Slow but not slow

S&P 500 bulls need to play good defence now as 4,040 predictably stopped the rally yesterday. The retreat in junk corporate bonds with cyclicals should give the buyers some pause. And as clear risk-off is unlikely to strike today (earnings aren‘t as strong a catalyst to trigger that, and UK figures didn‘t have that power either), we can look forward for both TLT to remain well bid, and tech not totally mirroring its daily strength.

It‘s about the soft landing, and its odds to be dialed back somewhat next – before the hype returns for next week‘s FOMC. For S&P 500 that means a lean day today of quite some chop with 3,990 and 3,955 levels being key.

As stated in yesterday‘s extensive analysis:

(…) Good luck with earnings projections and valuations – and don‘t forget about those two rate cuts priced in for late 2023.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

S&P 500 and 4,010s – that‘s what the buyers are eyeing (to close comfortably above). While today is no true Turnaround Tuesday, we‘re looking at sellers to be having the daily initiative.

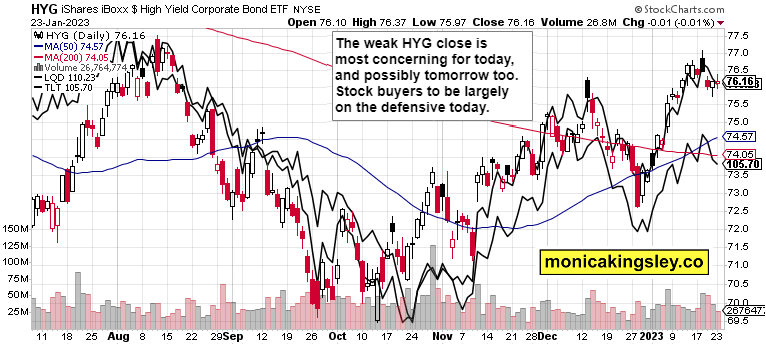

Credit markets

Bonds are in for a lackluster session, and merely defending current levels with price increases on the long end, would be a success. And constructive for the stock market.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.