Robust safe haven flow takes Gold to $3,977, defy overbought conditions

- Dollar Index shows resilience, climbs to 98.50.

- Geo political unrest boosts safe haven demand.

- Gold extends bullish move to $3.977.

- Immediate Support sits at $3.950.

- Immediate Resistance sits at $3.978.

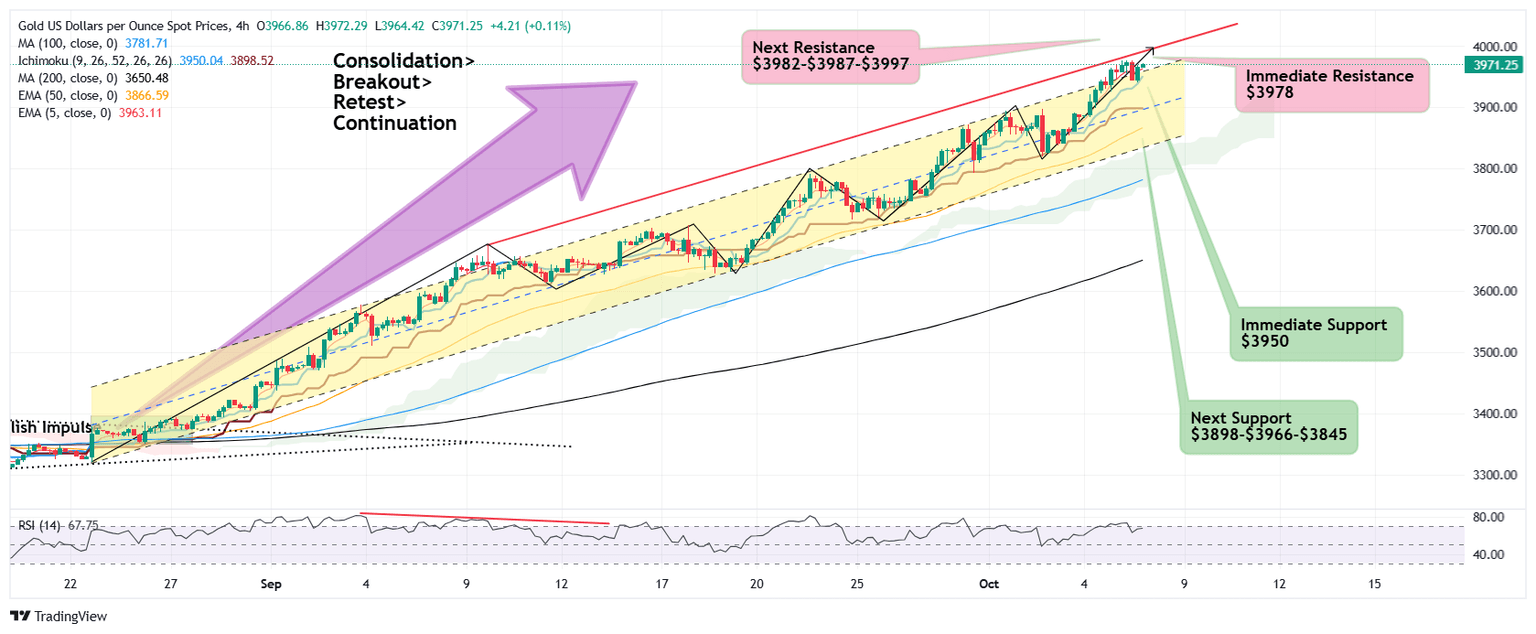

Gold continues to extend prevailing bullish streak setting new record high back to back with hardly any noticeable pullback as any retracement and dips are quickly being absorbed by buyers waiting for value buying on at bargain prices. Today's session has witnessed strong surge to new record high reaching $3977 and a pullback to $3941 followed by rebound to $3972 while immediate hurdle $3978 caps recent gains in consolidation mode.

Fundamental drivers

Strong buying by central banks and record ETF flow boosting structural demand for the metal as safe haven asset as the world prepares to add more Gold to reserves to ward off dollar risks.

Geo political uncertainties across some European countries and Japan elections add to global concerns already on edge from Tariff woes.

Sticky inflation remains pivotal concern for Fed's interest rate decisions and Fed's hawkish or dovish tones will significantly impact further price action for Gold, Treasury bonds and Gold.

The US government shutdown continues with standoff in Congress adding tailwind to Gold.

Technical drivers

Gold is trading inside a broad ascending channel with strong bullish momentum where any pullback is quickly being absorbed and bought by buyers waiting to buy at value bargain. The bullish momentum is defying odds of overbought conditions and has been testing channel resistance where casual downward spikes only work to scare away weak longs enabling strong longs to see further gains and sustainability.

There has been multiple tests of channel mid line and lower boundaries attracting buying intervention again and again.

The current momentum is bullish supported by price stability above immediate support $3950 which if broken, exposes next downside zone $3938-$3935

The only major catalyst with potential for a strong downside correction is extremely overbought RSI reading of 90+ on monthly time frame which may witness a sizeable price correction in near term as these heights are prone to profit booking.

Overall outlook

Immediate rend remains bullish with strong momentum buying any pullback while heights are vulnerable to profit booking and correction.

Markets are adopting very cautious approach and short sellers are miserably trapped.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.