Technical analysis: GBP/USD forms foothold at 11-month low, bearish bias stands

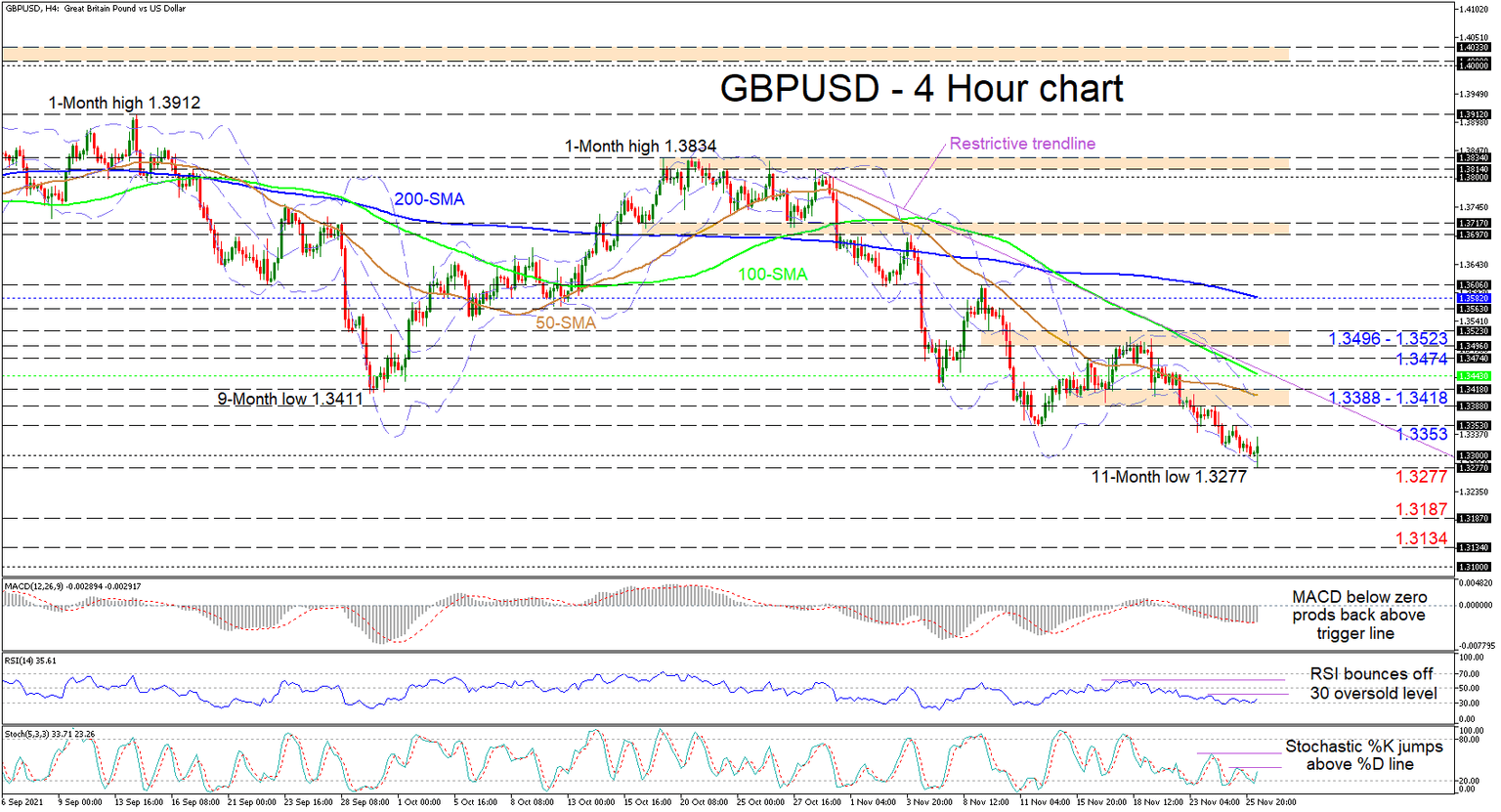

GBPUSD buyers have re-emerged around the 1.3300 handle and lower Bollinger band trying to make a comeback, after a one-week drop in the pair, which produced an 11-month low. The bearish simple moving averages (SMAs) are reinforcing the one-month descent from the 1.3800 vicinity.

Currently, the short-term oscillators are suggesting that negative momentum is fading, due to a surge in positive powers. The MACD, some ways below zero, has nudged over its red trigger line, while the RSI is improving off the 30 oversold level. The stochastic oscillator has turned bullish and is promoting additional advances in the pair above the 1.3300 hurdle.

If buyers manage to extend the rebound from the 1.3300 region, initial upside friction could commence around the mid-Bollinger band, bordering the 1.3353 high. Overstepping this, the bulls may face a fortified resistance section from 1.3388 to 1.3418, which encompasses the 50-period SMA and the upper Bollinger band. If the pair continues to progress, a potential neighbouring restrictive trendline, pulled from the 1.3814 high, and the 100-period SMA at 1.3443 could act as a downside defence. In the event the pair remains buoyant, the bulls could then attack the 1.3474 barrier before aiming for the 1.3496-1.3523 resistance boundary.

Otherwise, if positive forces start to subside, preliminary support could stem from the 1.3300 mark, the lower Bollinger band and the intraday low of 1.3277. Should the bearish trajectory resume, the price could target the 1.3187 trough from back in December 2020. Should the pair remain heavy, traders’ attention could then shift towards the 1.3134 barrier and the 1.3100 psychological number.

Summarizing, GBPUSD is exhibiting a firm bearish bias in the short-term picture below the SMAs. For the bulls to counter the negative picture, they would need to steer the price above the 1.3496-1.3523 resistance barrier. That said, an initial climb north of the 1.3388-1.3418 zone could reinforce buyers’ confidence.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.