Stocks rebounded as the US and China are set to begin trade negotiations

Highlights:

Market Update: Stocks rebounded as the US and China are set to begin trade negotiations today. The Vanguard Total World Stock Market ETF (VT) finished higher by 0.84%. U.S. 10-year yields moved higher by 5 basis points, causing bonds to fall.

Dow Theory: Transportation stocks were the top performing broad market equities yesterday, as the IYT ETF gained 1.21%. Transports have been weak and have not confirmed the Dow Industrials' positive trend this year. The negative non-confirmation suggests to us that the market is still very much on a Dow Theory sell signal. The Dow Industrial Average is back above its 40-week moving average, and even made a new all-time high this calendar year. The new high, if accompanied by a new high in the Transportation average, would have resulted in a buy signal. The Dow Transportation index did not confirm, however, and has made a series of lower highs and lower lows. The Transportation index is below its 40-week moving average.

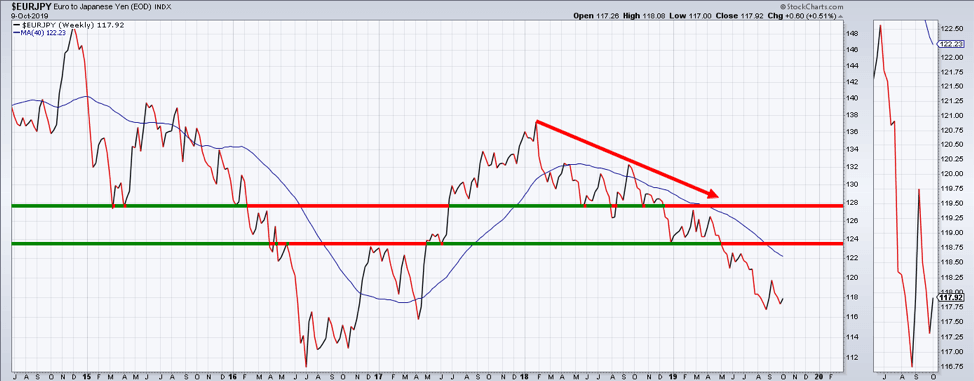

Japanese Yen: Market bulls want to see the Japanese Yen break down against currencies like the Euro and Australian Dollar. If the Yen is rallying or in a positive trend against these other major currencies, it suggests a more deflationary condition. The Yen has been rallying against the Euro and the Australian Dollar for over one year now and the trend shows no signs of letting up. If the Yen starts to break down against major currencies, we would expect inflation expectations to move higher and potentially emerging market equities as well. Right now, the strong trend in the Japanese Yen is suggestive of a risk-off posture.

China: As China and the U.S. begin another round of trade talks, we find it interesting that Chinese A Shares, as referenced by the KraneShares ETF KBA, are bouncing off the 200-day moving average. KBA has been above the 200-day moving average since early 2019. It will be interesting to see if KBA bounces from here on the back of a partial deal, or whether talks break down and the 200-day moving average gives way to further downside. It could also be true that KBA breaks down on good news and rallies on bad. We will have to wait and see.

Advance/Decline: The advance/decline line of the NYSE remains above an upward sloping 40-week moving average. The positive trend is suggestive of healthy internals. Historically, the cumulative advance/decline indicator has broken down prior to price. Right now, it remains in a positive trend.

Chart of the Day: CEO confidence is suggesting a breakdown in business investment. A significant decline in business investment can also turn into a recession. Let's hope that this survey no longer matters, like the ISM report, nominal GDP, productivity, corporate profits, or industrial production.

Futures Summary:

News from Bloomberg:

The White House is looking at rolling out a currency pact with China which would be part of a first-phase deal that would suspend tariff hikes, people familiar said. The accord, which the U.S. said had been agreed to before earlier talks broke down, would trigger more negotiations on issues like intellectual property and forced technology transfers.

Conflicting reports on trade talks created a volatile trading session in Asia. U.S. stock futures and Treasuries were little changed after fluctuating before today's negotiations. The dollar fell and the yuan reversed a decline. Stocks in Europe edged down while those in Asia nudged up. Oil and gold were steady. The pound rose.

Here's a look at what happened: The SCMP reported there was no progress in deputy-level meetings this week. Then, CNBC said the White House denied that talks were going to end early but Fox Business came up with Chinese sources that said they were being cut short. Bloomberg reported a currency pact may be part of the deal. And the NYT added Trump is going to allow some sales to Huawei.

Turkey's incursion into Syria will be discussed by the UN Security Council today. Turkish F-16 warplanes and artillery units, with howitzers and rocket-launchers, have struck at least 181 targets so far, its Defense Ministry said. Two U.S. defense officials said the U.S. and Turkey are no longer exchanging intelligence or coordinating air sorties in the region. Follow along with our Syria Update and take a look at the global impact.

PG&E's shares plummeted in early trading after a judge stripped it of exclusive control in its bankruptcy case, allowing bondholders including Pimco and Elliott to pitch their own restructuring plan. The utility also started to shut off power to 234,000 more customers on top of the half-million already without energy. Check out our QuickTake on the biggest orchestrated blackout ever.

Author

Clint Sorenson, CFA, CMT

WealthShield