Silver: Breakouts bon’t whisper; They deliver

Silver remains firmly in bullish territory.

Momentum is strong, structure is intact, and the price continues to respect higher levels despite short-term overbought readings. This is a market that’s not asking if - it’s asking from where.

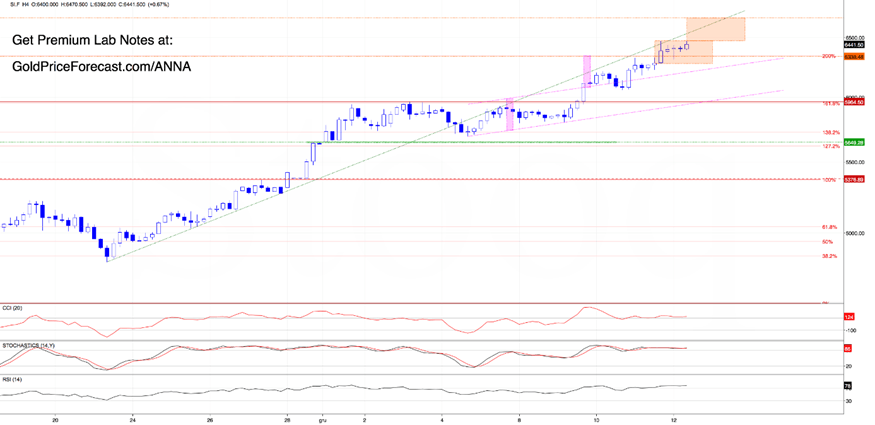

H4 update - Scenario delivered

In our Lab Note #34, we wrote:

“The first thing that catches the eye on the above chart is a breakout above the pink rising channel, which confirms bullish continuation. Therefore, if the move continues, the next stop could be around 6338-6340.”

Yesterday, bulls didn’t just reach that zone - they pushed straight through it, opening the door to higher upside targets we first outlined back on December 1st.

Well done to everyone who trusted the structure, stayed patient, and executed the plan.

This is exactly how clean technical scenarios are supposed to play out.

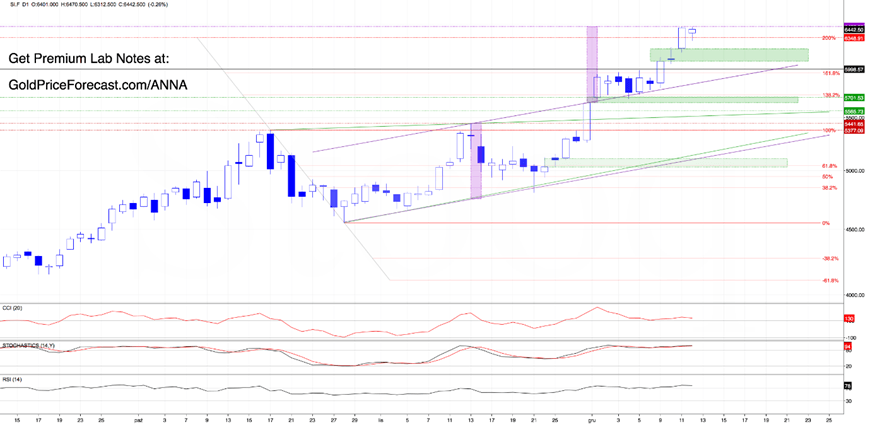

Daily chart - Where are bulls now?

Shifting to the daily timeframe, we can clearly see that yesterday’s impulse allowed price to complete the minimum upside projection following the breakout from the purple channel once again, a scenario discussed and mapped out on December 1st.

After printing a new high, silver has now slipped back into very short-term consolidation (marked on H4). That behavior is constructive, not bearish. In strong trends, consolidation after expansion often acts as fuel, not a ceiling.

If the price resolves to the upside, the next levels to watch are:

• 6500 - a key barrier already highlighted earlier

• 6665 - area, where the projected move equals the height of the orange H4 consolidation

Indicators? Overbought, but not broken. Both H4 and daily indicators remain overbought, and yes - negative divergences are present. However, and this is critical: there are still no sell signals.

In strong bullish environments, overbought conditions can persist far longer than most expect.

Divergences warn about risk, not timing. Until price confirms weakness, momentum remains with the bulls.

Key support zones to monitor

The most important downside references right now:

• the upper border of the pink rising channel - currently around 6220

• yesterday’s bullish price gap: 6103 - 6223.50

As long as price holds above these zones, the broader bullish structure remains intact.

Lab takeaway - What matters today

This is not the moment to chase highs blindly - and it’s also not the moment to fight the trend just because indicators look stretched. Silver is doing exactly what strong markets do: break structure, expand, consolidate and prepare for the next move. Today is about location. Either price holds above key supports, and the bullish continuation remains in play or it doesn’t, and the market gives us clarity. Patience here is a position.

Stay sharp and let the daily candles speak.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Anna Radomska

Sunshine Profits

Anna's passion for drawing evolved into a fascination with colorful lines and shapes, which later inspired her interest in the stock market.