Silver scales new highs as global supplies tighten

A fundamental dynamic is driving the rally in silver prices: there simply isn’t enough metal.

Silver topped $58 an ounce on Monday before sliding on Tuesday on profit-taking.

Silver has gained over 99 percent this year.

In October, a silver squeeze helped propel the price to $50. At the time, analysts explained the situation as a temporary displacement of metal.

Last spring, significant amounts of silver flowed into the U.S. due to tariff worries. This led to a shortage of metal in London. According to Bloomberg, the amount of free float silver (metal not committed to ETFs or other funds) dropped from a high of 850 million ounces to just 200 million ounces, a 75 percent decline. Metals Focus estimates that the available metal dropped as low as 150 million ounces.

Unprecedented silver demand in India pushed the silver market over the edge. With gold at record highs, Indians turned to silver. This put further pressure on London supplies.

The market ultimately adjusted with metal flowing back from New York to London, easing the squeeze.

A more fundamental supply problem

However, after a pause, silver has resumed its climb. As an ANZ Group analyst put it, “Shortages in the global market as a result of the recent squeeze in London are still being felt.”

It’s not so much that there isn’t enough silver in London. The problem is that there simply isn’t enough silver anywhere.

According to Bloomberg, the recent flow of silver into London has shifted the squeeze to other centers.

Warehouses associated with the Shanghai Futures Exchange report the lowest silver inventories in nearly a decade. Meanwhile, silver lease rates have climbed, reflecting strong demand and a limited supply of available metal.

This isn’t a problem that can be solved by moving metal from one warehouse to another. The issue is that demand has outstripped supply for several years.

According to Metals Focus, silver is on track for its fifth straight structural market deficit.

After setting a record in 2024, industrial demand is expected to drop by about 2 percent due to the price pressure. That will drive overall demand down by around 4 percent. However, with mine output flat, there still won’t be enough metal produced to cover the offtake.

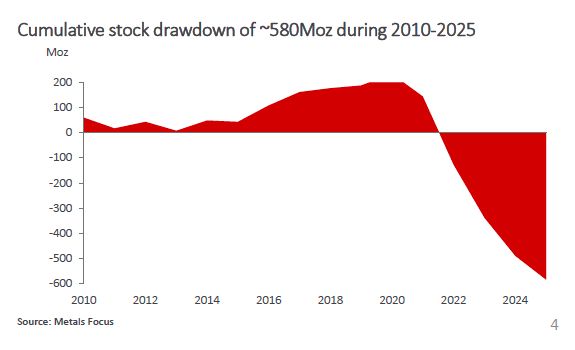

Metals Focus projects demand will outstrip supply by 95 million ounces this year. That would bring the cumulative 5-year market deficit to 820 million ounces, an entire year of average mine output.

Since 2010, the silver market has accumulated a supply deficit of over 580 million ounces.

Even with higher prices, it is unlikely that mine supply will quickly grow to erase the supply shortfall.

Silver mine output peaked in 2016 at 900 million ounces. Up until last year, silver production had dropped by an average of 1.4 percent each year. In 2023, mines produced 814 million ounces of silver.

It appears that for the next few years at least, we will have to depend on drawdowns of above-ground stocks to meet the silver supply deficit.

Silver is also getting a boost from expectations that the Federal Reserve will continue easing monetary policy.

The U.S. recently added silver to its list of strategic minerals. This could add to demand pressure and supply shortfalls.

Metals Focus Director of Gold and Silver Matthew Piggott told Kitco News, “There’s definitely going to be far more tightness in the silver market,” with the new designation.

According to Bloomberg, “Fear of a sudden premium in America has made some traders hesitant about sending the metal out of the country, offering little prospect of relief should the global market tighten further.”

There are also worries that the U.S. could impose tariffs on silver to protect the domestic supply.

These fundamental supply and demand dynamics should continue to support the silver price at least in the near to mid-term.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.