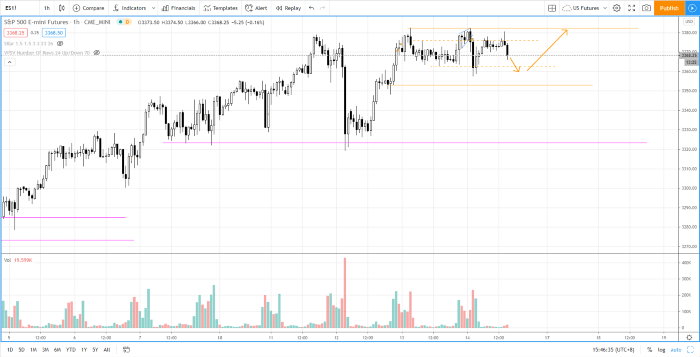

SP500 trade review - 3 different entries to initiate this breakout trade

Yesterday S&P 500 had a small spread candle with decreasing volume. This could be a sign of supply absorption before the next rally up. A failure below yesterday's low could see S&P 500 to test 3320 level.

Check out the video for a complete walk through of the daily market analysis of S&P 500 futures (ES) for 14 Aug 2020 trading session. In this video, I am going to show you the market recap on the last session and trade reviews in the three-minutes timeframe (including entry, exit and the rationale behind). Going forward, I will cover the bias, the key levels to pay attention to, the potential setup for the US session later.

Check out my daily market analysis video on last session if you haven't in order to better relate to the market recap and the trade review.

Bias — neutral (Day trading); bullish (long term)

Key levels — Resistance: 3385–3400; Support: 3360–3365, 3320–3330, 3300, 3273, 3230

Potential setup — Look for potential long near 3360 upon a rebound.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.