Rocky start to the year for Retail Sales

Summary

Retail Sales pulled back more than expected in January, yet the data may say more about the end of last year than the start of this one. The drop in sales came with upward revisions to December and was after solid gains across retailers at year-end. The January data position for weak sales growth in Q1, but consumer fundamentals are still solid.

Pull-back after pull-forward?

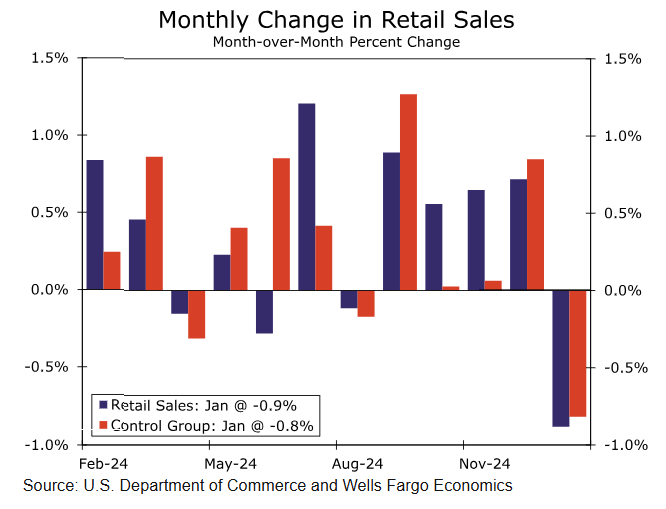

Consumers tightened their belts at the start of the year. Retail sales slipped 0.9% in January, which marks the largest one-month drop in nearly two years. Before we get carried away on consumer-weakness some context is warranted. This decline comes off a recent impressive trend in sales. Retail sales were revised higher in December, now showing a gain of 0.7% (versus the previous reported increase of 0.4%), and comes after large sales gains in five of the past six months. Compared to a year-ago, retail sales are still up a solid 4.2% through January.

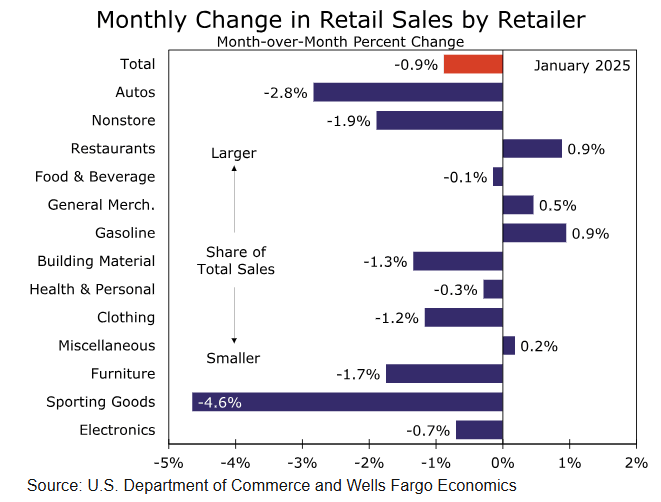

Yet still, the data were weak at the start of the year. Weaker sales were broad based across retailers, with considerable payback in auto (-2.8%), furniture (-1.7%) and building material (-1.3%) sales (chart). Autos and furniture received a year-end boost with solid Q4 data, so January may simply represent some pull-back after a pull-forward in sales, that may be somewhat tariff-fear related. For building material sales, however, January marked the fourth-straight monthly decline.

The largest drop was in a smaller component—sporting goods and hobby stores, which dropped 4.6%. Since the retail sales data are seasonally adjusted, this decline may not simply reflect a holiday-related hang over, but the drop came after the largest monthly gain in December in nearly three years.

Ultimately the January retail sales report may say a lot more about December. All but four categories of retailers saw sales decline in January, and most declines came after large gains at year-end.

There was also poor weather across the U.S. last month, with snow storms across the southern portion of the country. Bad weather will typically keep people home and reduce spending. While that may be partially at play with weaker sales figures at the start of the year, the fact that nonstore retailers (online sales) saw a -1.9% drop in sales and restaurant sales were up 0.9% somewhat works against this theory of people staying put.

The retail sales data are also reported nominally, and when we consider that the core goods CPI rose 0.4% in January, this suggests inflation-adjusted retail sales were likely weaker than the 0.9% drop suggests. This sets us up for a pretty rocky start to the year for spending.

The control group measure, which excludes auto, gas, restaurant and building material store sales and is a good proxy for broad goods spending in GDP accounting, declined 0.8% (chart). These data alone suggest some downside risk to our estimate for real personal consumption expenditures to rise at a 2.8% annualized rate in the first quarter. But, beyond these January retail data we're not seeing significant signs of consumer stress and therefore expect a rebound in the remaining months of the quarter.

While households continue to take on more debt, the household sector is broadly in good financial shape and income growth remains supportive of a decent pace of consumption growth this year. That said, tariff worries are real, and it remains to be seen how consumers concern over tariffs referenced in recent consumer sentiment surveys influences spending in the months ahead.

Author

Wells Fargo Research Team

Wells Fargo