The big stories will be a flood of PMI’s from several places

Outlook

Today the US stories include the Nov NAHB housing market index, the NY Fed service sector survey, and TICS (Treasury capital flows). Nothing here to move markets.

The big stories will be a flood of PMI’s from several places. We detect PMI is of late losing its muscle as a big market mover. We also get CPI and retail sales from the UK and Canada, plus the RBA minutes plus a speech by RBA gov a few days later

To winnow things down a little more, the Bloomberg survey forecasts the UK CPI will rise by 2.2%, from 1.7% in Oct, the first reading below the 2% target in three years. Normally this would stay the hand of the BoE. But on Friday, GDP for Q3 at a mere 0.1% from 0.5% the previous quarter and against forecasts of 0.2-0.3% might have the opposite effect.

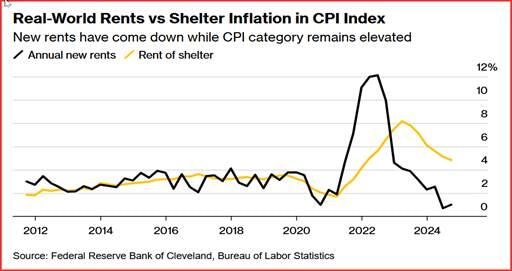

Bloomberg has a story headlined “Powell May Be Waiting Until 2026 for Housing Inflation to Cool.” Last week Powell said the Fed is keeping an eye on housing inflation. The Cleveland Fed has a study indicating it may take to mid-2026 for rent inflation to return to the pre-pandemic level.

Shelter is a far bigger portion of CPI than PCE, but a portion of shelter is taken from CPI into core PCE. One analyst said we will get a rise in core PCE from 2.7% to 2.8% when it comes out next week. Private rent trackers like Zillow see slowing increases—but CPI catches it with a tremendous lag. See the chart. The Fed can see the private data as well as the next guy, We say the headline doesn’t match the chart.

The CME FedWatch tool still shows the majority betting on a rate cut in Dec—30 days away—but falling by the day. The probability of a cut as of this morning is 58.4%, down from 61.9% a day ago and from 65.3% a week ago. The next PCE release is especially important—but it’s not until next week (Nov 27). And we continue to project that political developments are critical to the Fed’s thinking, even if nobody will admit it. We still don’t have a new candidate for Treasury Sec. It’s possible those approached have turned down the Trump overtures, knowing it can bring only misery to work for someone with so little understanding of the economy and financial markets. Several fund managers have come and gone from the headlines, with former Fed Warsh on the table now. A qualified guy, for once.

We don’t know what to make of the upcoming central bank meetings. The ECB meets on Dec 12 and is thought to be on hold, which seems nuts when its biggest economy is on the cusp of recession. The Fed meets on Dec 18th and as noted above, still thought to be in cutting mode, which seems nuts when the incoming president has deliberate plans to drive inflation back up. The Bank of England meets one day later, with most thinking a rate cut is postponed to next year, which seems nuts when inflation targets are being met.

The Bank of Japan is the trickiest (Dec 18-19). Earlier today Gov Ueda didn’t address the subject directly, but warned again of keeping real rates low for too long and said the BoJ won’t hold off until all uncertainties are gone. He is more worried about external risks than consumption and wages. Going into the weekend, yen traders expected more and took the yen stronger, then back down again in disappointment Ueda was not more hawkish. The dollar yen started at 156.75 at the high on Thursday, and fell to 153.75 (futures). It has now retraced exactly half that space. We think this is probably a mistake. Intervention is off the table because Trump would rant and rave about it, so a rate hike is the only remedy if the yen level is to be targeted. That means a return to 153 and better.

Forecast

Because it’s data-light week, again Trump and the Trump trade are in the spotlight. So far it looks like a consolidative tone is in the air but panic can come at any time. A sideways move in the first few days can morph into a bigger move, likely in the primary trend direction. But the euro is vastly oversold and in the absence of any hammering data this week, a rebound would be the normal thing, or at least a line in the sand around 1.0500. This would mark a breathing spell from the Trump trade—until he pulls another stunt. The likelihood of a meaningful euro rise is very low.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat