See-sawing between risk-on optimism on vaccine and risk-off because of the new surge in covid cases

Outlook:

The data this week is heavily populated with real estate information scattered throughout the week. We also get the Empire State survey and tomorrow, retail sales. Given the scary surge in Covid cases, projections of a happy Q4 recovery are fading fast. Some speak of a double-dip recession. We also get some Fed speakers this week, but like already outdated data, will likely have little or no effect on financial markets.

Off on the side, signs of a recovery that may not get squashed by the third wave. The WSJ "Investors are making bullish wagers on agricultural commodities. Dry weather, China's push to fatten its pigs and the lockdown-induced baking bonanza are lifting prices for U.S. row crops. Futures prices for soybeans, corn and hard red winter wheat have risen by about a third since a rally began Aug. 10. Soft red winter wheat, found in animal feed and processed foods, is up about 20%.

"In the bond market, investors who bet U.S. consumers would keep paying debts this year are reaping a windfall. Bonds backed by consumer loans returned about 10% through October, according to data from Citigroup, making them one of the top-performing investments of 2020. Consumers bucked expectations and responded to the pandemic by paying down debt at a rapid clip."

Here's another one from the WSJ: PNC Financial is buying a Spanish bank's US operations in what will be the biggest "banking tie-ups since the 2008 global financial crisis. It would create the fifth-largest U.S. retail bank, with more than $550 billion in assets, a giant in an industry that has been slow to consolidate."

The more things change, the more they stay the same. You'd think the stock market would give a nod to the Third Wave, but instead focusses on the vaccines. This makes sense, sort of, in the context of an incoming government that is promising top-notch pandemic control AND vast government spending that will, as Morgan Stanley expects, lead to "trust the recovery." It's not clear how much a Pres Biden can get done by executive order in the event the Jan 5 run-off election in Georgia leaves the Senate is McConnell's obstructive hands.

Given the Covid-blind stock market response to vaccine stories, it looks like we are on the risk-off upswing of the sentiment cycle and thus a falling dollar today. We are a little worried about the market flipping to a risk-on mode as early as tomorrow, the all-too-frequent Tuesday pullback, for some unknown reason or the plain old-fashioned habit of re-positioning and profit-taking.

Bottom line, as we wrote on Friday, markets are trapped between a rock and a hard place. We are getting see-sawing between risk-on optimism now that vaccines are in sight, and risk-off because of the new surge in Covid cases.

There is a second conflict—between the immediate near-term (a week) and the very long-term (months or years).

For the very long-term, Kenneth Rogoff points out the future is not bright for the dollar. It was overvalued for a long time and likely reverting to the mean—i.e., falling. He writes in an essay last week—following up on the September Brookings Institute paper that got a lot of attention -we actually have less volatility in this crisis than in previous crises.

During and after the 2008 financial crisis, when the dollar had a far wider range than now--$1.58 to $1.07 to the euro. Dollar yen varied between ¥90 and ¥123. This "muted response of core exchange rates has been one of the pandemic's major macroeconomic puzzles."

Rogoff credits "the paralysis of conventional monetary policy. All major central banks' policy interest rates are at or near the effective lower bound (around zero), and leading forecasters believe they will remain there for many years, even in an optimistic growth scenario. If not for the near-zero lower bound, most central banks would now be setting interest rates far below zero, say, at minus 3-4%. This suggests that even as the economy improves, it could be a long time before policymakers are willing to "lift off" from zero and raise rates into positive territory."

Other factors count, but the freezing of interest rates removes the single biggest source of uncertainty. In fact, volatility was already fading before the pandemic as central banks headed for zero. In a delicately put phrase, Rogoff says the uptrend in the real value of the dollar (after inflation) will probably revert to the mean. In other words, the dollar should fall. It can go up first, but "Simply put, there is a fundamental inconsistency over the long run between an ever-rising share of US debt in world markets and an ever-falling share of US output in the global economy."

Now that's good phrasing! Rogoff likens this development to the end of the Bretton Woods fixed rate deal and this time it's China that triggers the re-arrangement. China's economy will be 10% bigger in 2021 than in 2019 (IMF).

Ah, but there he stops. We would add a number of conditions to his forecast. Readers are familiar with these, first and foremost the necessary pre-condition for a reserve currency of the property rights of the individual. We've got it and China doesn't. Second and not unrelated, the vibrancy of the entrepreneurial spirit in the US. China may have it, but can squash it at will. Third, there is a shift in the mindset about debt as illustrated by the Modern Monetary Theory. MMT itself if bilge but its central point—that debt levels don't matter because the sovereign can print more money—has a grip on some thinkers and influencers. Debt worries may be legitimate in a personal and corporate level, but not on the sovereign level. Forget taxpayer capability; all that counts is the willingness to run the printing press. Worries about debt as percentage of GDP are outdated and fuddy-duddy. Again, this is ridiculous and doesn't deserve the word "theory"—just ask Greece and Italy.

Still, there is some price (meaning bond yield) that allows an overindebted country to keep borrowing. This is the context in which confidence and trust in the US economy and its actors will take a very long time to get swept away. Probably years and years, and not soon enough to have an effect on day-to-day FX trading. The market has been able to ignore the twin deficits for decades. They may be an influence today, but not the central ruling factor.

One way to detect any loss of confidence in the US because of the twin deficits (or any other reason) is capital inflow or capital flight, and we get data on that this week in the form of the Treasury Capital flow report late tomorrow. Another metric is incoming direct foreign investment. Unfortunately, the FDI data is pitifully out of date and the best we can do is 2019. The BEA reports "Expenditures by foreign direct investors to acquire, establish, or expand U.S. businesses totaled $194.7 billion (preliminary) in 2019. Expenditures were down 37.7 percent from $312.5 billion (revised) in 2018 and below the annual average of $333.0 billion for 2014–2018. As in previous years, acquisitions of existing businesses accounted for a large majority of total expenditures."

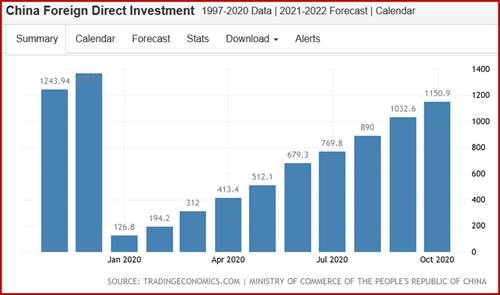

Now look at China, which is indeed catching up. TradingEconomics.com reports FDI rose 6.4% y/y to $115 billion in the January-October 2020 period. So, the US got $195 in 2019 and China got $115 year-to-date in 2020. TradingEconomics has FDI at an increase of "26661 USD Million in the second quarter of 2020," so that's $26.661 billion. Yes, indeed, the trend is for capital to flow to China and less to the US, although the TICS report wills show appetite for non-direct investments in everything from short-term T-bills to long-term bonds. So, Rogoff may not be overly premature in seeing a loss of real sovereign power in the US.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat