Silver aims the mother of all supports again

Bulls on precious metals have not had an easy life in the past months or even years. Trading metals pretty much brings misery, with occasional hope, but in general, it is just you holding an asset, which is moving 2%, while everybody around (Stocks, Cryptos, Forex) is making two digits returns. Anyway, I know that trading silver and gold has a lot of fans, so of course, we are not forgetting about these assets. In fact, we regularly analyze Silver, for example, we did that at the beginning of the year. We saw crucial support where the price was approaching, and we mentioned that it could be a nice bullish opportunity:

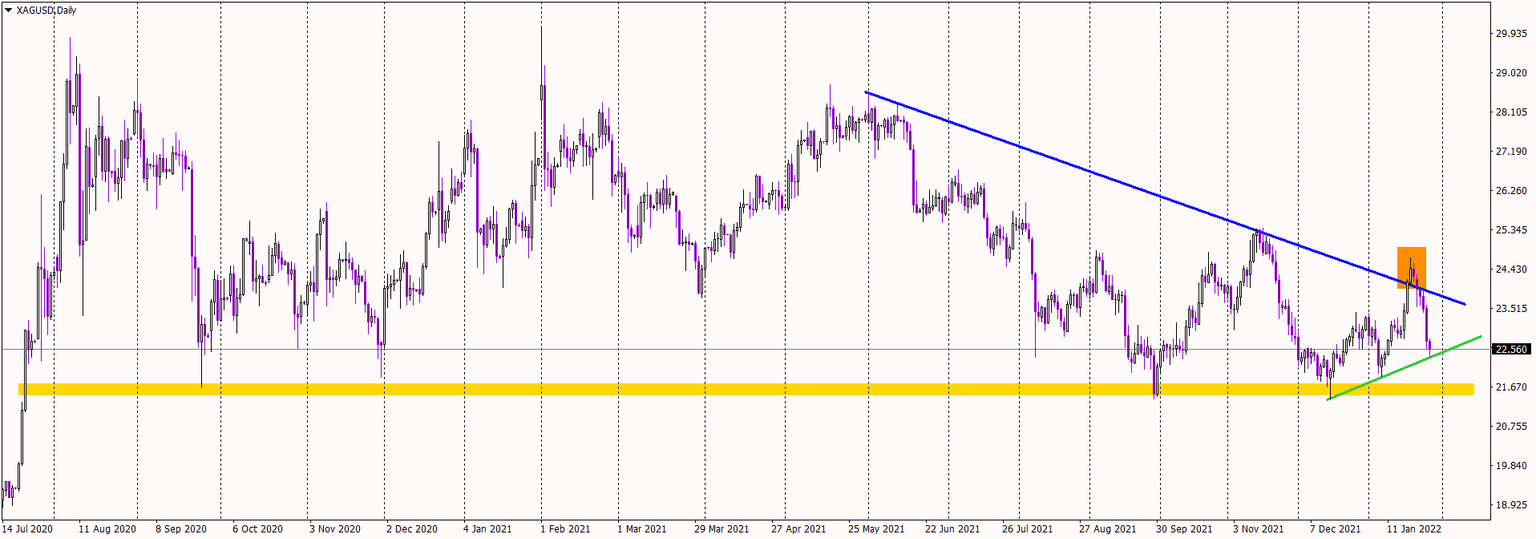

“You can see that the price is approaching the orange horizontal support. What is that line? Silver’s daily chart will definitely help us understand. That is 21,7 USD/oz, so an ultimate long-term stronghold for buyers. This level means ‘to be or not to be’ for the bullish fraction on Silver. The way to trade it is pretty simple despite the gravity of the situation. A proper bounce (with a pattern or candle) would be a legitimate buy signal.”

The price did not manage to test this support, buyers attacked almost immediately, lifting the price from 22.1 to around 24.6 USD/oz – over 10%. Not bad, huh? Those were just two weeks. Two weeks of hope, but the verification was brutal. The price falsely broke the mid-term uptrend line, creating a false bullish breakout (orange). They usually give signals in the opposite direction, so the sell-off accelerated. Currently, after six bearish days in a row, the price met short-term dynamic support (green), which can pause the drop for a while. Not entirely reverse but pause, as the bearish momentum is significant.

What’s next? This is probably another test of the mother of all supports on Silver, which we expected in the previous analysis. This support is 21,6 USD/oz, and most probably, we will get there pretty soon.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.