Tech stocks lose out in tax reform excitement

Tech stocks are taking a knock as investors look to chase the potential winners from tax reform, while it appears the Brexit bill is not yet settled.

- New record highs for the Dow

- But tech out of favour thanks to tax reform plans

- No clarity yet on Brexit bill

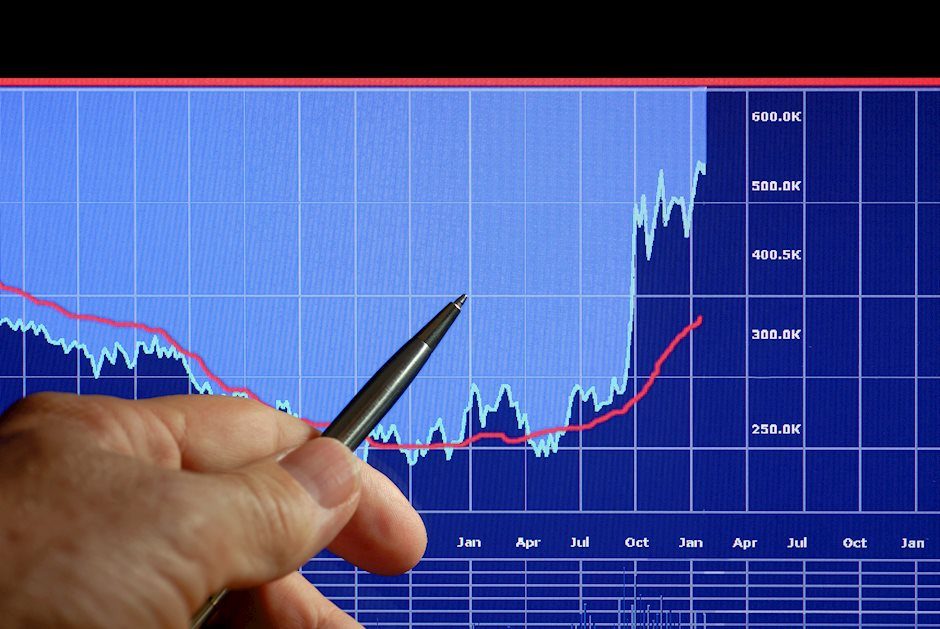

Hopes of tax reform continue to drive US markets higher, although the gains are concentrated in those firms which are expected to be significant beneficiaries. Tech is not in that exalted bracket, and as a result is taking heavy losses. The caution is being amplified by comments from the German defence minister, who is arguing for tighter regulation for big tech firms. However, with Wall Street clocking up record highs, markets look vulnerable to some short-term reversals. Short-term reversals are exactly what we got last night on the North Korea news, and the rebound was equally rapid. No doubt there will be plenty of investors willing to buy this micro-dip in the FANG stocks, especially

if they need to spruce up their performance ahead of year-end.

Is there a Brexit deal, or isn’t there? That is the key question this afternoon, after yesterday’s reports seemed to indicate a done deal. Downing Street refuses to be drawn on the topic, and recent wire reports suggest that the EU Parliament still thinks more work has to be done. This knocked back sterling temporarily, but the parliament itself of course has little say on the matter. The real decision comes later, and until then, the market is still pleased to see progress on this thorny issue. Just a few small other issues to resolve as well.

Author