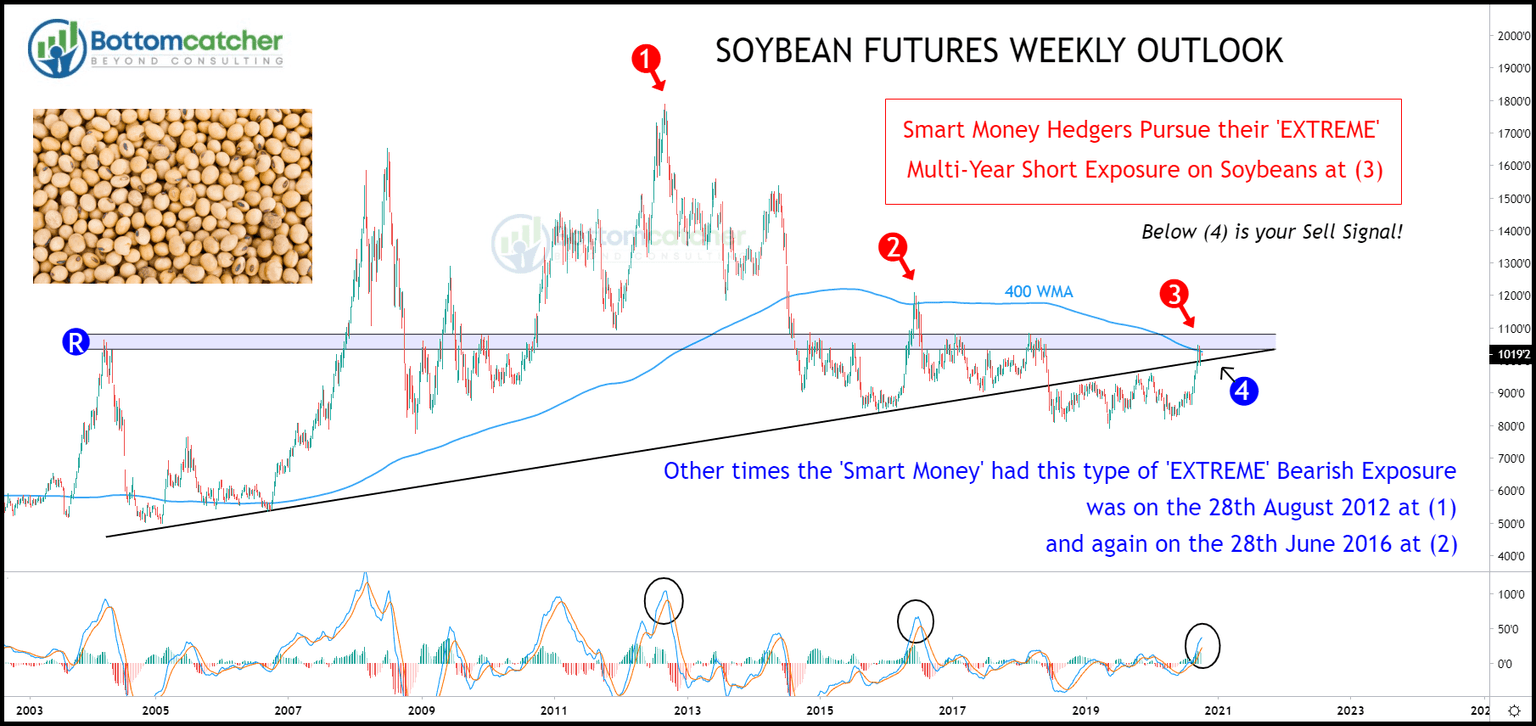

Smart money adds to extreme soybean shorts

According to last weeks commitment of traders (COT) report which covers positions held amongst three groups of traders (Commercial hedgers more commonly known as the Smart Money hedgers, Non-commercials and Non-reportables) through Tuesday the 29th September showed the Smart Money is still aggressively shorting Soybeans along with agriculture commodities in general. Their total shorts against agriculture contracts hit another multi-year low, with extreme bearish readings on Soybeans, in particular, totalling -218,443 contracts at (3) (previous week -201,737 contracts).

Non-commercial (funds etc) positions totalled 239,872 contracts, an increase of 21,306 contracts from the week prior. And Non-reportables (small speculators) totalled -21,429 contracts (previous week -16,829).

It's important to note that when commercial hedgers reach multi-year extremes, as they are now, they have a tendency to drive the markets. In contrast to that, non-commercials who typically always take the opposite side to the commercials usually get caught out at these likely turning points. From a technical perspective, the soybean weekly chart suggests we are toying with multi-year overhead resistance zone (R) and weekly prices are being capped by the 400 period moving average, which has proven to be a reliable source at turning points.

Smart money trade set-ups, such as this one are for the mid to long term.

Author

Steven Mylonas

Bottomcatcher.com

With more than 20 years of experience, Steven has a broad knowledge of market strategies and the markets in general, with a strong focus and understanding of data reading.