Silver: Be ready to buy a break above 24.45

Gold – Silver

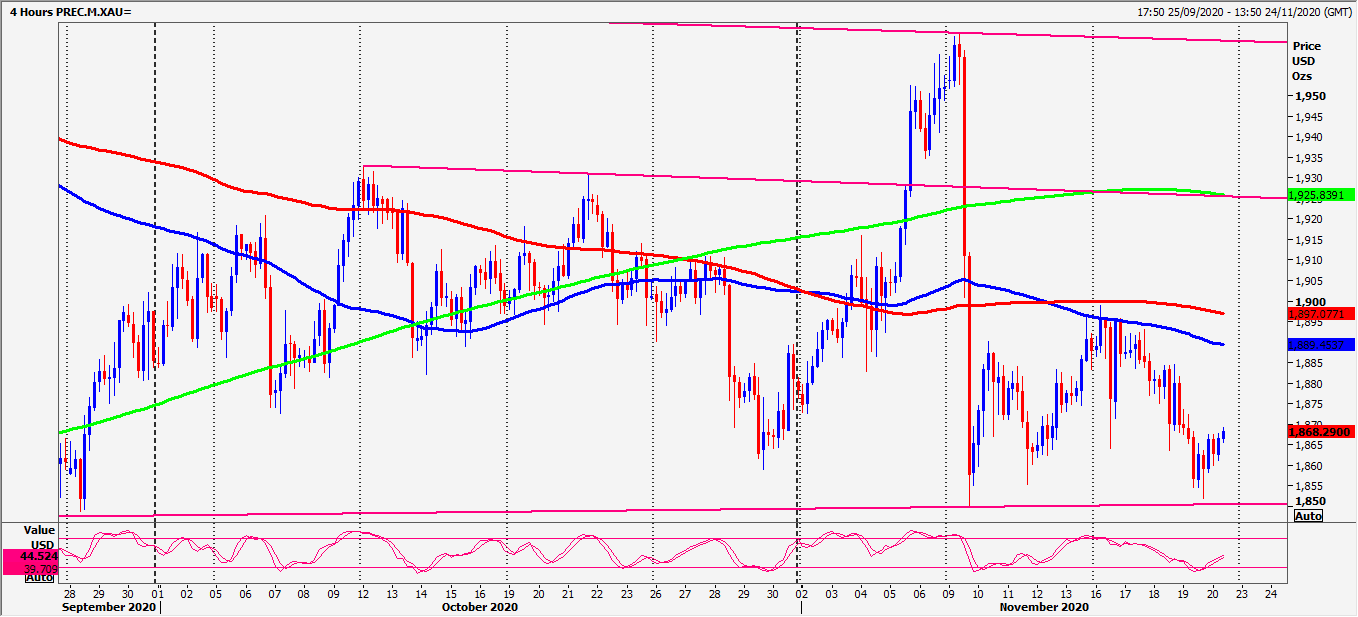

Gold Spot held the retest of last week's low at 1850/49 for a small bounce to 1867.

Silver Spot bottomed exactly at last week's low at 2360/55.

Daily Analysis

Gold bounces to first resistance at 1863/65. Try shorts at 1875/78 with stops above 1883. A weekly close above here is a buy signal for next week. Today we will target 1888/90.

Important support at the November low at 1850/49. Longs need stops below support at the September low at 1848/47 A weekly close below here is a sell signal initially targeting 1835 next week.

Silver try shorts at with stops above 2525/35 with stops above 2445. Our shorts target 2390/85 & perhaps as far as last week's low at 2360/55. Further losses target 2325/20.

Be ready to buy a break above 2445 targeting 2465/70. A break above 2480 is the next buy signal.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk