Soft Dollar, stubborn yields, how markets read the Fed

- The dollar index remains in a well-defined down-channel near 98.8 while 10-year US yields push up toward 4.15–4.20%, an unusual mix that reflects expectations of a “hawkish cut” from the Fed rather than a new easing cycle.

- The latest dot-plot still clusters 2025–2026 rates in the low-to-mid 3s, with the longer-run rate just under 2.75%, confirming that the Fed sees a structurally higher rate environment than the pre-2020 decade.

- RBA-driven repricing has sent Australian 10-year yields to two-year highs around 4.74% and widened the AUS–US spread to its biggest premium since 2022, powering AUD crosses like AUDJPY to trend highs.

- Gold is holding near record territory around 4,200 despite higher real yields, supported by a weaker dollar, central-bank demand and retail rotation into “financial gold” over jewellery, especially in Asia.

Macro backdrop: Fed week in a 4% yield regime

Overnight data reinforces a simple picture: global growth is uneven but not collapsing.

Japan’s Q3 GDP was revised to a -0.6% q/q contraction (-2.3% annualized), underlining how fragile domestic demand is just as the Bank of Japan edges along a very gradual normalization path. China, by contrast, surprised on the upside with November exports jumping 5.9% y/y and imports up 1.9%, helping the trade surplus widen above 110 billion dollars. Germany then printed a strong 1.8% m/m gain in October industrial production, supporting the idea that the Eurozone slowdown is more “muddling through” than outright recession.

Against this backdrop, the Fed walks into Wednesday’s meeting with:

- Core PCE stuck around 2.8–2.9% y/y,

- Labour data that is softer, not broken,

- A market that has already fully priced a 25 bp cut and another two or three moves into 2026.

-1765182064561-1765182064562.png&w=1536&q=95)

The dot-plot snapshot in front of us tells the real story. The bulk of projections sit around 3.6% for 2025, fading gradually toward roughly 3.0–3.1% in 2026–27 and a longer-run “neutral” below 2.75%. This is a world where:

- Policy is easing from restrictive to “less restrictive”,

- Real yields remain positive for a long time if inflation settles near 2½–3%,

- Long-term yields around 4% are not an aberration – they are the new centre of gravity.

That is exactly what the bond market is starting to price.

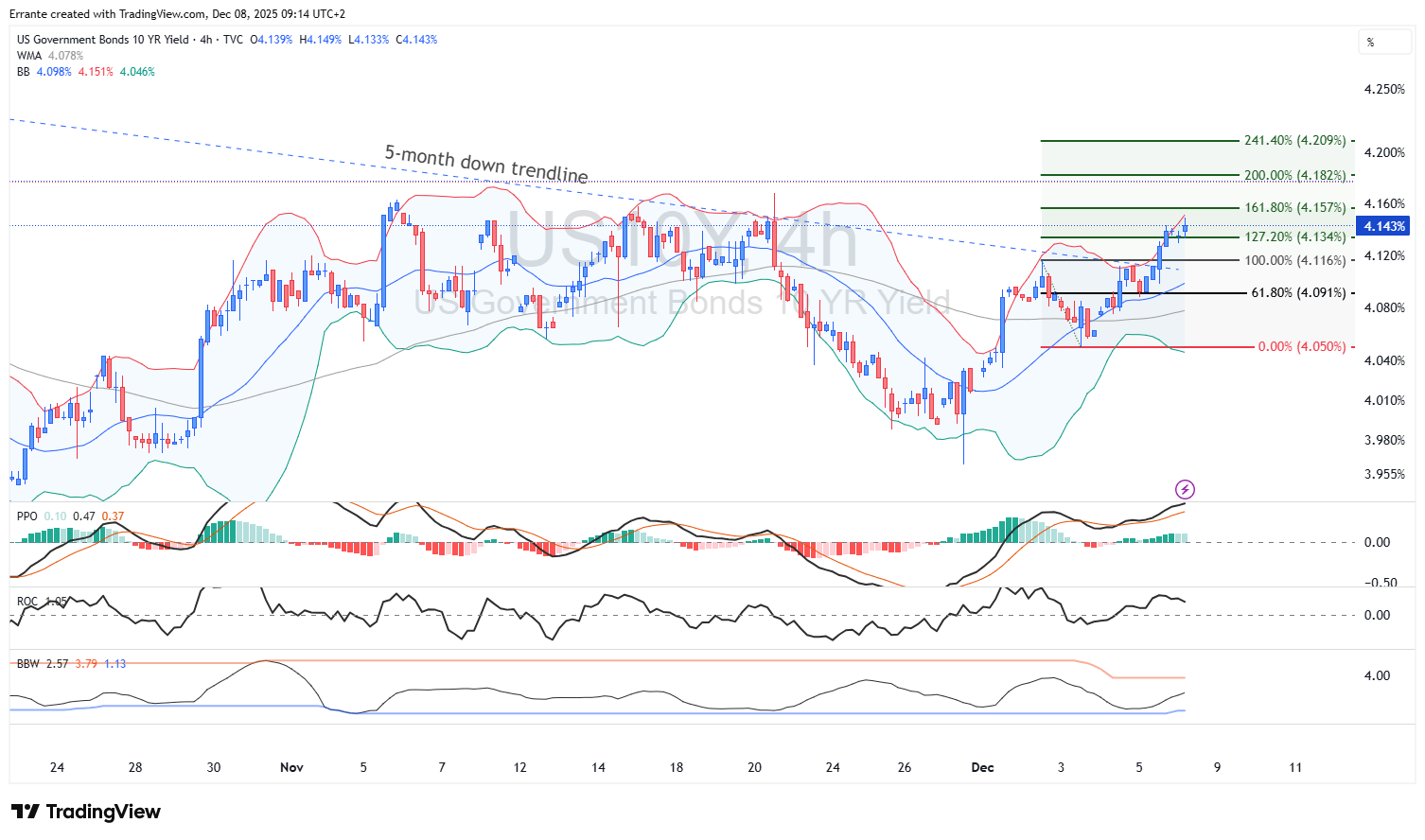

Bonds and fixed income: the market quietly pushes back

The 10-year US yield has bounced hard from the 4.05% area and is now trading around 4.14% on our 4-hour chart, pressing into a short-term Fibonacci cluster between 4.16% and 4.21%. Momentum (PPO) is positive and rising, ROC has turned up, and Bollinger bandwidth is widening – classic signs of an impulsive move rather than random noise.

In other words, investors are using the run-up to the Fed to:

- Take profit on the “lower-yields forever” narrative,

- Rebuild term premium as Treasury supply remains heavy and fiscal risks stay in focus,

- Hedge against the risk that the Fed validates a higher-for-longer rate path.

Two things follow from this:

1. If Powell delivers the expected 25 bp cut but leans heavily on upside inflation risks and fiscal realities, the 10-year can easily extend toward the 4.30–4.50% zone in coming weeks.

2. A dovish surprise in the statement or press conference is more likely to flatten the move (10-year drifting back toward 4.0%) than to create a sustained rally much below that level – the supply and term-premium story is structural, not cyclical.

For credit and EM, this matters more than the Fed funds rate itself. Funding costs are already adjusting to a world where 4% on the US 10-year is the floor, not the ceiling.

Dollar and major FX: soft index, strong carry

The dollar index on the 4-hour chart is sliding within a clean descending channel. Each bounce toward 99.4–99.5 has been sold, and price is now sitting just under the 61.8% retracement of the last minor rebound around 98.90, with extension levels pointing to 98.67 and 98.40 as the next downside waypoints.

Technically:

- PPO is mildly negative, consistent with a controlled downtrend,

- ROC is weak, not yet capitulating,

- Bollinger bands are narrowing – volatility is compressed ahead of the Fed.

Fundamentally, this is exactly what a “hawkish cut” regime looks like for the dollar:

- Short-end rates are coming down, removing some of the dollar’s carry advantage.

- Long-end yields are firm rather than collapsing, which keeps USD from collapsing.

- Relative stories matter more – and the clearest relative story today is Australia.

Australian 10-year yields have blown out to about 4.74%, a two-year high, and the spread over Treasuries has widened to roughly 60 bps, the largest since 2022. Markets have gone from pricing rate cuts in early 2026 to assigning a 50% probability of another hike by May.

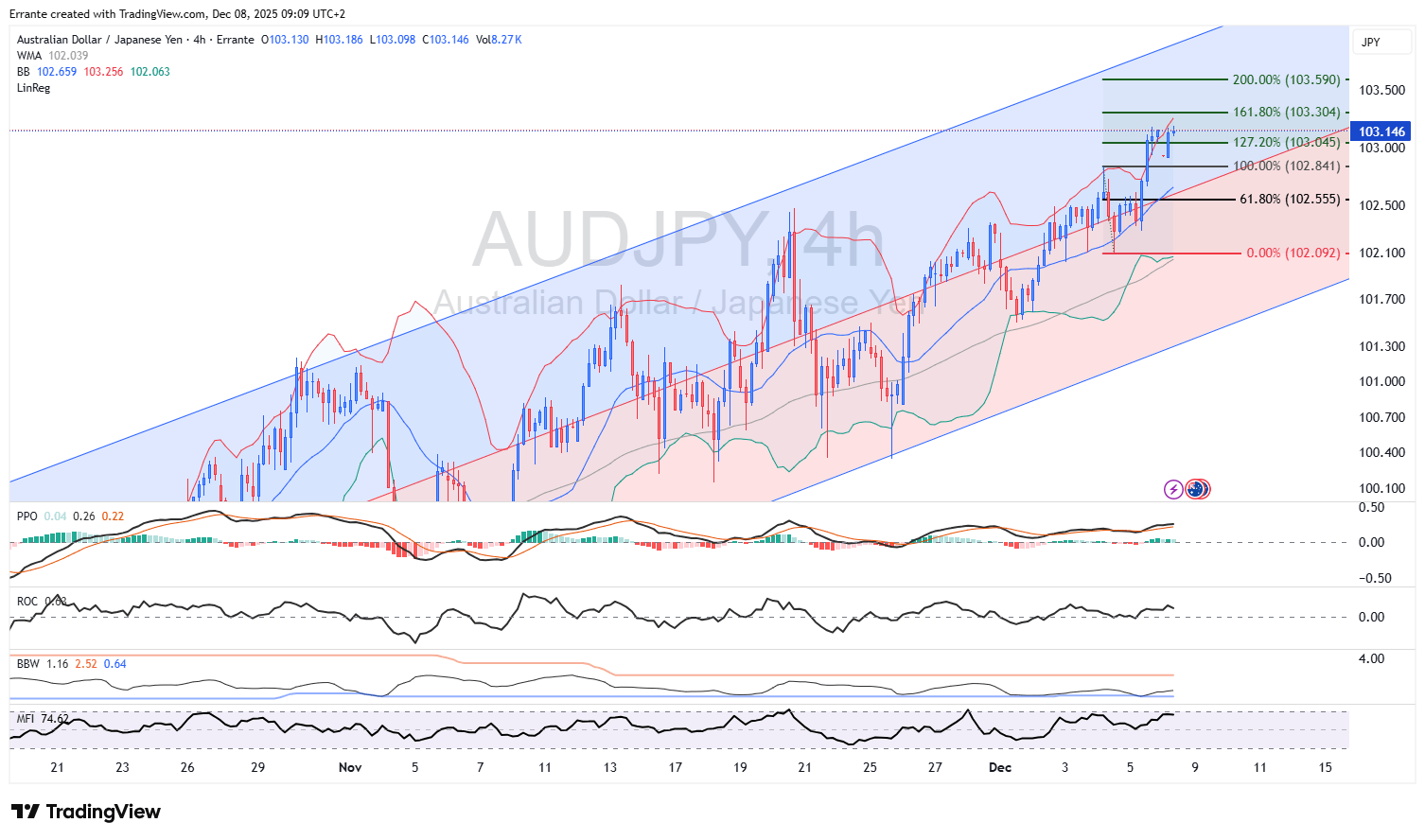

AUDJPY on the 4-hour chart is a textbook carry-trade trend:

- Price grinds higher inside a rising channel from around 100,

- The pair is flirting with the 127.2–161.8% Fibonacci extension band between 103.05 and 103.30,

- Money Flow Index is above 70, signalling stretched but not yet exhausted demand.

As long as:

- RBA rhetoric leans hawkish,

- Japanese yields are capped by a cautious BoJ facing negative GDP,

- Global risk sentiment remains constructive,

the path of least resistance for AUDJPY remains up, with pullbacks into the 102.50–102.80 area likely to attract buyers.

Elsewhere in majors, the implications are straightforward:

- EUR should stay supported on the crosses while the US dollar index trends lower and Eurozone data stabilise.

- CAD benefits from a similar dynamic to AUD: stronger domestic data, a central bank in no hurry to cut, and oil holding in the high-50s/low-60s.

- The main risk for USD bears is not today’s light US calendar, but a Fed that leans more heavily on the “dots” than on market pricing.

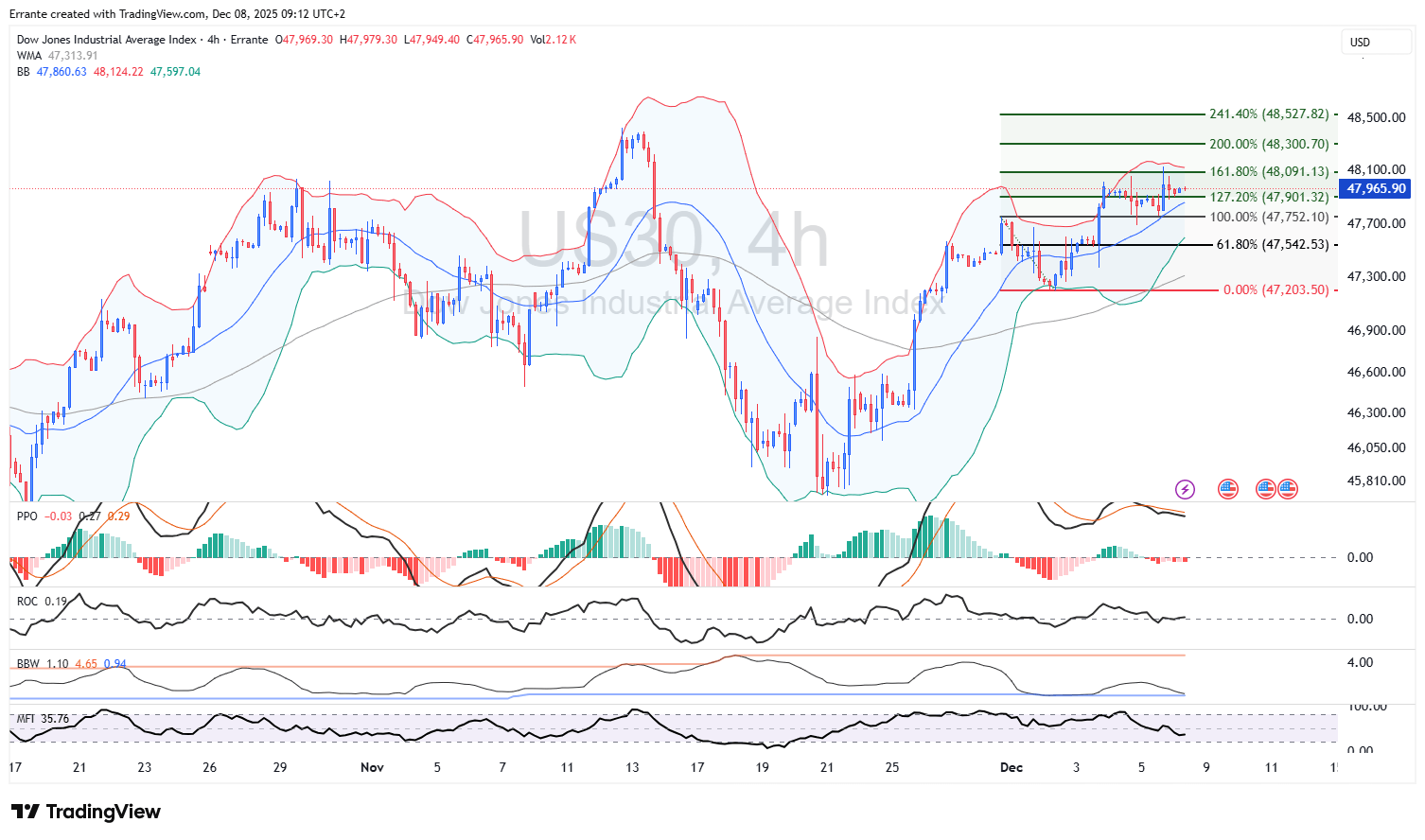

Equities: Dow grinds higher into resistance

The Dow Jones Industrial Average on the 4-hour chart is consolidating just below 48,000 after a strong leg higher. The index is stuck between:

- Support around 47,540–47,750 (61.8% retracement and recent swing lows),

- Fibonacci extension targets at 48,193, 48,300 and 48,528.

Momentum (PPO) has rolled over from overbought territory, while ROC is flattening – suggesting the rally is maturing rather than breaking. This fits the macro story:

- A Fed cut plus still-solid US growth keeps the “soft landing” narrative alive.

- Higher long yields and term premium prevent valuations from blowing out.

Equities can keep grinding higher into year-end, but the risk/reward on fresh longs at these levels is less attractive. For institutional money, the more compelling angle is rotational: from long-duration growth into cyclicals and value that benefit from a 4% yield world and a steeper curve.

Gold and commodities: hard assets in a world of sticky real yields

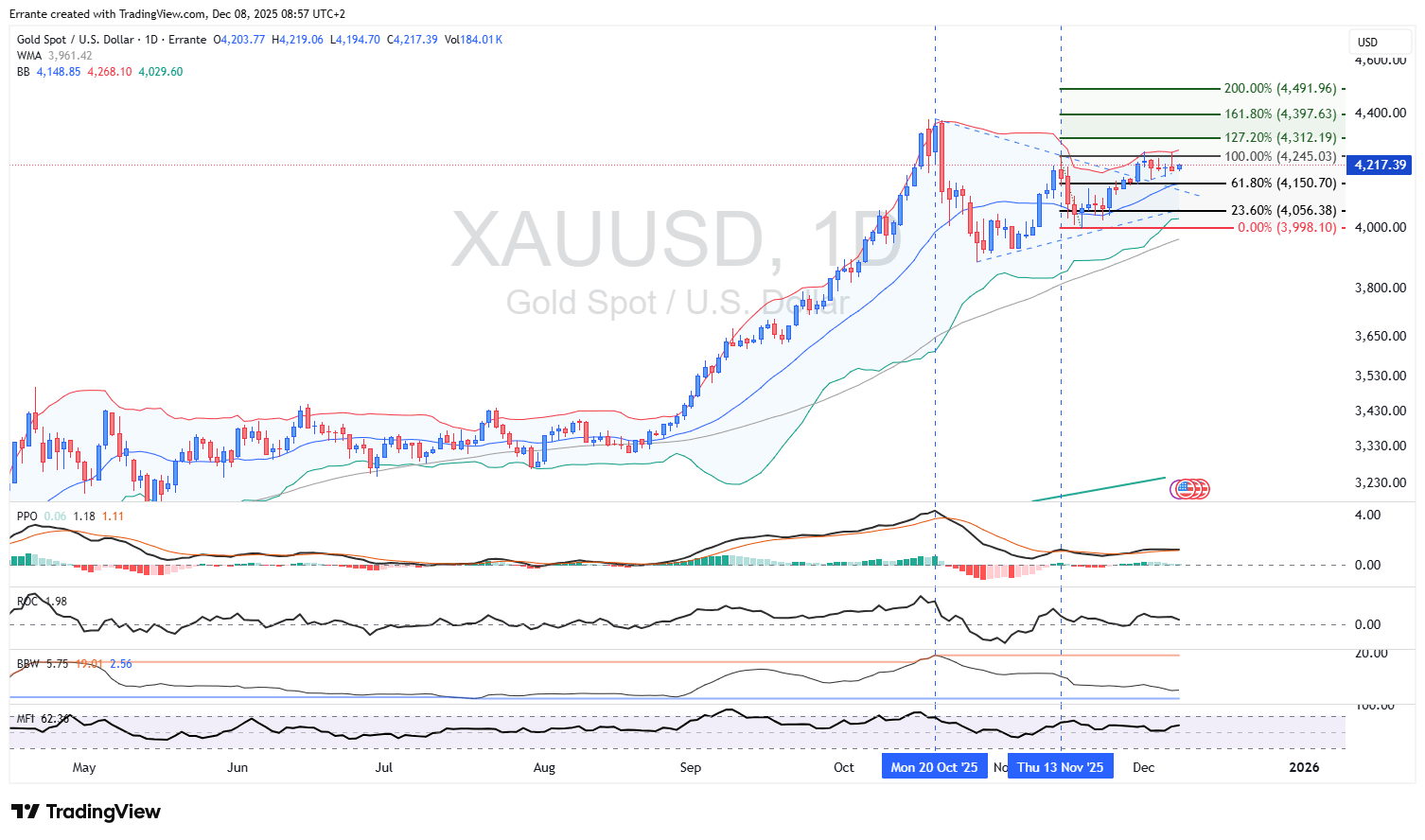

Gold’s daily chart looks like a coiled spring. After the parabolic run into early November, price has spent weeks building a sideways range between roughly 4,150 and 4,245.

Technically:

- The 61.8% retracement of the latest leg up sits just below current price and has repeatedly acted as support.

- Overhead, 4,245 is the first serious resistance, with 4,312 and then 4,398–4,492 as higher-timeframe Fibonacci targets if the range breaks.

- PPO remains positive, while Bollinger bandwidth has compressed; MFI is in the low 60s, signalling steady inflows rather than blow-off froth.

Fundamentally, three forces are supporting gold despite higher nominal yields:

1. A softer dollar index makes bullion cheaper in local currencies.

2. Central banks, led by Asia, continue to accumulate reserves, providing a steady bid.

3. Households in key markets are gradually shifting from jewellery into “financial gold” – ETFs, coins, bars – which channels investment demand more efficiently into the price of the metal itself.

In this regime, gold behaves less like an anti-yield asset and more like a hedge against policy mistakes and debt overhang. A Fed that cuts rates while long yields stay anchored above 4% actually strengthens that narrative.

On the energy side, crude remains range-bound in the high-50s to low-60s, supported by geopolitical risk premia and constrained supply, but capped by still-moderate global demand and non-OPEC supply growth. That balance keeps inflation expectations contained enough for the Fed to ease – another subtle support to risk assets and gold.

Trading takeaways

1. Dollar index: bias remains lower while price holds within the descending channel and below 99.10. Intraday bounces into 99.0–99.2 look sellable ahead of the Fed, with 98.67 and 98.40 as near-term downside markers.

2. Rates: the 10-year is the real battlefield. A daily close above 4.20% would validate the “4% floor” thesis and pressure equity valuations; failure there keeps the range-trade intact.

3. AUD crosses: AUDJPY is the purest expression of RBA–BoJ divergence and risk appetite. Trend followers will buy dips while the channel holds; mean-reversion traders will watch for exhaustion signals if price spikes into 103.5–103.8.

4. Gold: as long as 4,150 holds on a daily closing basis, the structure favours an eventual upside break toward 4,312 and beyond once the Fed event risk is out of the way.

Conclusion

The common thread across all of this is simple: we are no longer in the zero-rate, QE-everywhere world. The Fed is cutting, but in a regime where 4% long yields, positive real rates and selective risk-taking are the new normal. For traders, that means less dependence on a single “liquidity” narrative and more emphasis on relative stories – carry, curve shape, and how each asset class reacts to a world of hawkish cuts.

Author

Ali Mortazavi

Errante

BEc, CMSA, Member of IFTA - International Federation of Technical Analysis, Associate Member of STA - Society of Technical Analysis (UK).