Reserve Bank of Australia Preview: Is the central bank ready to slow the tightening pace?

- The RBA is expected to hike rates by another 50 bps, but a 25 bps move is not out of the table.

- Mounting pressure on consumer sentiment and house prices may take its toll on the RBA.

- AUD/USD is technically bearish, and a below-expected hike may send it to 0.6680.

The Reserve Bank of Australia is having a monetary policy meeting and is expected to pull the trigger for another 50 bps and send the cash rate to 2.35%. If that’s the case, it would be the fourth consecutive hike of such an extent. However, Australian policymakers could choose to decelerate the pace of quantitative tightening, given its impact on the housing market.

It’s all about inflation

The Australian Consumer Price Index surged at an annualized pace of 6.1% in the second quarter of the year, the highest in more than 30 years, according to the Australian Bureau of Statistics. The RBA joined the tightening train late, and soaring interest rates weighed on consumer sentiment. Home loans plunged by 8.5% in July, the second-largest fall in two decades, driving property prices sharply lower. If Australian policymakers maintain the aggressive pace of hikes, it may be found to be the cause of a recession.

The RBA has a triple objective: price stability, full employment and “the economic prosperity and welfare of the people of Australia.”

According to the latest available figures, the Australian Unemployment Rate fell to 3.4% in July, its lowest in almost fifty years. However, the participation rate was also down, from 66.8% to 66.4%, resulting in net employment in the same month falling by 40.9K, a sign that hiring may be cooling.

AUD/USD possible scenarios

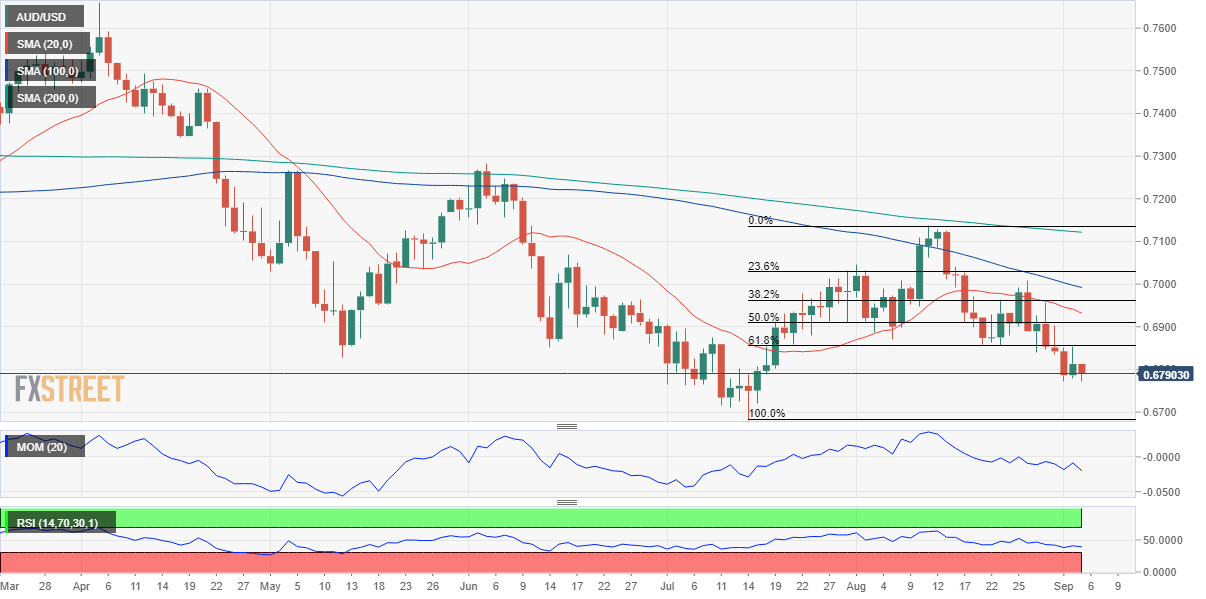

Ahead of the decision, the American dollar leads the FX board, with AUD/USD is trading just below the 0.6800 figure. The pair has been on a selling spiral ever since 0.7136 in August and seems poised to test the June low at 0.6680. The 61.8% retracement of such a rally is providing strong static resistance at 0.6855, where the pair topped last Friday.

Should the RBA slow the pace of tightening and choose to hike by 25 bps, the pair would likely fall towards the aforementioned 0.6680 level. A break below the latter should be the first move towards a steeper slump, eyeing in the upcoming days the 0.6650 figure.

On the other hand, market players have already priced in a 50 bps move. If the market mood improves ahead of the release and the greenback eases, the pair could reach the 0.6850/60 region, where sellers should reject the advance.

Finally, if the accompanying statement is extremely hawkish, letting market players believe that Australian policymakers are going to tame inflation regardless of its effects on economic growth, the pair has room to break higher and advance towards 0.6900/40.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.