S&P 500 snapback, USD strength, what’s next for US equities?

Monday gave us a fast snapback rally in the major US indices, with the S&P 500 adding 1.40% and erasing Friday’s losses. What’s on tap for the remainder of this week?

Good morning folks. Today we hear from Fed Chair Jerome Powell again at 2:00 PM, as he provides testimony on the Fed’s lending programs and policies. I am sure the market will be hanging on every word. However, what else could be said at this moment to either spook or encourage market participants? On Friday, the Fed’s Bullard talked about Q4 2022 for an initial hike and said that Chair Powell has already opened up talks of tapering. This commentary spooked the markets on Friday and led to the decline. But, we have already regained those losses (on Monday at least).

All of this hawkishness sure has moved the US Dollar to the upside. As I discussed in the May 19th publication, the $DXY had been approaching a key long-term Fibonacci retracement level before all of this hawkish talk even began. It never actually traded to it ($88.36); however, it got very close: around $89.60, and found support. Time will tell if the US dollar strength is sustainable. By looking at the technicals, it looks like it could be.

Figure 1 - US Dollar Index December 20, 2019 - June 21, 2021, Daily Candles Source stockcharts.com

We can see the breakout about the 50 and 200-day Simple Moving Averages. In addition, we have the MACD crossing the zero line to the upside. The next test of strength will be to see if the $DXY can hold its 200-day moving average on a test, which sits at 91.58 as of the close on June 21st.

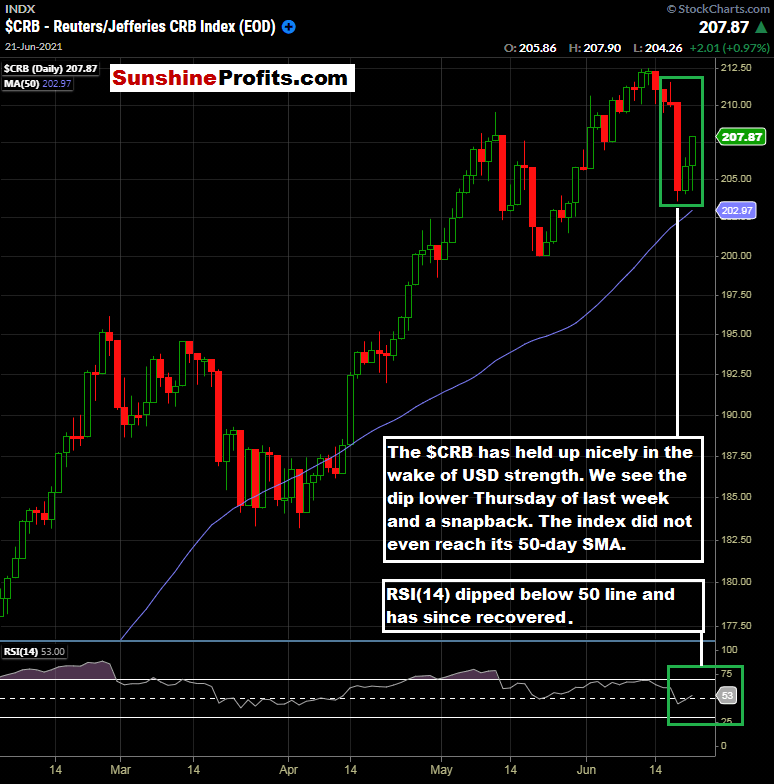

Commodities, however, have broadly held their strength with the $DXY increasing. The big exception being interest-rate-sensitive precious metals. The general inflationary theme seems to be sticking right now.

Figure 2 - $CRB Reuters/Jefferies CRB Index February 3, 2021 - June 21, 2021, Daily Candles Source stockcharts.com

Commodities are still firmly entrenched in an uptrend. It is an interesting phenomenon to see the US Dollar moving higher and commodities moving higher simultaneously. That could portend things to come in the future. Combined with higher rates, the overall market picture could change significantly over time in the long run. However, that’s a story for another time.

Instead of getting caught up in the longer-term picture for the markets, we want to stay focused and dialed in on the short and medium-term to capture potential opportunities. Based on the snapback that our subscribers were prepared for in the broader markets, we start to get a sense of how the market may react to the more hawkish Fed rhetoric in the short term.

Until things appear differently, buying the dips is still the higher probability move, in my opinion, especially in select names and themes.

Figure 3 - S&P 500 Index February 3, 2021 - June 21, 2021, Daily Candles Source stockcharts.com

I want to emphasize the aforementioned select names and themes. A broader market rally like we saw yesterday is fantastic and was something that we were looking for based on a 50-day moving average pattern repetition. I think we can look to further stack the odds in our favor by drilling down to specific names, sectors, and stories.

Market themes change over time

Let’s not discount the fact that the Fed has changed its stance. Rates will most likely increase in the future. There should be some tapering coming soon, and tapering will not be instant; it is a process that occurs over many months or even over a year. These things will certainly impact overall market sentiment. Trading the S&P 500 via the ES, SPY, or $SPX (for equity options) is a solid strategy. However, I am beginning to realize the importance of individual names and themes in what could very soon be more of a stock pickers market versus a broader market story.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Rafael Zorabedian

Sunshine Profits

After spending years as an active trader across several capital markets, Rafael earned his stripes as a former futures and options broker specializing in equity indices, energies, metals, and soft commodities.