Oil futures in fierce battle with 200-SMA [Video]

-

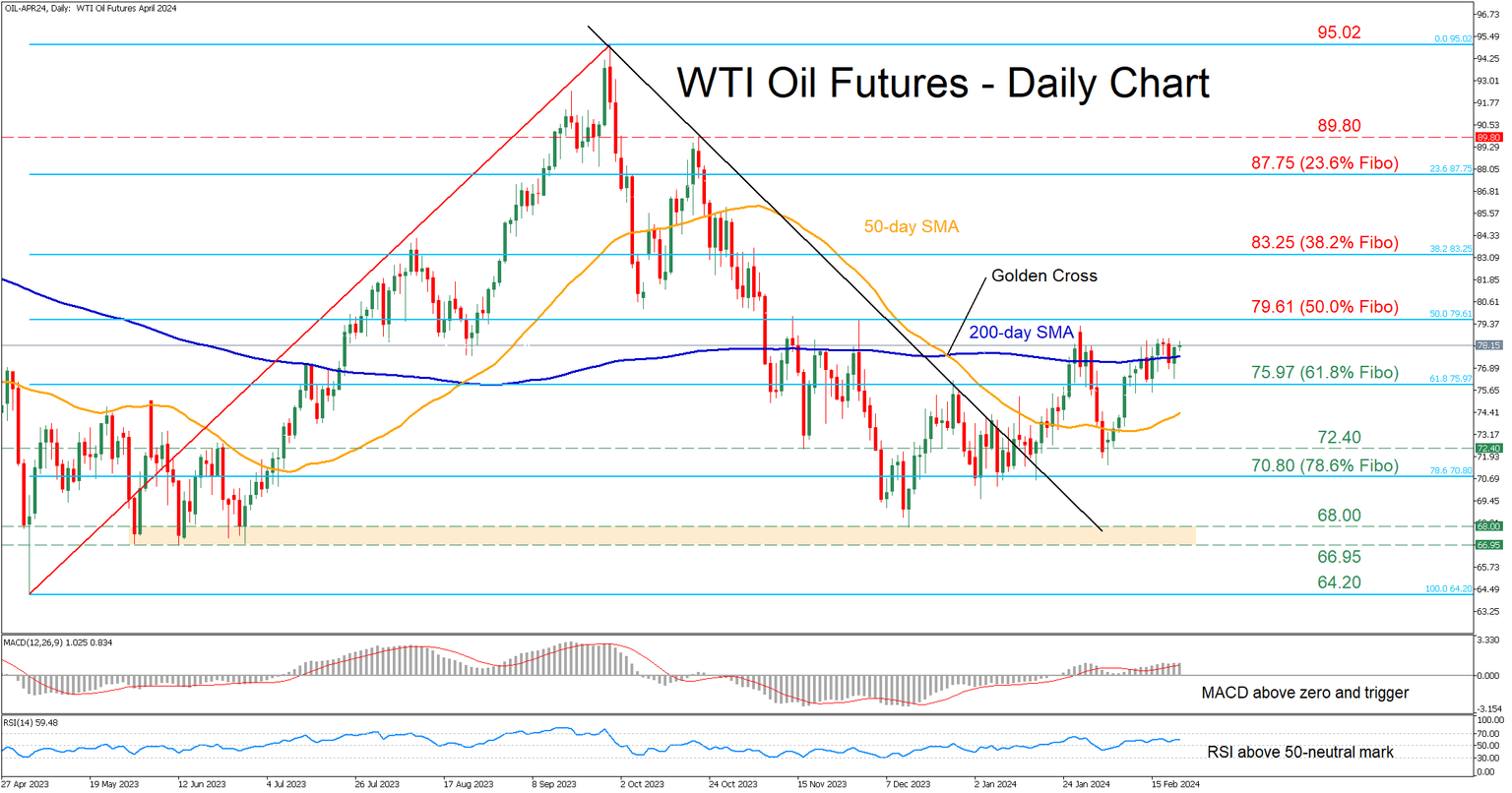

WTI futures hover around the 200-day SMA.

-

Failure to edge higher might lead to a double top.

-

Oscillators suggest intensifying positive momentum.

![Oil futures in fierce battle with 200-SMA [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/oil-platform-on-the-sea-38503532_XtraLarge.jpg)

WTI oil futures (April delivery) have been staging a comeback following their break above the 50-day simple moving average (SMA) in early February. However, the recovery seems to be on hold for now as the 200-day SMA has been curbing the price’s upside.

Given that both the RSI and MACD are tilted to the upside, the bulls might attack $79.61, which is the 50.0% retracement of the $64.20-$95.02 upleg. Further advances could then stall around the 38.2% Fibo of $83.25. Surpassing that zone, the price could ascend to face the 23.6% Fibo of $87.75.

On the flipside, if sellers re-emerge and push the price back below the 200-day SMA, initial support could be found at 61.8% Fibo of $75.97. Lower, the November bottom of $72.40 could act as the next line of defence. A violation of that zone could set the stage for the 78.6% Fibo of $70.80.

In brief, WTI oil futures' recovery has stalled as the price has been trading sideways around the 200-day SMA in the past few sessions. Therefore, a clear jump above the latter is needed for the short-term rebound to resume.

Author

Stefanos joined XM as a Junior Investment Analyst in September 2021. He conducts daily market research on the currency, commodity and equity markets, from a fundamental and a technical perspective.