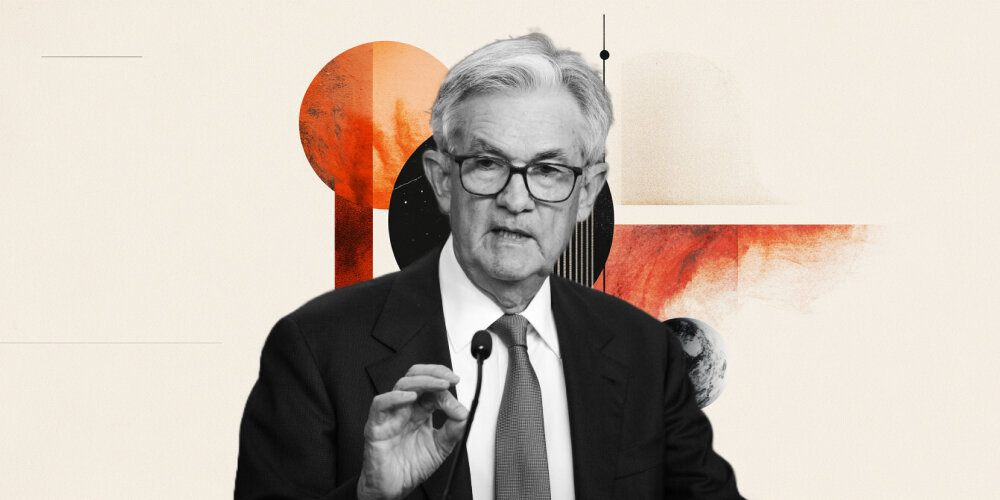

The Fed's deepening civil war

Highlights:

- Fed set slash rates during final meeting of 2025.

- Futures almost fully pricing in 25bp rate cut.

- Officials lacking clarity on state of US economy.

- Available data points to “low-hire, low-fire” economy.

- Dot plot to show wide range of views among FOMC.

- Powell to play down chances of sequential cuts.

He said: “With futures markets now pricing in around a 90% chance of a 25bp cut on Wednesday, the dollar will take its cue from the Fed’s guidance on rates. We expect Powell’s remarks to be laced with hawkish undertones that could pour cold water over the prospect of additional easing in early 2026, which may offer some relief to the dollar.

His remarks and the dot plot will also make clear that the rate path is shrouded in uncertainty in 2026. This is complicated further by the annual rotation of Fed voting members in January, particularly given that three of the four incoming officials explicitly opposed recent Fed cuts.

We would argue that the data that we have received has not been conclusively supportive of a December cut, but it has also not been enough to rule one out either. The jobs market appears stuck in a “low-hire, low-fire” state. Net job creation has slowed significantly and, even if employment growth remains around the breakeven rate, we’re not looking at levels that are consistent with a robust and expanding economy.

Author

Matthew Ryan, CFA

Ebury

Matthew is Global Head of Market Strategy at FX specialist Ebury, where he has been part of the strategy team since 2014. He provides fundamental FX analysis for a wide range of G10 and emerging market currencies.