SNB cut sends Swiss Franc tumbling

The Swiss franc is down sharply on Thursday. USD/CHF is trading at 0.8897 in the European session, up 0.67% on the day.

Swiss National Bank trims rate to 1.25%

The Swiss National Bank kept investors hanging right up to the last minute as to whether or not it would cut rates at Thursday’s meeting. In the end, the SNB opted to cut rates for a second straight time and lowered the cash rate from 1.50% to 1.25%.

There were good reasons for the SNB either to hold or cut, which meant that either decision was likely to shake up the Swiss franc, which is exactly what happened. Inflation remained unchanged at 1.4% in May, in the upper half of the target band of 0% to 2%. Growth has been steady and the SNB could have easily decided to hold rates.

There were other factors at play which swayed policy makers to lower rates, such as the exchange rate. The Swiss franc has been on a tear, climbing 3.3% against the US dollar since late May. The SNB doesn’t want the Swissie to appreciate rapidly as this hurts the export sector, a key engine of the Swiss economy.

Thursday’s rate cut has already pushed the Swiss franc lower and the rate statement noted that the SNB “is willing to be active in the foreign exchange market as necessary”. This was a reminder that the central bank, which has intervened in the foreign exchange markets in the past, won’t hesitate to do so again in order to keep the exchange rate at a desirable level.

The SNB shocked the markets in March when it cut rates, the first major central bank to do so in the era of rate-tightening in order to curb high inflation. This decision was less of a surprise but had the same effect in sending the Swiss franc sharply lower.

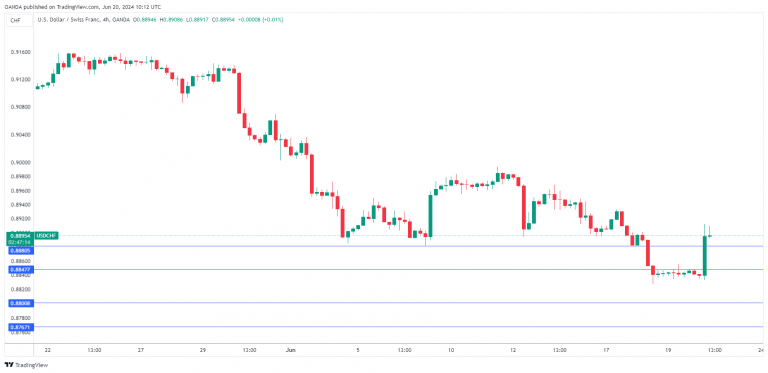

USD/CHF technical

USD/CHF has pushed above resistance at 0.8847 and 0.8880 and is putting pressure on resistance at 0.8911.

There is support at 0.8800 and 0.8767.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.