RBA poised for rate cut as inflation cools, but how far will it go?

As the Reserve Bank of Australia (RBA) prepares for its upcoming monetary policy meeting, expectations of a further interest rate cut on Tuesday are growing increasingly unanimous among major banks and traders. With inflation continuing to cool and economic activity remaining subdued, the central bank finds itself under renewed pressure to support the domestic economy.

Core inflation slides toward target band

Core inflation in Australia has now edged closer to the lower end of the RBA’s 2–3% target range, providing a stronger rationale for further monetary easing.

According to the Australian Bureau of Statistics, the monthly Consumer Price Index (CPI) rose by 2.1% in the 12 months to May, a deceleration from April’s 2.4% print. Likewise, the trimmed mean inflation—a key measure watched by the RBA—slowed to 2.4% in May from 2.8% the previous month.

These developments reinforce the case for another 25 basis point cut, which would take the official cash rate from 3.85% to 3.6%. Major Australian banks have already factored this in, aligning with growing market consensus that sees further easing on the horizon.

Market pricing and the possibility of consecutive cuts

Financial markets are even more bullish on rate cuts than analysts. According to The Guardian, traders are pricing in back-to-back 25 basis point cuts in both July and August, with a third potential cut by November. This scenario would lower the cash rate to 3.1% by year-end.

However, not all experts agree with this trajectory.

While two cuts in the coming months appear likely, many economists believe that a third on Tuesday might be excessive, especially if the inflation trend stabilizes. A recent Wall Street Journal commentary highlighted that the RBA might prefer to pause after two reductions and reassess the inflation outlook before committing to additional easing.

May cut set the stage, but caution remains

The RBA already trimmed rates by 25 basis points in May, citing mounting global uncertainties—particularly from U.S. tariffs and geopolitical tensions—as major risks to the economic outlook. At the time, the central bank also debated a more aggressive 50 basis point cut, reflecting heightened concern about both domestic softness and external shocks.

Minutes from the May policy meeting, revealed that “a reduction in the cash rate could be warranted on the basis of either domestic or global factors, and that the combination of these might therefore warrant a 50 basis point reduction.”

Back then, fears of a global recession were pronounced. U.S.-China trade tensions were peaking, and dysfunction in the American bond market raised alarm bells. JPMorgan Chase CEO Jamie Dimon even suggested the probability of a U.S. recession could be as high as 60%.

Since then, however, global financial markets have stabilized. Equity markets have rallied, and fears of an imminent U.S. downturn have subsided. This calmer backdrop gives the RBA space to focus more on domestic data rather than reacting pre-emptively to international turbulence.

Australian domestic economy still sluggish

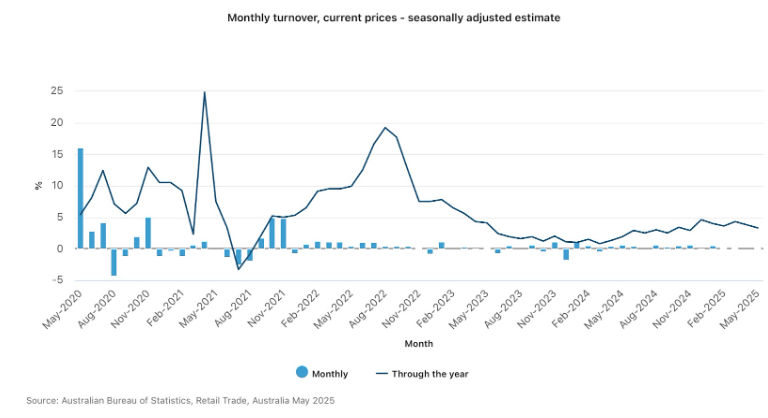

Despite the more favorable external environment, Australia’s domestic economy remains soft. Retail sales rose just 0.2% in May, following a flat reading in April. On an annual basis, sales grew by 3.3%—the slowest pace since November 2024—indicating tepid consumer spending.

Consumer sentiment in Australia remains subdued despite recent policy support.

The latest Westpac-Melbourne Institute survey showed a marginal 0.5% rise in the sentiment index for June, following a 2.2% increase in May. However, underlying indicators suggest that optimism is still lacking. Expectations for personal finances over the next 12 months declined by 1.9%, while the broader economic outlook fell by 2.4%.

While the RBA’s May rate cut and the easing of inflation have provided some relief, their positive effects on consumer confidence appear limited. Pessimism continues to dominate, weighed down by weak domestic demand, stagnant retail activity, and persistent global uncertainties. These trends highlight the fragile nature of the recovery and suggest that households remain cautious, with little conviction that conditions will materially improve in the near term.

What to expect on Tuesday and how it might affect AUD/USD

With inflation continuing to ease and consumer demand showing persistent weakness, the Reserve Bank of Australia is widely expected to deliver a second consecutive rate cut at its meeting on Tuesday. However, the trajectory of monetary policy beyond July remains uncertain. The RBA has shifted back to a data-dependent approach, and the upcoming inflation update on July 30 is likely to play a crucial role in determining whether further easing—possibly in August—will be justified.

While some market participants are pricing in an aggressive easing cycle, the central bank may adopt a more cautious stance, especially if incoming data suggest that inflation is stabilizing or if there are signs of a recovery in domestic activity. A wait-and-see approach may become more appealing as global financial conditions improve and the worst recession fears begin to fade.

Source: ActivTrader

From a technical perspective, the Australian dollar has come under renewed pressure ahead of the decision.

The AUD/USD is currently trading near 0.6506, having retreated sharply after failing to clear resistance around 0.6580 earlier this month. This rejection, coupled with weakening short-term momentum, reflects increasing bearish sentiment in the market. The Ichimoku Cloud setup shows that the pair has dipped below the Tenkan-sen and is testing the Kijun-sen, which often signals further downside risk in the short term. Though the price remains above the green cloud—suggesting the broader trend is still intact—the narrowing of the cloud itself hints at a potential loss of directional conviction.

The Relative Strength Index (RSI) sits just below the neutral 50 level, further confirming a lack of bullish momentum. A break below immediate support at 0.6485, followed by a move beneath the lower boundary of the cloud near 0.6446, would increase the likelihood of a deeper correction toward the 0.6350 area. On the flip side, only a decisive move back above 0.6580 would restore confidence in the uptrend and signal a possible shift in sentiment in favor of the Australian dollar.

Stay up to date with what's moving and shaking on the world's markets and never miss another important headline again! Check ActivTrades daily news and analyses here.

Stay up to date with what's moving and shaking on the world's markets and never miss another important headline again! Check ActivTrades daily news and analyses here.

Author

Carolane de Palmas

ActivTrades

Carolane graduated with a Masters in Corporate Finance & Financial Markets and got the AMF Certification (Financial Markets Regulator in France). Afterward, she became an independent trader, investing mostly in European and American stocks/indices.