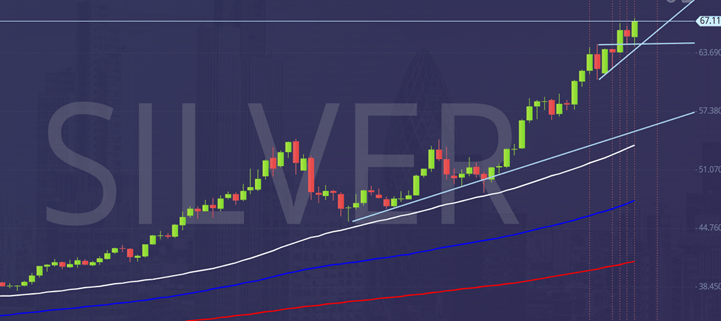

Silver buy level works again on Friday

Silver

Silver is trending higher but with significant declines after a break higher & periods of low volatility, trading sideways for long periods after a move.

Longs at support at 6470/6460 worked as we shot higher from 6445 to my 1st target of 6620/6630.

We paused exactly here for a few hours then eventually broke the all time high at 6678/6688.

We immediately hit the next target of 6700/6705 reaching a new all time high at 6745.

Eventually we should reach 6775/6778 then 6795/6799.

Downside corrections are common & quite swift so be careful, especially in low volume conditions over the holiday period.

First support at 6570/6550 could hold the downside (initially at least) but longs need stops below 6525.

If we break lower, look for a buying opportunity at 6455/6435 & longs need stops below 6420.

Author

Jason Sen

DayTradeIdeas.co.uk