Sterling surged vs Euro on Scottish referendum news

The cross was sharply lower on Monday, losing 0.85% since Asian opening until early hours of American session.

Sterling accelerated further, after being initially lifted by weaker dollar on downbeat US jobs data, with the latest signals that probability of Scottish independence referendum before 2025, decreased further, additionally boosting pound.

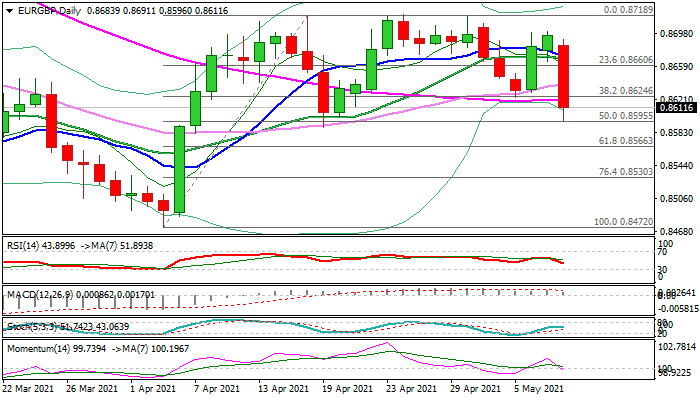

Fresh weakness cracked psychological 0.90 support and hit three-week low at 0.8595, pressuring key supports at 0.8590/88 (daily cloud base / Apr 19 low).

Firm break here would increase risk of deeper fall on completion of lower platform at 0.8720 zone (April’s multiple upside rejections) and signal an end of corrective phase from 0.8472 (Apr 5 low), with break of nearby 0.8566 Fibo support (61.8% of 0.8472/0.8718) to confirm bearish stance.

Today’s bearish acceleration brought daily moving averages back to bearish configuration and momentum entered negative territory, supporting the action.

Caution on failure to break 0.8590 zone pivots at first attempts that would keep bears on hold for consolidation, but the action is expected to remain biased lower while holding below daily Tenkan-sen (0.8656).

Res: 0.8619; 0.8638; 0.8656; 0.8670

Sup: 0.8590; 0.8566; 0.8530; 0.8500

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.