SP 500: The easiest way to avoid unnecessary losses in the market [Video]

![SP 500: The easiest way to avoid unnecessary losses in the market [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse2-637299021353183737_XtraLarge.jpg)

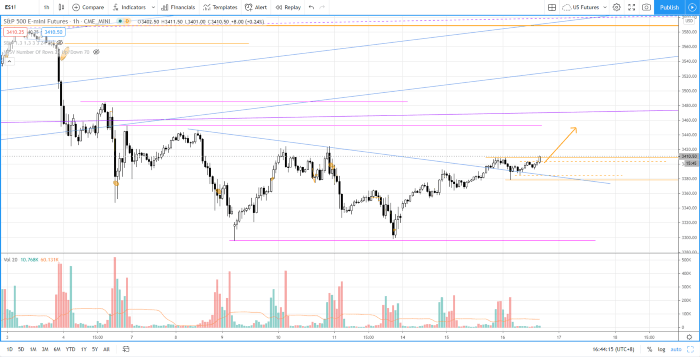

Check out the video for a complete walk through of the daily market analysis of S&P 500 futures (ES) for 16 Sep 2020 trading session. In this video, I am going to show you the market recap during the last session and a trade review in the three-minutes timeframe (including entry, exit and the rationale behind). I will focus on why some losses are not necessary and one easy way to avoid the unnecessary losses. Going forward, I will cover the bias, the key levels to pay attention to, my trading plan for the session later.

Check out my daily market analysis video in the last session if you haven't in order to better relate to the market recap and the trade review.

Bias — neutral (Day trading); bullish (long term)

Key levels — Resistance: 3425, 3450; Support: 3380, 3350–3360, 3300, 3230

Potential setup — Look for potential reversal at the key levels.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.