South Korea: Beginning of a new wave

New cases of Covid-19 have been rising again in Korea, with more than 300 cases per day on average since mid-November (349 on Nov 24). The number of new infections had remained stable (under 100 new cases per day) since mid-September. The government reinforced social distancing measures twice (on Nov 19 and 24), raising the level of alert to 2 (on a scale of 5) in the Seoul area, the main seat of recent infections.

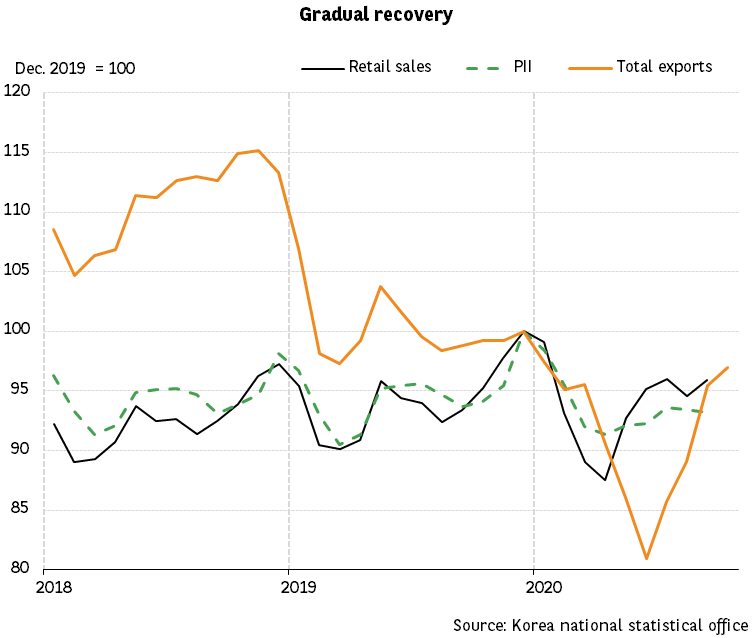

Provided it remains contained, this beginning of a new wave should not call into question the gradual recovery initiated in Q3 (+1.9% q/q, after -3.2% in Q2). The social distancing measures will weigh on domestic demand in the last quarter of 2020, but the effect should remain limited, as observed in August-September (when the level of pandemic alert was also raised to 2). Meanwhile, slowing growth in the US and fluctuating growth in the European Union will probably be offset by the strong growth rebound of China’s economy and the rapid shift of Korean exports towards Covid-related products (such as laptops chips and components, medical supplies, masks, tests…). After a 1% deceleration in 2020, Korean real GDP should grow by 2.7% in 2021.

Read the original analysis: South Korea: Beginning of a new wave

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.