Sterling cruises to a four-month high

The British pound rose to the highest level since February 24 after the strong economic data from the UK. The data showed that the country’s unemployment rate declined t0 4.8% in March as the government started its gradual reopening. This decline was better than the median estimate of 4.9%. At the same time, the economy added 84,000 jobs in the past three months to March, better than the median estimate of 50,000. Further, the average earnings rose by 4.6% in March and by 4.0% with bonuses included. The data show that the country’s economy is recovering at a faster pace than most analysts were expecting. Tomorrow, the ONS will publish the second estimate of the UK GDP data.

The euro rose above a key level of resistance as market mood improved. This happened after several Federal Reserve officials like Raphael Bostic said that this was not the right time to consider the tightening of policies. The euro also rose after the latest EU GDP data. According to Eurostat, the European economy declined by 0.6% in the first quarter, as expected. On a year-on-year basis, the economy declined by 1.8%, as expected. Further data showed that the employment change in the bloc declined by 0.3% in the quarter and the trade surplus rose to 15.8 billion euros. European stocks rose after these numbers, with the DAX, FTSE 100, and CAC 40 rising by more than 0.20%.

The price of crude oil rose sharply today as investors remained optimistic about the recovery of the world economy. Brent rose back to $70 while West Texas Intermediate (WTI) rose to $66.80. The increase in crude oil prices was spread across the commodities sector, with the prices of gold, silver, copper, and iron ore bouncing back. Oil prices also reacted to news by the International Energy Agency (IEA). The agency said that oil and gas companies will need to stop all oil and gas exploration this year to achieve net-zero by 2050.

EUR/USD

The EUR/USD pair rose to a high of 1.2225 as the US dollar retreated. On the four-hour chart, the pair managed to move above the upper side of the ascending channel and is approaching the highest level on 1.2241. The price has also risen above the 25-day and 15-day exponential moving averages (EMA) while the moving average of oscillator and Relative Strength Index (RSI) have all risen. Therefore, the pair may keep rising as bulls target the next resistance at 1.2250.

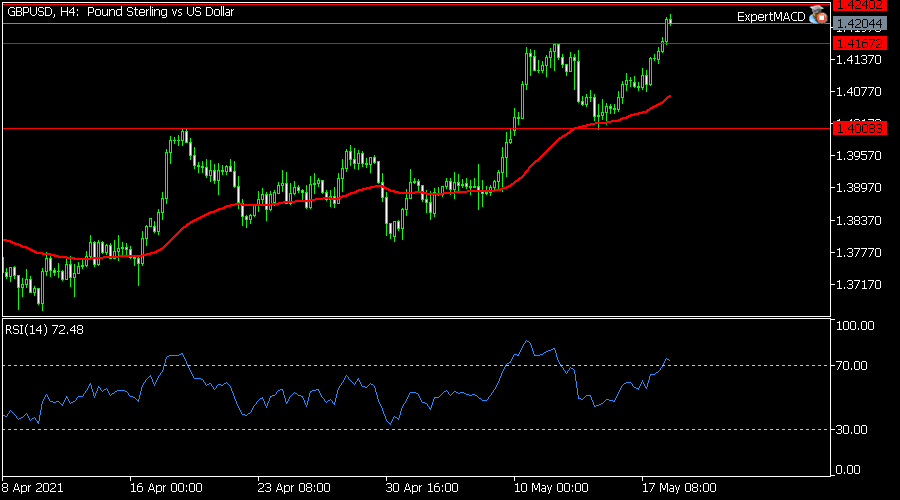

GBP/USD

The GBP/USD pair rose to 1.4220, which was the highest level since February this year. On the four-hour chart, the price has managed to move above the important resistance at 1.4167. It has also moved above the 25-day and 15-day exponential moving averages (EMA). It is also along the upper line of the Bollinger Bands while the Relative Strength Index (RSI) and MACD have risen. Therefore, the pair may keep rising, with the next target being 1.4240.

XAU/USD

The XAU/USD pair rose to 1,875, which was the highest level in three months. On the daily chart, the price has moved above the 25-day and 15-day moving averages. It has also formed an inverted head and shoulders pattern, which is usually a bullish sign. The pair’s Relative Strength Index (RSI) has also rallied to the overbought level of 70. Therefore, the pair may keep rising as bulls target the next resistance at 1,900.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.