The animal spirits index turns negative in September

Summary

-

In September, our Animal Spirits Index dropped below zero for the first time since February.

-

The index's 32-point drop was broad based, with four out of the five index components falling on the month.

-

Consumer's confidence in the ongoing expansion has soured in the face of rising COVID cases and still-high inflation, while similar pressures have weighed on financial markets.

-

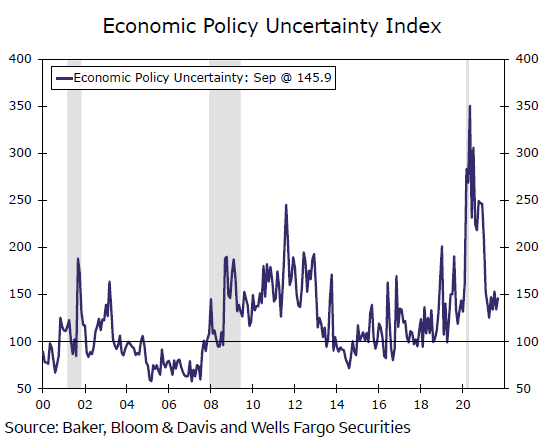

The Economic Policy Uncertainty Index picked up in September due to a narrowlyaverted government shutdown and a debt ceiling stand off. While the index remains well below its 2020 level, the potential for further increases in the index later this year remain, with Congress set to continue to debate on new spending packages and government financing deadlines looming large in December.

-

Overall, improvements in the labor market recovery as well as strong household and business balance sheets should help buoy sentiment in the coming quarters. That said,deterioration on the public health front and persistent price pressures could offset these positive trends should they materialize.

ASI lost its momentum

The Animal Spirits Index (ASI) dipped into negative territory in September, dropping from +0.30 in August. Previous reports detail the methodology, but on a basic level an ASI value above zero indicates optimism, while a value below zero suggests pessimism. September's reading is the index's first print below zero since February and suggests confidence in the ongoing recovery has soured meaningfully in recent weeks. Moreover, the ASI's plunge in September was broad based, with four of the five components of the ASI contributing negatively on the month.

The Economic Policy Uncertainty Index rose to 145.9 in September from 133.9 (Figure 1). While the 12 point increase is noteworthy, the index remains well below its 2020 level as well as its level during previous debt ceiling showdowns in 2011 and 2013. Consumers’ perception of the economy has also been under pressure. The Conference Board’s Consumer Confidence Index dropped to109.3 in September, the third consecutive month decline. Alongside rising policy uncertainty and anincreasingly apprehensive consumer, the S&P 500 index dropped to 4307.5 from an all-time high in August, and the VIX hit its highest monthly average since February. The sole positive contributor on the month was the spread between the 10-year and three-month Treasury yields, which widened in September as markets solidified expectations for longer-lasting inflation.

Author

Wells Fargo Research Team

Wells Fargo