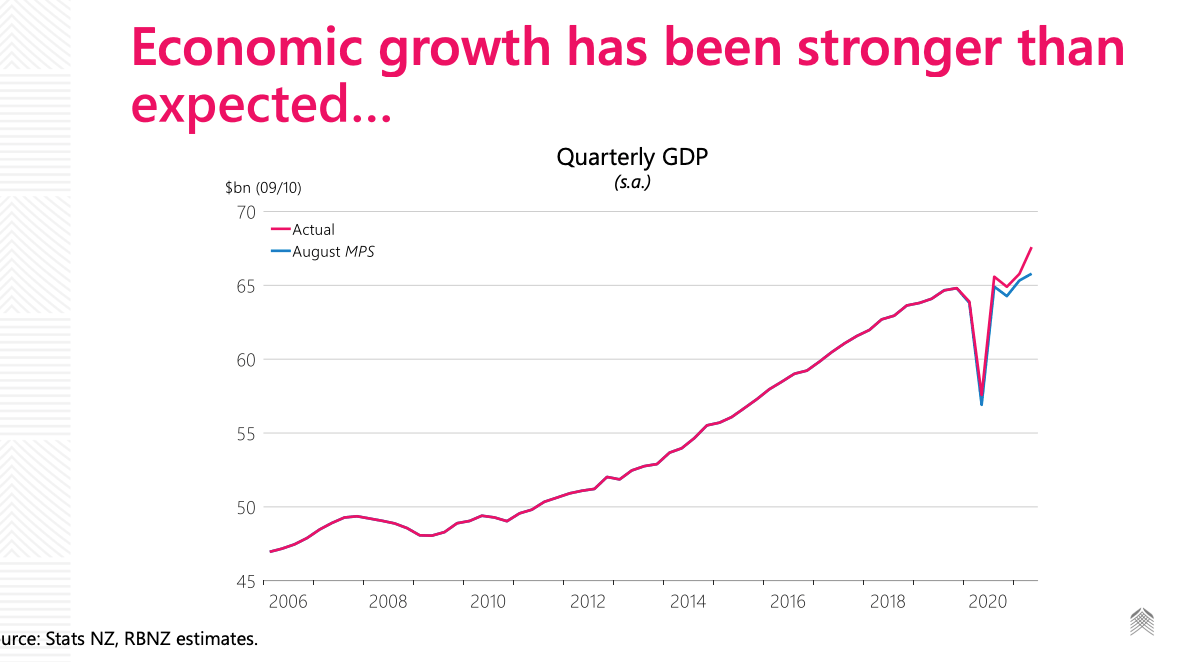

RBNZ: Dovish hike, but revising growth higher

The latest RBNZ hike saw a 25bps rate hike as expected. There had been outside talk of a 50bps hike, but in the end, the RBNZ decided to take their time and go for a 25bps hike. However, the RBNZ were more hawkish in their forward guidance.

Faster rate hikes to come

The RBNZ see the official cash rate at 0.94% in March 2022 (vs 0.86% previously, 2.14% in December 2022(1.62%), and 2.30% in March 2023 (previously 1.77%). That’s the positive news. However, the RBNZ does see some headwinds ahead.

Latest COVID-19 lockdowns

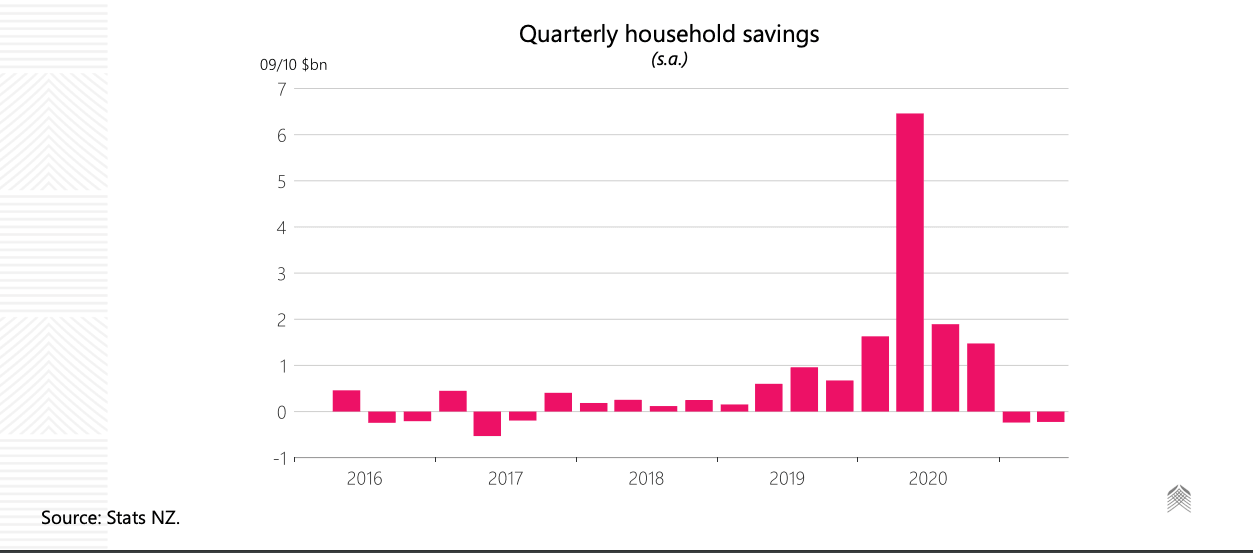

The RBNZ recognised the impact of the more prolonged restrictions in Auckland, Northland, and Wakato and the continued ‘level 2’ restrictions throughout the rest of the country. However, restrictions are now being lifted at the end of November and the committee noted that underlying economic strength was supported by aggregate household and business balance sheet strength.

Also, accumulated savings have not yet unwound.

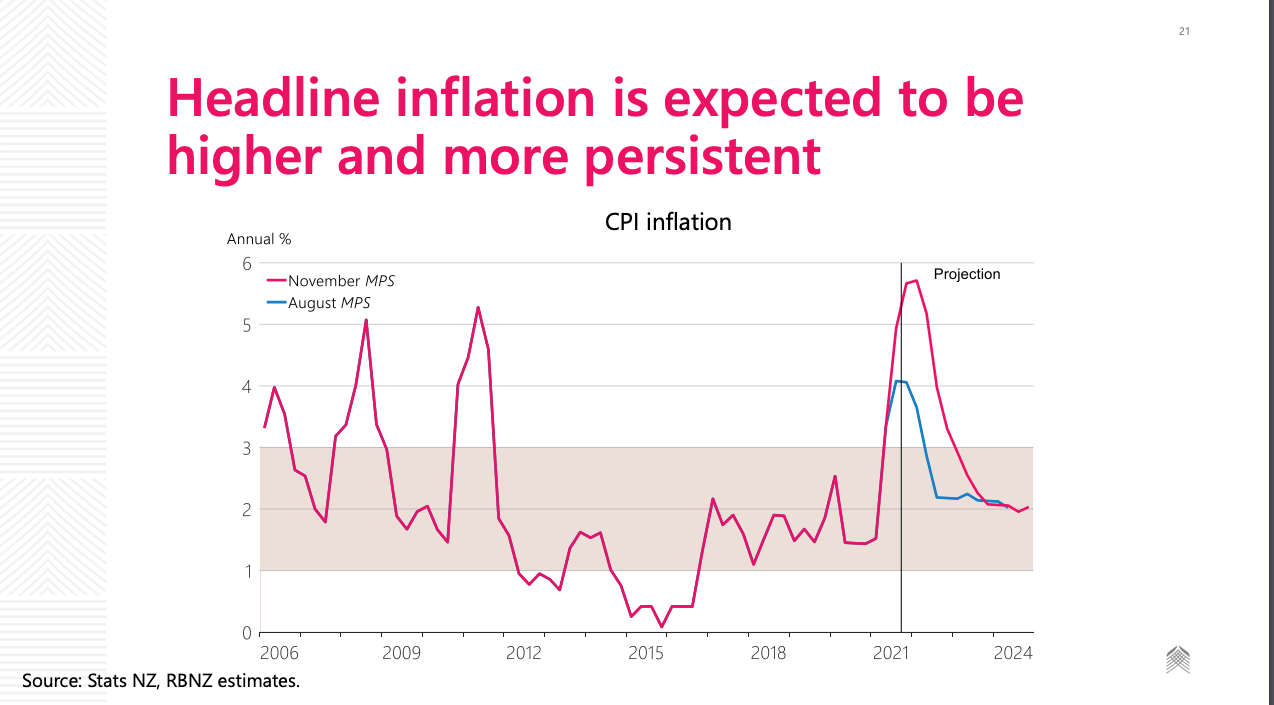

Inflation

The RBNZ is in the transitory camp and sees headline inflation rising above 5% in the near term before returning towards 2% in the next 2 years. Interestingly, the Committee assessed that near-term risks to inflation are skewed to the upside, and discussed the risk that higher near-term inflation could become embedded in price-setting behaviour. However, the RBNZ noted that medium-term measures provide a better gauge of whether inflation expectations remain anchored. They considered these remaining close to the target midpoint.

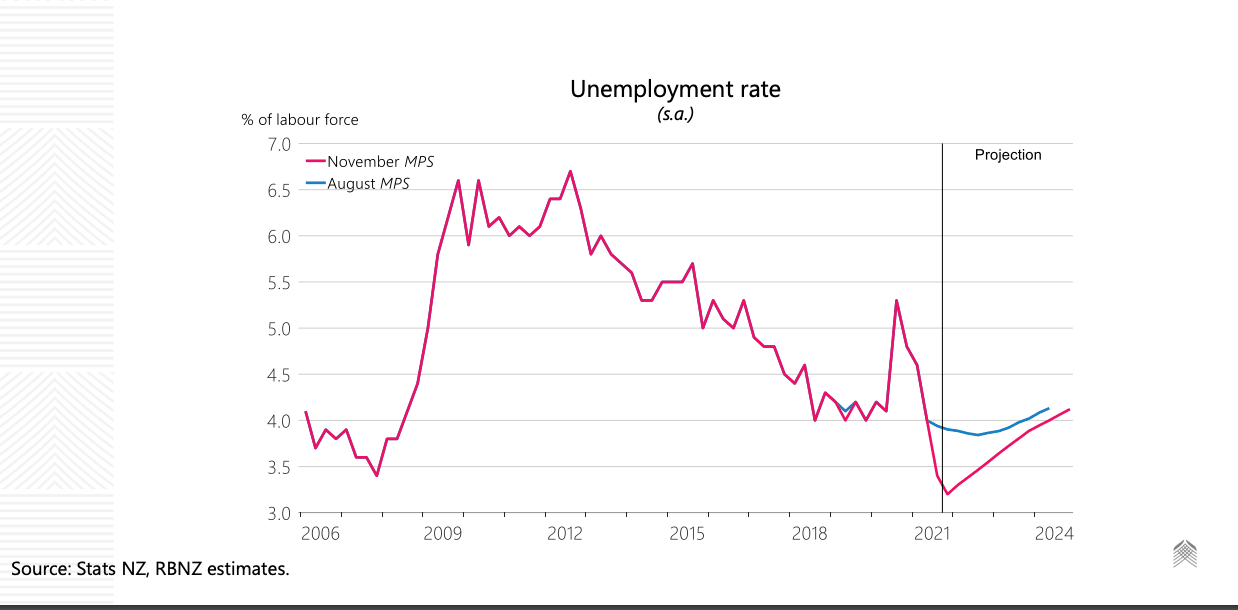

Labour market

The RBNZ considered that employment is above its maximum sustainable level with unemployment at decade lows. The RBNZ fear that it is actually easier to leave NZ than arrive, so some of the labour force may end up going overseas.

Takeaway

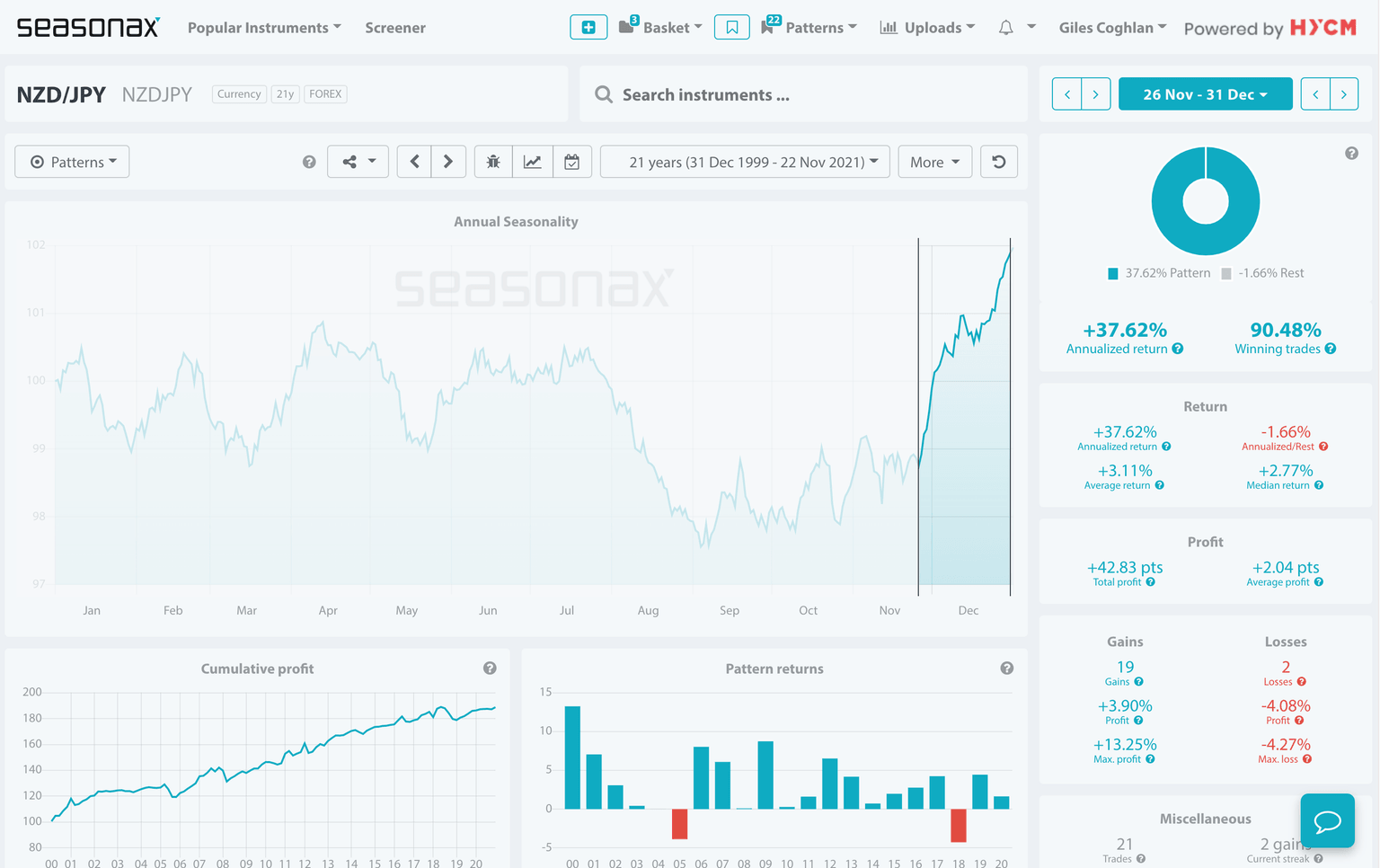

In balance, the RBNZ is still on a hawkish bias. The seasonals are very solid for the NZDJPY pair. Check them out below. You can see that there is a solid seasonal bias for gains. Over the last 10 years, the NZDJPY pair has risen nine times out of ten.

Europe also looks to be heading into another wave of COVID-19 so EURNZD shorts also look attractive from a diverging outlook point of view.

Both currency pairs, NZDJPY and EURNZD, are available to trade at HYCM, as well as other instruments in forex and other asset classes.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.