Technical analysis: USD/CAD rockets off 200-MA, fuelling upward trajectory

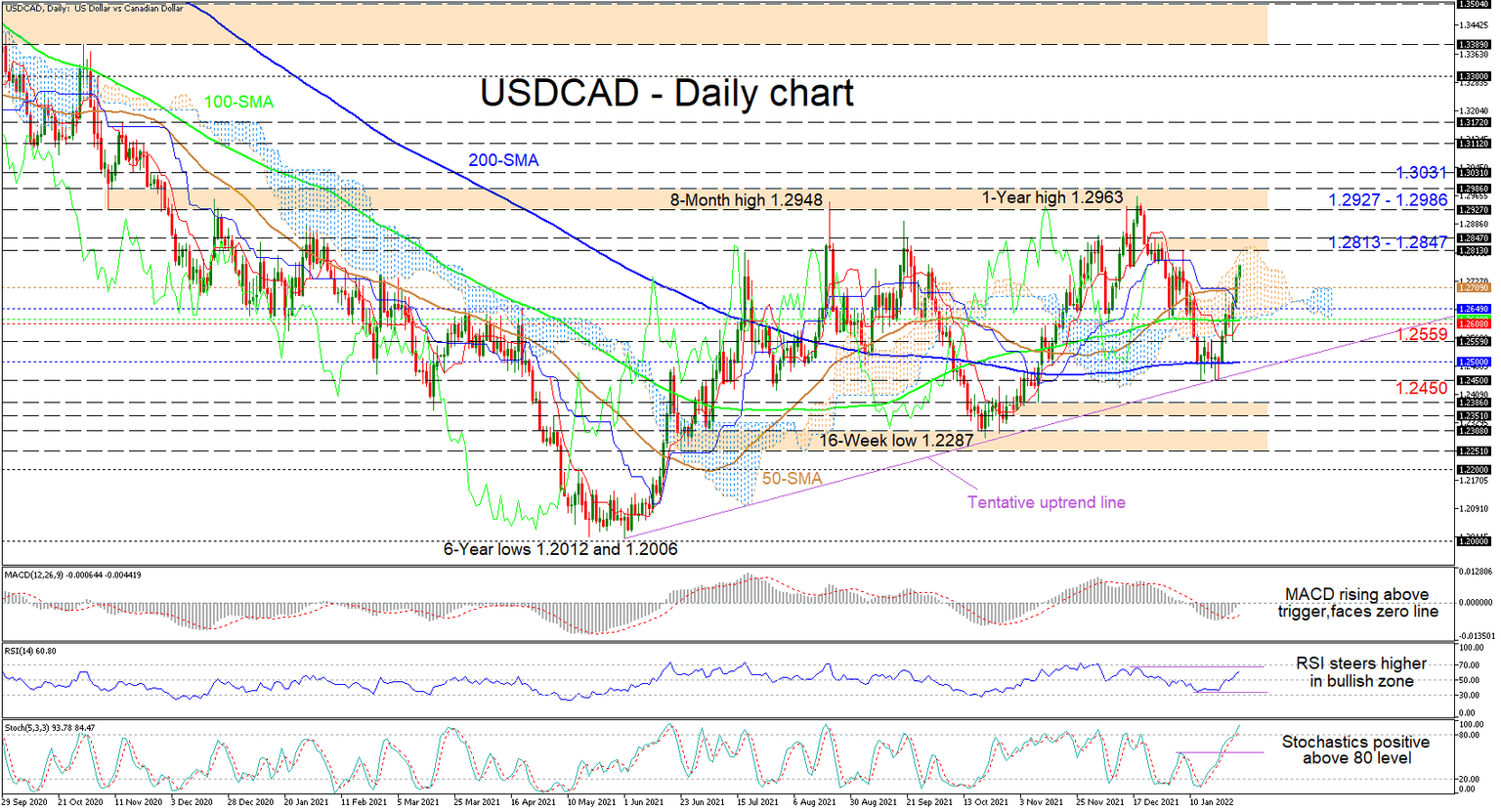

USDCAD remains positively energized aiming for the Ichimoku cloud’s upper band around the 1.2813 high, after taking flight from the 200-day simple moving average (SMA) around the 1.2500 mark. The longer-term SMAs are suggesting an overall neutral trend in the pair, while the marginal incline in the 50-day SMA is sponsoring the recent rally from the 1.2500 level.

Currently, the Ichimoku lines are converging, failing to indicate a leading directional force, while the short-term oscillators are skewed to the upside. The MACD, above the red trigger line, is tackling the zero thresholds, while the RSI is improving in bullish regions. The stochastic oscillator is exhibiting a strong bullish charge, promoting bullish price action.

If the pair continues to push higher, initial upside deterrence could occur at the 1.2813-1.2847 zone, where the upper band of the cloud currently resides. Overcoming this barrier, the bulls may then challenge the critical 1.2927-1.2986 resistance barricade that has hindered advances since December 2020. Successfully conquering this acting ceiling and extending past the nearby 1.3031 resistance border, upside momentum in the pair may then intensify.

Otherwise, if positive forces abate ahead of the 1.2813-1.2847 barrier, preliminary support could arise around the 50-day SMA at 1.2709. Sliding lower, an obstructing zone between the Ichimoku lines, which encapsulates the 100-day SMA at 1.2619 and the cloud’s floor, could step into the spotlight. Sinking further, the 1.2559 low could delay the test of the tentative uptrend line, pulled from the 1.2006 troughs, and the acting base between the 200-day SMa at 1.2500 and the 1.2450 lows.

Summarizing, USDCAD is sustaining a positive bearing, strengthening a bullish tone above the SMAs and the ascending trend line.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.