The Chart of the Week: Gold on verge of significant correction

- Gold is struggling to convince on the upside.

- A bearish correction could be on the cards for the week ahead.

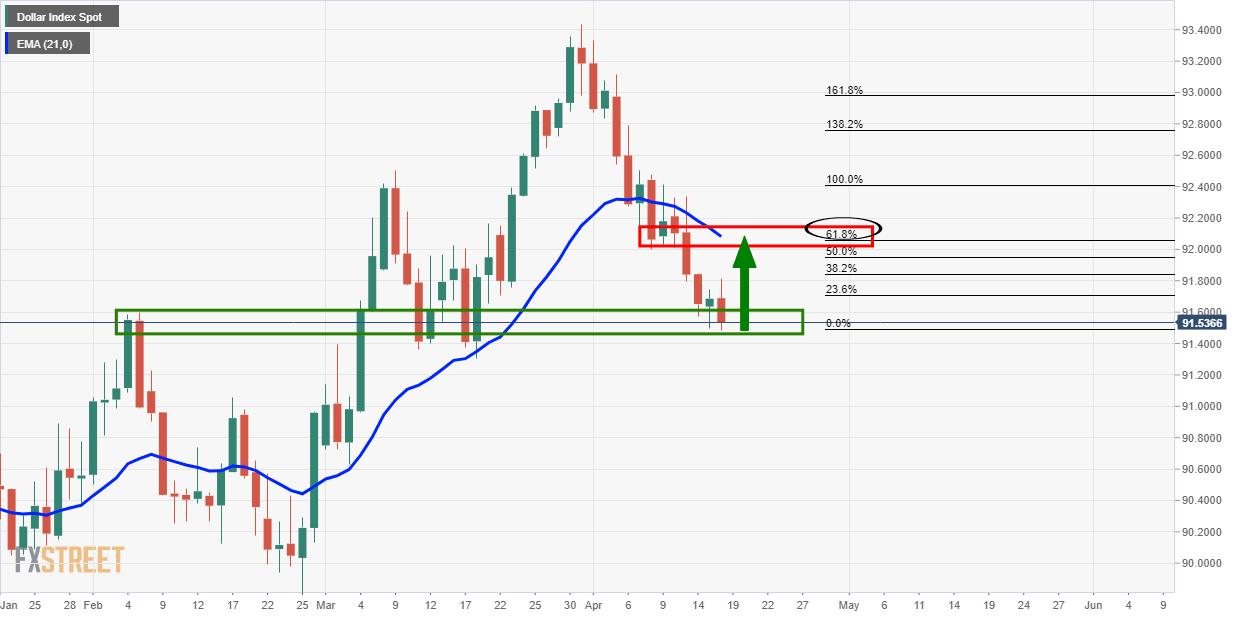

The price of gold is interesting at this juncture as it dips its toe in supply territory, just as the DXY meets a critical support area.

Moreover, a wider measure of dollar positioning shows that the greenback posted a net short position of $5.71 billion this week, from net shorts of $7.75 billion the week before.

There is still plenty of appetite for the greenback out there, which will be a headwind for gold prices in the medium term.

Gold price analysis

Let us move over to the gold charts.

The following is a top-down analysis that illustrates prospects for the next downside opportunity on gold:

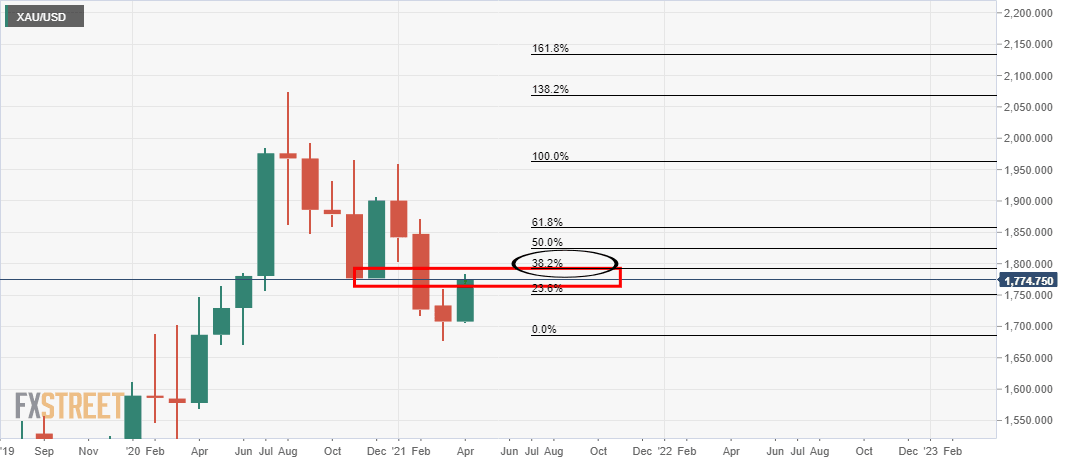

Gold monthly chart

The price has corrected toward a 38.2% Fibonacci retracement of the last series of bearish candles.

The correction is significant as it meets prior support that would now be expected to act as resistance.

Therefore, the outlook is bearish.

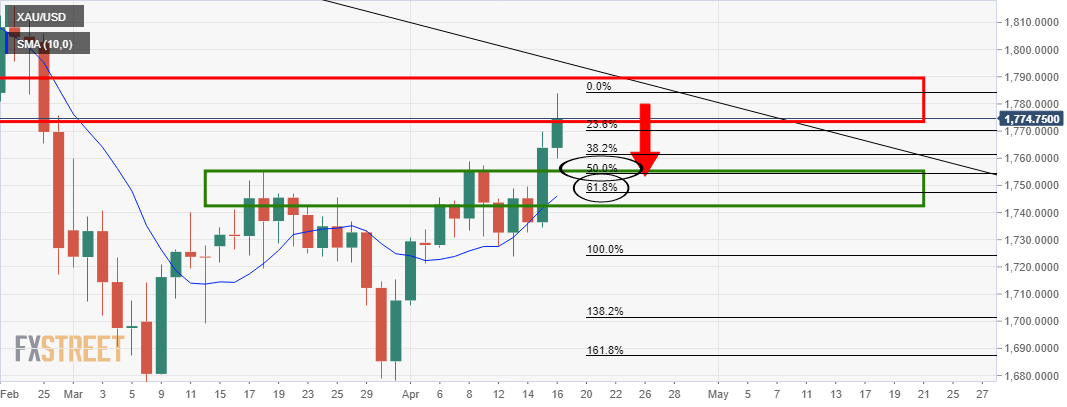

Weekly chart

The price is on the approach to the dynamic weekly resistance line.

Bulls are now testing the bearish commitments from prior weekly support, which would be expected to now act as a resistance area.

While there is definitely room for an upside extension for the week ahead to penetrate deeper into supply and fully test the resistance line, the path of least resistance, at this juncture, is to the downside.

Traders can monitor the lower time frames for bearish structure and to sell from resistance.

Daily chart

The daily chart has seen a bullish close, and there is room to go on the upside yet.

With that being said, the prior highs looking left have a confluence with a 50% mean reversion of the last few sessions of bullish closes.

A deeper 62% retracement will meet with the 21-day EMA and the neckline of the W-formation.

1-hour chart

Meanwhile, the hourly conditions have shown that the price has failed in a double top scenario, and a break below the 50% mean reversion mark would be significant for the opening sessions of the week ahead.

This would signal that the bears are taking control with the intent of breaking to the downside at the start of what would be expected to be a far bigger correction toward the daily aforementioned targets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.