked the fastest expansion in more than two years. Full-year growth accelerated to 2.5% in 2024, up from 2.0% the year before, with the government maintaining its 3% growth target for 2025.

The rebound has been underpinned by a resurgence in tourism, resilient consumer sentiment, and robust public spending. Chinese travelers once again topped the list of foreign arrivals, providing a critical boost to an industry that remains a cornerstone of Thailand’s economy.

Meanwhile, inflation crept up slightly to 1.32% in January from 1.23% in December, staying comfortably within the central bank’s 1–3% target band.

Despite consensus keeps pointing to further easing, the central bank governor has reiterated that the current policy stance remains appropriate given ongoing external risks, including renewed trade tensions.

Upcoming Decision: April 30

Consensus: 25 basis points cut

FX Outlook: USD/THB has been trading in a sidelined fashion near the 33.50 zone, with the 33.00 neighbourhood expected to remain a solid contention area in case sellers regain the upper hand.

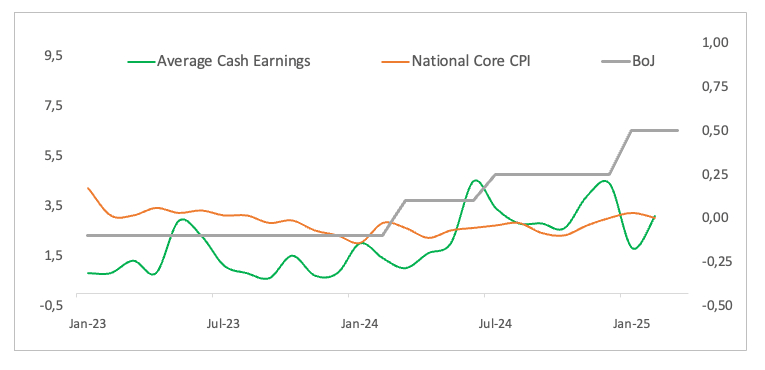

Bank of Japan (BoJ) – 0.50%

Steady wage growth and sustained inflation were key factors behind the BoJ’s decision to end its ultra-loose monetary policy last year, culminating in a landmark rate hike to 0.5% in January, its first in 17 years.

With inflation exceeding the central bank’s 2% target for a third straight year and major employers continuing to boost salaries, the BoJ has signaled a willingness to further tighten policy.

But the outlook has grown murkier. A fresh wave of tariffs proposed by former US President Trump has cast a shadow over Japan’s fragile recovery, prompting economists to reassess the timing and likelihood of the bank’s next rate increase. While the central bank remains on a tightening path, the risks to growth may slow its pace.

Upcoming Decision: May 1

Consensus: Hold

FX Outlook: USD/JPY seems to have met quite decent support near the key 140.00 region so far, always against the backdrop of a steady tariff-led demand for the safe-haven universe.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.