The economic backdrop is still deflationary in real terms

The economic backdrop is still deflationary in real terms

Even with such severe central bank and government policy responses to the pandemic in the developed world so far, households and real economies are being squeezed financially. In an attempt to make the asset-owning class “whole” while boosting consumer price inflation, policymakers have made it harder for a robust recovery to take place in the real economy. Investors must now brace for a bumpy ride as a new US administration begins to float its new fiscal policy ideas and deflationary forces continue to persist throughout the real economy.

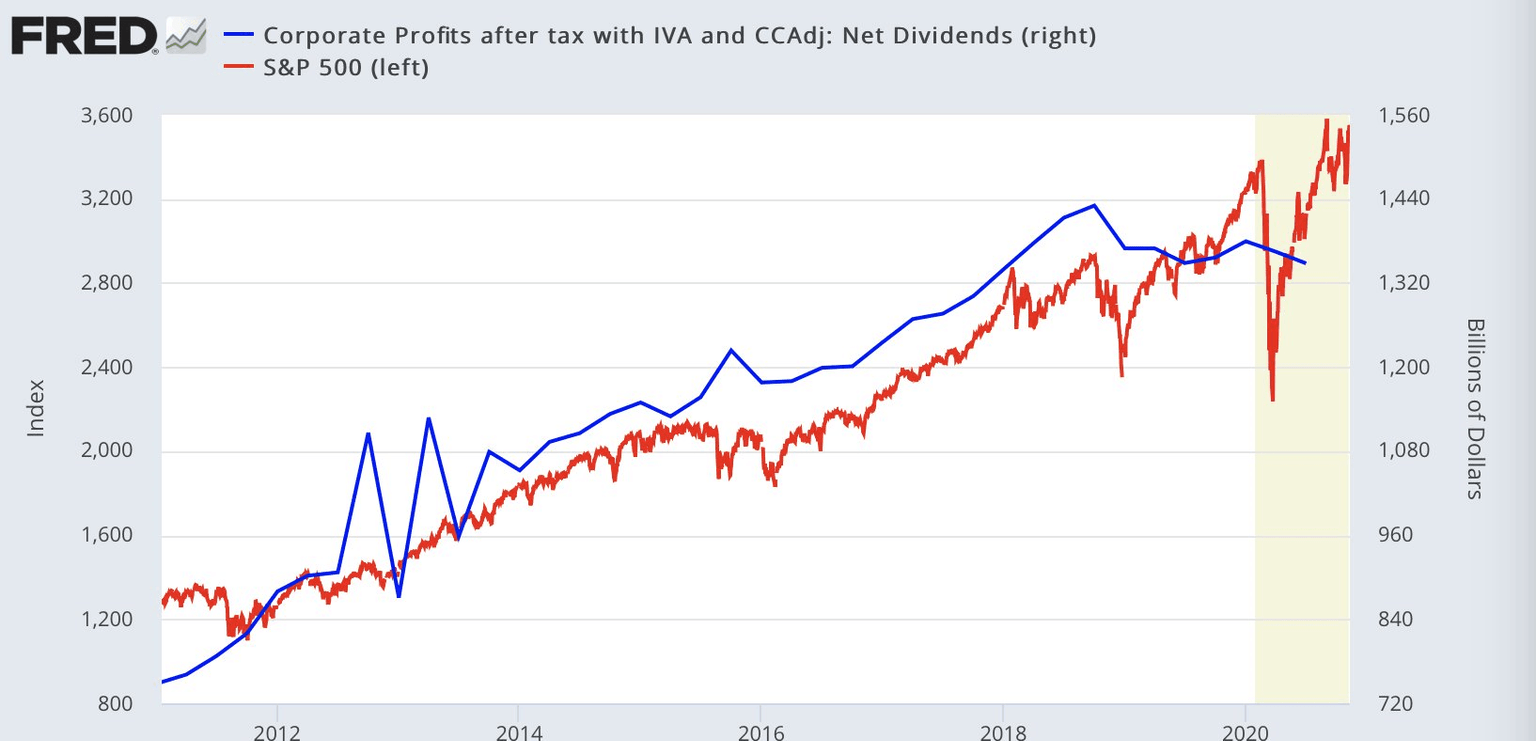

A look at the chart below tells us that corporate profits remain a deflationary drag on the real economy, as asset prices paint a more positive picture in nominal terms only.

Households in the world-leading US economy face a prolonged uphill battle, with the next two charts together showing us that higher inflation levels have been manufactured against a backdrop of steadily rising permanent job losses - in the millions. This is what was referred to in the opening paragraph as a squeeze on households.

The US household remains under pressure after Fed and government planners have forced higher consumer prices on a working class that has lost a record amount of its productive capacity. Higher inflation levels are not only an illogical policy fix but could stunt corporate profits for a prolonged period if the consumer does not recover quickly. This would reinforce the conditions for structurally high unemployment. Most forecasters estimate that permanent job losses will eclipse 2008 levels, meaning they are unfortunately favored to double from here. Passive investment managers and media talking-heads seemingly maintain their blind faith in the Fed’s ability to keep things glued together, but in reality, it’s only getting more difficult for the Fed and/or Treasury officials to levitate financial markets in real terms.

We may also be witnessing a shift in the US consumer’s prevailing sentiment - from a consumption-based mentality to one of prioritizing savings. Furthermore, a (likely) Republican Senate is anticipated to keep a lid on the (likely) incoming Biden administration’s spending. Without free reign to deficit spend in increasing quantities, there may not be a government backstop to paper over the consumption issues in the real economy moving forward. It with therefore be important to keep an eye on consumer sentiment, and whether this chart below is beginning a sustainable rebound or not.

The US economy is largely built on asset prices and trust. If the consumer sentiment chart above fails to make a meaningful recovery, this could potentially lead to the end of the days where the US economy can thrive being principally consumer-based.

Another drag on real economic activity will be the incoming wave of bankruptcies in real estate markets. Various government support arrangements will be expiring, and we are just beginning to see what is certain to be a grim rise in commercial real estate delinquencies. The chart below shows the beginning of an uptick which will pick up its pace quickly if more government or central bank interventions don’t come to the rescue.

A broad overview of how tight lending standards are can give us further insight into whether the banking sector is buying into the recovery narrative being pushed by elected officials and media pundits. Note that as long as data sets below remain above the black line, it suggests banks aren’t ready to be as risky with their capital as they would be if they trusted the economy was healthy. Even though the Fed’s quantitative easing programs hand banks new lending reserves which are “printed” out of thin air, it seems a large percentage of banks are still tightening lending standards!

Each measure tracked by the Fed’s data shows a large percentage of US banks remain in tightening mode. This is hardly a display of confidence. Banks are not ready to place their trust in the real economy’s creditworthiness just yet. Keep in mind, this is after liquidity injections from the Fed and government have been working their way through the banking system for many months now. Most notably, commercial real estate loans (purple) with development purposes are being tightened at the highest rate, with 57% of US banks remaining in tightening mode. The metric that has recovered the furthest (red) is consumer loans and credit cards, but it’s still showing that over a quarter of US banks are tightening lending standards. This is extremely telling considering this is where banks make their largest profit margins.

One other notable item in the last chart is that the banks were already in a slight tightening mode before the pandemic even began, pointing toward the fact that the economy was already beginning to falter before the pandemic even began.

CONCLUSION:

The bottom line is that no economy can flourish under the pressure of rising consumer prices with a diminishing level of real activity and structurally high unemployment. This is such a basic economic principle, any 10-year-old can understand it. However, the Federal Reserve and other central banks seem to be confused, they remain intent on pushing asset prices higher along with their “inflation at all costs narrative.” This does not help replace the economy’s lost productive capacity, it largely just promotes a more significant wealth divide between the real economy and financial assets.

The path to a full recovery will be long, and we can keep an eye on the data sets outlined above to identify when the real economy may be recovering to a healthy degree. For a robust recovery to take hold, we would likely need to see the Fed’s liquidity injections promote looser lending conditions. For this to be clear, we would need to see the data sets in the last chart to make a return to their zero lines and remain there. We would also need to see the permanent job losses to hit their peak and reverse, with a meaningful and prolonged uptick in consumer sentiment data.

For now, it is surely time to be cautious and understand that in reality markets are not simply numbers on a computer screen. Financial markets reflect what is happening in the economy, it doesn’t go the other way around. Regardless of how much blind faith the masses may place in Federal Reserve’s narratives, realities remain apparent in real data.

Author

Miles Ruttan

Bytown Capital

Miles' focus at the firm is to oversee our macro analysis, with the emphasis being placed on global credit and liquidity flows.