S&P 500 Index soars to record highs as Tesla soars

The price of crude oil jumped sharply in the overnight session as demand expectations continued rising. Brent, the international benchmark, rose to more than $86 while West Texas Intermediate (WTI) rose above $85 for the first time in seven months. The rally was triggered by an analyst note from Goldman Sachs. In their note, the analysts noted that demand had already recovered from last year’s collapse and that it was heading towards 100 million barrels per day. The bank also noted that the surging natural gas prices were pushing companies to buy oil for power generation.

The US dollar index rose in the overnight session as investors waited for key economic data from the United States. The Conference Board will publish the latest consumer confidence data later today. Economists expect that the data will show that consumer confidence declined from 109.3 to 108.3. This decline will mostly be because of the rising consumer prices. Recent data showed that prices rose by 5.4% in October. Other numbers that will be in the spotlight will be new home sales numbers. These numbers are expected to rise from 740k to 760k. Also, the US will release the latest house price index data.

The economic calendar will be relatively muted today. Therefore, investors will continue watching the rising crude oil and natural gas prices. At the same time, the market will be watching the ongoing earnings season. The companies that will be in the spotlight today will be S&P Global, Centene Corporation, Xerox, Raytheon, UPS, ADM, and Waste Management. Other companies to watch will be Microsoft, Invesco, and PulteGroup.

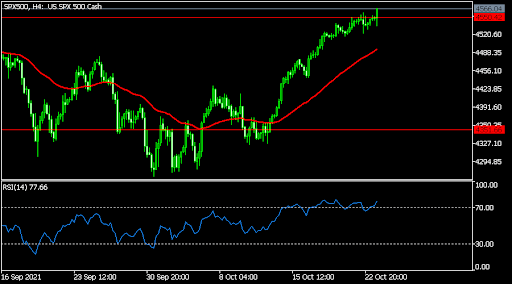

S&P 500

The S&P 500 index soared to an all-time high as investors remained optimistic about the strong earnings. The index soared to $4,565, which was the highest level on record. By doing so, it moved slightly above the previous all-time high of $4,550. It is still above the 25-day and 50-day moving averages while the Relative Strength Index and MACD have kept rising. Therefore, the index will likely keep rallying after the bullish breakout.

US 30

The Dow Jones index soared to an all-time high of $35,690 as investors cheered the strong results and rising oil prices. Like the S&P 500 index, the Dow Jones is above the short and long-term moving averages. On the daily chart, it is along the previous all-time high and it has formed a small cup and handle pattern. Therefore, the index will likely keep rising as bulls target the next key resistance at $36,000.

EUR/USD

The EURUSD pair declined sharply in the overnight session as the US dollar bounced back. On the four-hour chart, the pair declined to a low of 1.1590. The price managed to move below the key support at 1.1620. It has moved below the 25-day moving average while the Relative Strength Index (RSI) has moved lower. Therefore, after the bearish breakout, the pair will likely keep falling as bears target the next key support at 1.1550.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.