Should you trade water equities in 2021?

At the end of the movie The Big Short, a message appears on the screen that has stuck with me since I first watched it in 2015. One of the movie’s protagonists, the hedge fund manager Michael Burry is said to have shifted his interest from US real estate to Water.

If Burry, the man that made US$800 million predicting the crash of the US subprime housing market, is interested in H2O, shouldn’t we consider an interest in Water seriously? And maybe try to get a bit of the action ourselves?

It has been six years since The Big Short had its theatrical debut, and in this time, interest in Water based equities has multiplied. Is it too late to consider a stake in Water for ourselves? In this analyst’s opinion, not at all.

Water ETFs

There are, of course, ETFs comprised of companies concerned with Water, whether it be filtration, water services, or the like. Generally, these ETFs have performed really well, with gains mainly concentrated in the past six years. For example, one of the most popular funds, Invesco’s Water Resources ETF, is up 192% since it launched in 2006, with 129 percentage points earned in the past six months. In contrast, the S&P is up 96.32% in the same time frame.

More importantly for those of us late to the party is how these thematic ETFs might perform going forward.

Good news: demand for these ETFs is expected to grow in the next few decades. That is, at least, the market consensus. Moreover, ETF issuers can already see that the market is underserving the demand, particularly in Europe, further fuelling price growth.

What is fuelling this demand for Water ETFs? Probably climate change. A significant number of investors are beginning to recognise how vital Water will be in the very near future, as variables such as ever-increasing droughts and extreme weather conditions increase its precarity.

Water CFDs

CFDs are used to gain exposure to commodities, including Water, without purchasing the underlying asset. A big opportunity exists for traders of Water CFDs. As such, the big price movements expected in Water-based ETFs and the commodity becoming scarcer can be capitalised upon by CFD traders.

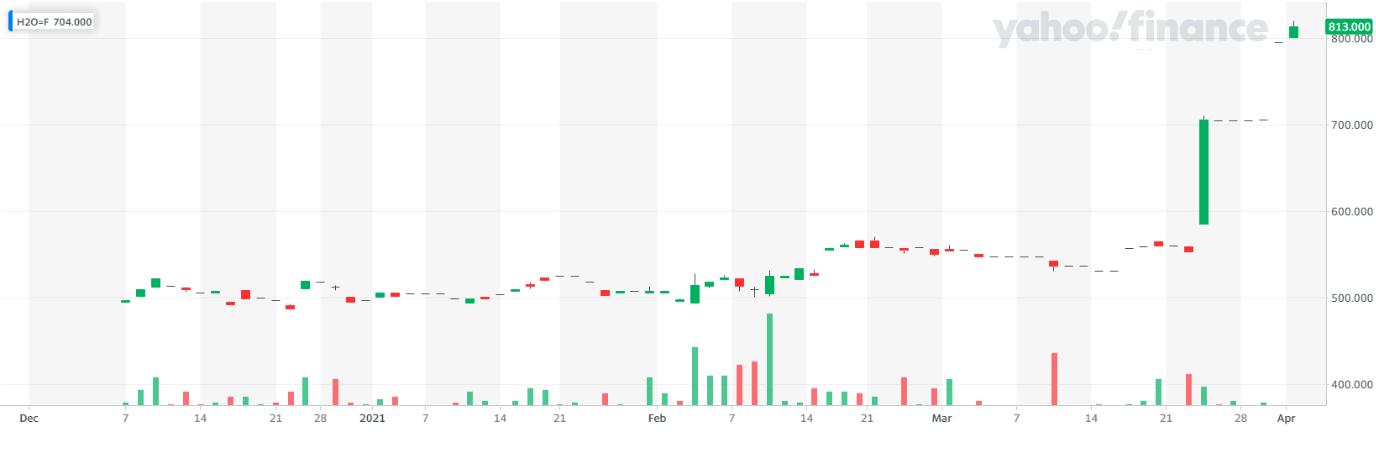

A view of the NQH2O water index futures below, which follows the price of Water in California, shows us … not a hell of a lot. The index is relatively new, only being added to the Nasdaq last year. A trickling upwards trend was meet with an uncharacteristic growth spurt in March last month. If I can wring anything from this chart, it is that there is an incongruity between the volume levels and the price movements as we enter late March. Variables outside normal market conditions are likely dictating the market prices in these circumstances. In this case, the drought conditions affecting the US west coast, which, as misfortune would have it, is expected to worsen.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.