The FX market is choppier than usual

Outlook: Today we get the University of Michigan consumer sentiment index and the Chicago national index, but more important is personal consumption and the embedded PCE deflator (we were wrong to expect it yesterday). Personal income is expected up at 0.3% m/m and spending up 0.2% m/m, both one point higher than July.

For July, the PCE deflator was 6.3% and core, 4.6%.

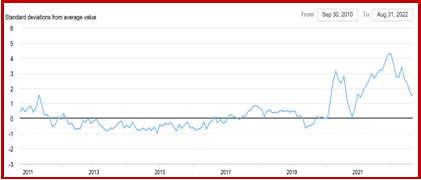

The core PCE chart shows a slide to the downside, but we need to be careful—for the preceding four years, it was mostly below 2%. As of 2021 and this year so far is the recovery from the 2020 Covid shut-down and the supply chain carnage that followed. Supply chains are improving, if not back to pre-Covid levels. Here is the chart from the NY Fed’s Global Supply Chain Pressure Index (GSCPI), last updated in Aug. We get a new one Oct 4.

Again we have to note that the US economy has contradictory sets of data—low unemployment and a labor shortage with good consumer attitudes and spending, vs. slowdowns in many sectors as shown in the regional Fed indices—and yet the PMI’s showed a tiny burst of positivity. San Francisco Fed Daly has been saying the recession doesn’t have to be deep to bring inflation under control, not quite contradicting Powell’s Volckerish “there will be pain” but an interesting sop to distress. The dichotomy between the public and the finance world is stark.

Then these is the strange Amazon news—shutting warehouses, dumping office building plans, getting call center staff to work from home, etc. Amazon benefited more than any other single company during Covid, so something is amiss here—probably assumptions about upcoming business that failed to materialize, not that brick-and-mortar stores did all that well in goods. Maybe it’s just the switch from material goods to restaurant meals.

Bottom line, the FX market is choppier than usual, making classic trend-following especially hard—when intraday reversals are the size of the average daily true range plus a little. But keep the faith that between economic resilience and safe-haven status, the dollar rally is not over. Besides, the drama in the UK (will Truss back down?) and at the ECB (rates hikes at a time of fuel rationing) will keep traders on their toes.

About sterling: In trying to link economic data to currency moves, note that Q2 GDP shows expansion by 0.2% instead of contraction by 0.1%. Consumption rose, exports rose, and the government spent less.

To add to good news, the government will meet with the Office of Budget Responsibility (OBR). Technically the OBR has no real power to change anything the government proposes, but it has the power of the press, something Truss and Kwarteng now appreciate. The FT reports that Kwarteng and the BPR have now confirmed the actual budget and accompanying forecasts will be released on Nov 23, the original date, “which would deliver a verdict on whether the chancellor’s sums add up. Truss and Kwarteng ‘reaffirmed their commitment to the independent OBR and made clear that they value its scrutiny’, the readout from the meeting said.”

One wonders whether Truss & Co. care much about polls with the next election not until Jan 2025. The price for shooting off your mouth recklessly comes in the form of the latest YouGov survey-- Labour now gets 54% support vs. 21% for the Tories. YouGov says this 33-point lead is the biggest of any party since the late 1990s

The OBR announcement gets the credit for raising the pound back up, according to the FT. Whether causal or not, the 10-year Gilt yield is down to 4.053% at of 7:30 am ET, from 4.04% a week ago—so a lot of screaming but not to no avail—Truss and Kwarteng have been corralled.

In fact, 10-year yields fell everywhere in G10 and rose everywhere in emerging markets.

Back to sterling: in yet another plea for coordinated central bank action at the WSJ, this nugget of information emerged: “For all the fretting about British debt, the U.K.’s total debt to GDP ratio (86%) is lower than America’s (127.5%) and its interest expense as a share of GDP is lower. The saving U.S. grace is the dollar’s status as a global reserve currency.” And globally, “The big surprise so far during this great monetary correction has been the lack of a big financial casualty. There’s been no Orange County (1994), no Long-Term Capital Management (1998), and no Fannie Mae (2008). But then again, maybe the British pound and bond panic is a sign of what is coming.”

This is fear-mongering. We have had plenty of explanations of why the BoE intervention was useful to pensions funds that were hedging exposures (it’s complicated and we don’t need to repeat it here). It’s almost certain that some badly managed financial institutions are going to fail, if only because that generally follows a series of rate hikes. The probability of a Lehman moment is fairly low these days, if only because of the big bank stress tests, new regs (e.g., Graham Dodd) and a general acknowledgement of the danger.

To be fair, the pound is a victim of anti-Tory sentiment that was born of Boris shenanigans and got lit on fire by Reaganomics budget proposals—not the actual budget, just an ideological position with numbers attached. This is not to say the response was wrong, just that it was exaggerated. And we should probably assume there is some left-over resentment toward the British and Schadenfreude when it suffers yet another financial crisis because of Brits’ assumed superiority and everyone else’s inferiority, especially when it mismanages so much, so often. We fully expect the pound to re-test the recent low at 1.0350.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat