The Chart of the Week: The Silver rush and big short squeeze kicks-in

- Silver prices shooting higher in the open begs the question as to whether we will see unprecedented moves higher without a correction.

- XAU/USD has left an overextended W-formation on the daily charts.

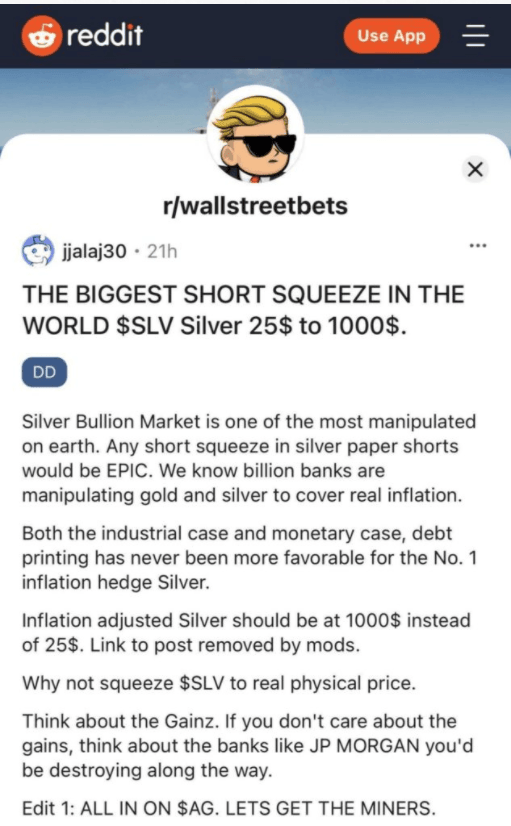

Plans to short-squeeze silver to never before seen prices circulated on Reddit and has sent price higher in this week's open.

15-min chart

$1000 an ounce is a number that has been spread on Reddit. That is a far cry from current levels, especially while longs are being closed still, according to the CFTC data.

We are in the unprecedented territory and no fundamental analysis is likely going to help when these communities of retail investors are banding together to manipulate the markets.

In any case, the price has rallied as call option gamma squeeze can affect the futures markets and move the physical and spot price.

If the retails sector really can move the price for a sustainable period, then and only then will there be an adjustment to back to basic fundamentals that meet the frenzy.

That is where things really could take off when once presumes the Fed is not about to tighten, the ratio between silver and gold is so undervalued and the current trajectory of the US dollar.

Nevertheless, fundas aside, for the time being, the following is a top-down analysis that illustrates where the price action has been over the time frames and what next might be in store.

Monthly chart

The monthly chart is quite bullish with the price having already retraced once to the 38.2% and then also testing the monthly neckline of the W-formation.

Weekly chart

As illustrated in the above chart, the W-formation has seen the price pullback to the neckline prior to heading higher in a fresh bullish impulse.

Daily chart

By the same perception, we have a W-formation on the daily chart which has been extended in the open on speculative demand.

Can silver continue higher without a semblance of logic?

If Gamestock is anything to go by, then yes, but by the same logic, all can come crashing down as fast as it went up.

S&P 500 Weekly Forecast: A Black Swan so soon for 2021 in Gamestop GME, a new dynamic

However, this would make for prospects for at least a 38.2% Fibonacci retracement based on the current price before the possibility of a continuation towards the $ '30s, if indeed we will see any kind of order to the flows during this Reddit inspired fad for the week ahead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637477327507050957.png&w=1536&q=95)

-637477333808874250.png&w=1536&q=95)

-637477336567619262.png&w=1536&q=95)

-637477342239759702.png&w=1536&q=95)