Stock price action analysis for NET, DDOG, MDB – Post-earnings strategy [Video]

![Stock price action analysis for NET, DDOG, MDB – Post-earnings strategy [Video]](https://editorial.fxstreet.com/images/Markets/Equities/stock-market-surge-bull-green-financial-screen-5785196_XtraLarge.jpg)

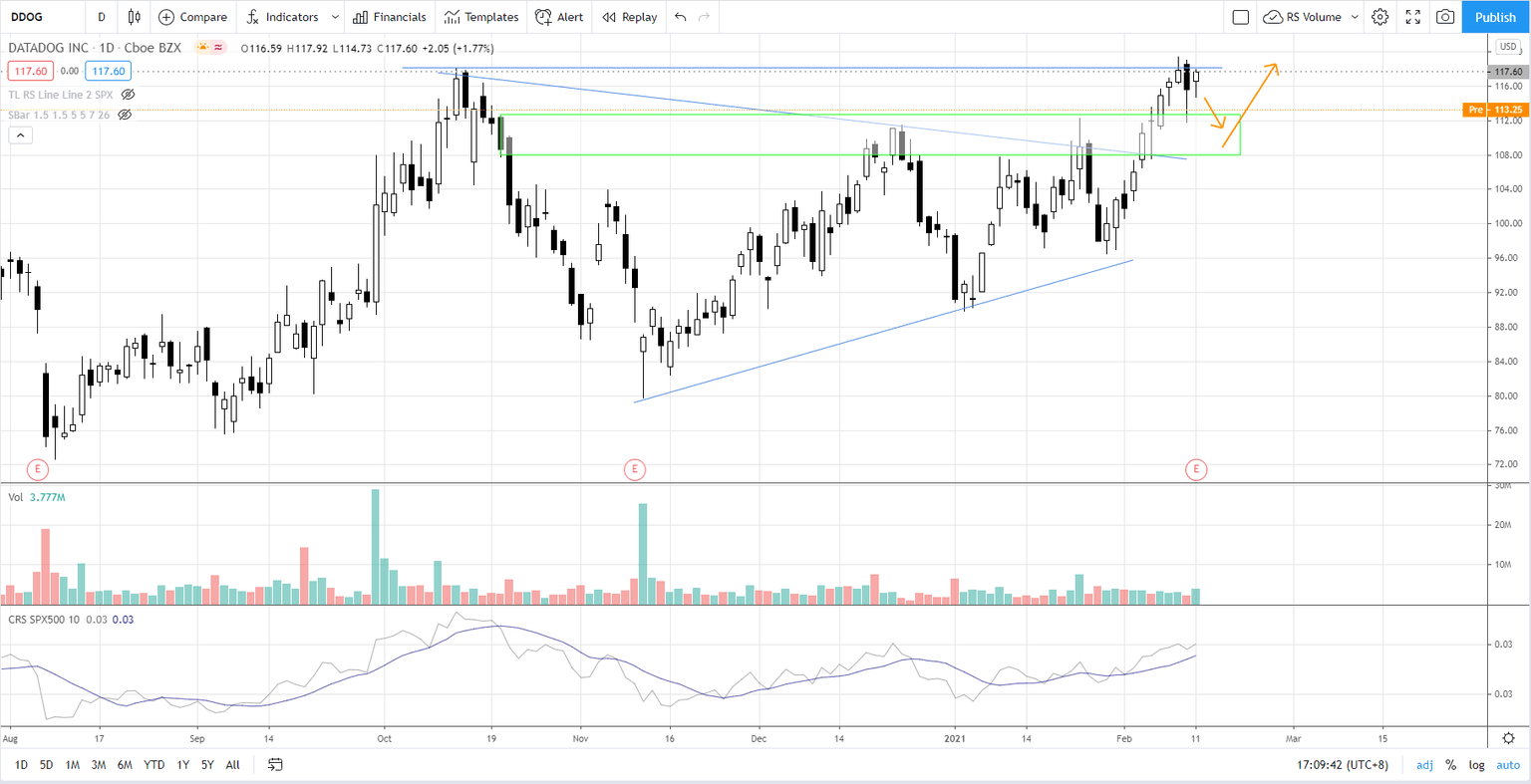

NET (CloudFlare INC) and DDOG (DataDog INC) have both reported earnings yet the post-earnings reaction as shown in the post-market is negative where NET posted -7.43% drop to 84.5 while DDOG posted -2.64% drop to 114.5. Are the drops a temporary knee-jerk reaction which will be quickly negated or will this cause serious damage to the bullish price structure for NET and DDOG?

In the video below, I pointed out the demand zone where a retracement to the zone could potentially form a low risk entry with pullback trading strategy upon confirmation for each stock because of the bullish formation based on Wyckoff trading analysis. Reversal trading from (or near) the demand zone is the key for the low risk entry with great reward to risk ratio. Else wait for the breakout confirmation with my favorite breakout trading strategy to catch the explosive move. Watch the video below:

Timestamps

-

0:21 DDOG (DataDog INC).

-

3:36 MDB (MongoDB INC).

-

6:07 NET (CloudFlare INC).

Refer to the updated demand zone, which is also the support zone for DDOG.

Note: Pay attention to MDB (MongoDB INC)'s earnings announcement which is scheduled on 17 Mar 2021.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.