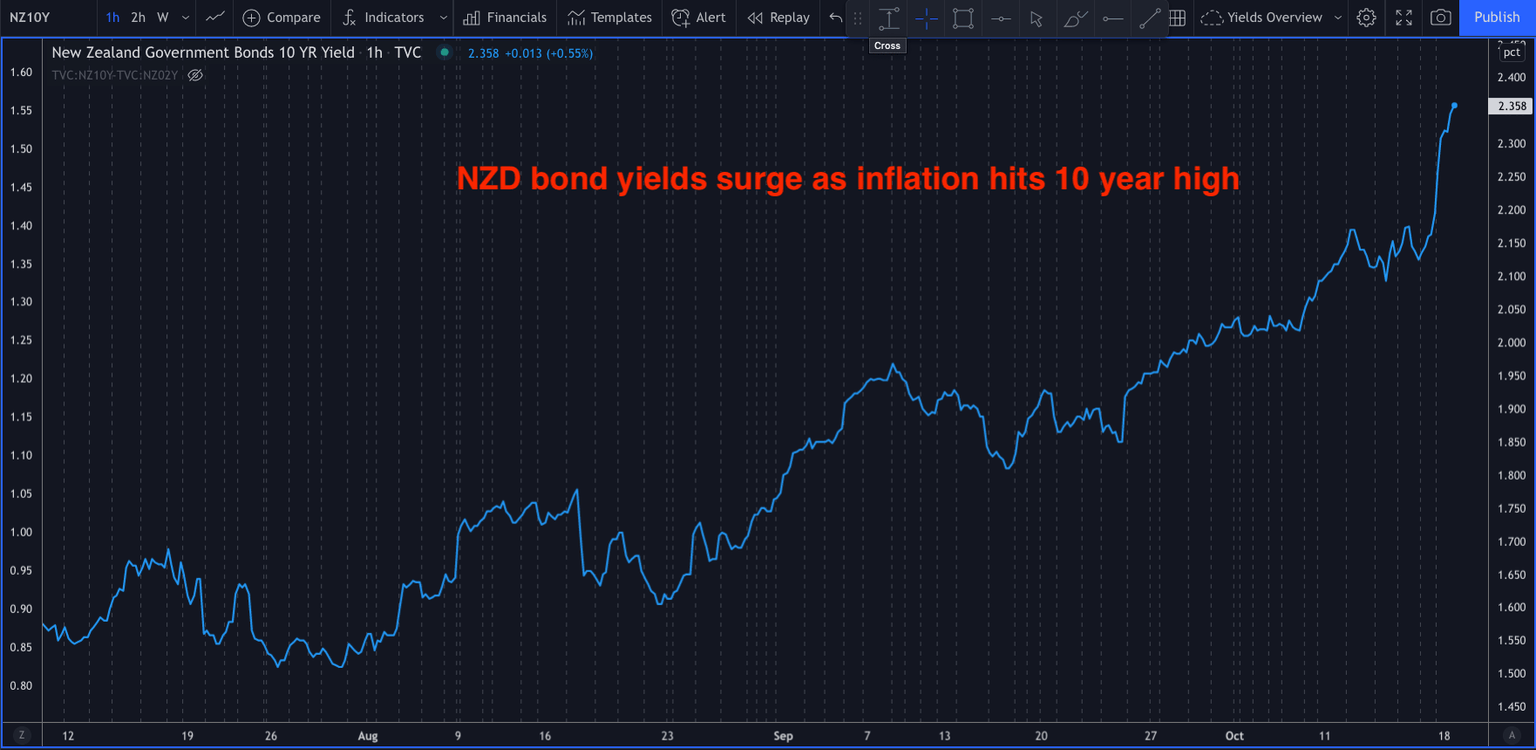

Surging inflation to lift the NZD/JPY?

New Zealand Q3 inflation has risen at its fastest pace in 10 years with the annual inflation rate move up to 4.9% from 3.3% in the second quarter. This has caused the New Zealand bond yield to rise sharply higher as expectations now increase for a 50 bps rate hike at the next RBNZ rate meeting.

The latest swaps data show that the chances of a 50bps rate hike for November now stand as a 50/50 bet. The main drivers for the higher inflation were the prices of construction for new homes and gas prices.

The divergence between the RBNZ and the BoJ

The sharp fall in the JPY last week was due to all the world’s central banks being expected to raise interest rates to counter surging inflation. The one central bank that is not expected to respond is the BoJ. Their yield curve control keeps Japanese bond yields low and the deflationary forces Japan faces are expected to keep the BoJ on hold. However, remember that the BoJ is starting to see some small signs of inflation now.

NZD/JPY dip buying

However, as long as risk-off flows don’t result in strong gains for the JPY then NZDJPY dip buying makes sense. The strong seasonal pattern for NZDJPY gains over the last 10 years further play into this outlook as the chart shows below.

The chart

The obvious place to look for buyers would be from a retracement down to the 50% Fib retracement level just above 78.50. If price retraces here it would be reasonable to expect buyers on the strong diverging outlook between the RBNZ and the BoJ.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.