RBA: Past peak inflation?

The RBA thinks it has reached peak inflation and is citing monthly CPI data suggesting that inflation has peaked. Remember going into the meeting we pointed out that the headline and core inflation readings were still climbing and there was not an obvious sign of peaking. This is significant because the RBA sees signs of inflation peaking and is the main reason for the dovish reaction to the latest decision.

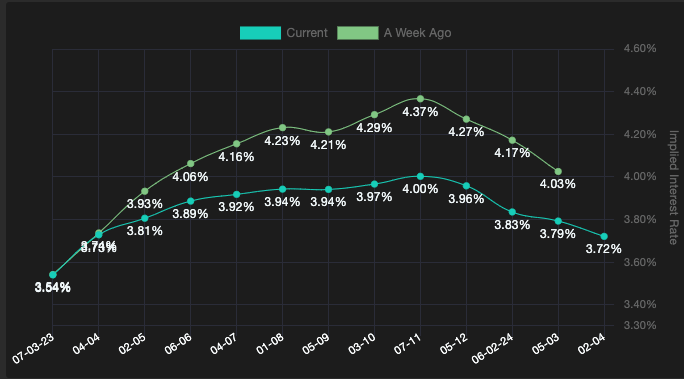

The RBA was widely expected to hike by 25bps which it did bringing rates to 3.60%. However, confidence regarding inflation showing signs of peaking has now seen a reduction in peak rate expectations. The terminal rate is now seen at 4.00% by STIR markets:

Has inflation really peaked?

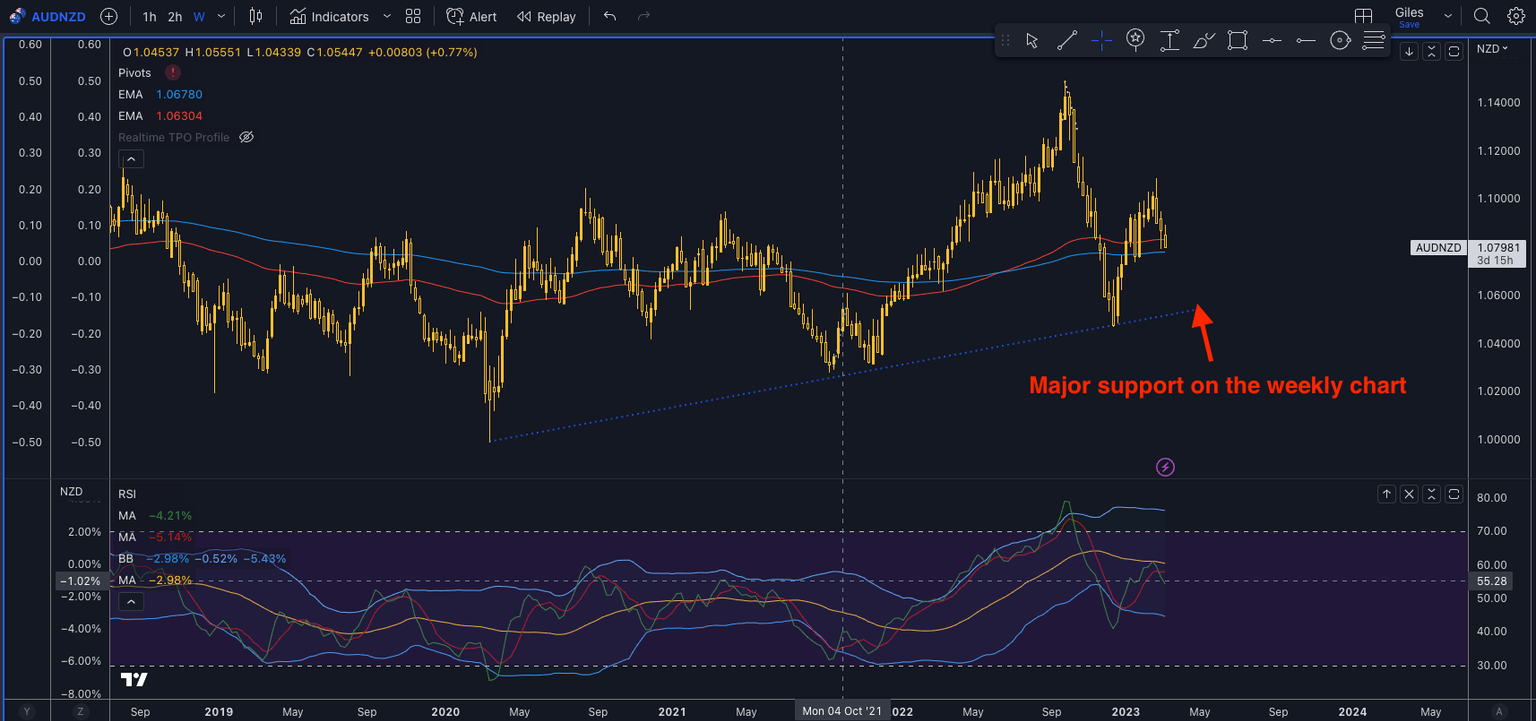

Shortly after the meeting Westpac’s Bill Evans forecasts, in contrast, to STIR markets, that the RBA will still need to hike in April and May. Bill Evans noted the inflation outlook is still too high and it is too soon to pause in April. So, this means that incoming inflation data will be absolutely crucial for the Australian dollar moving forward. High inflation prints will once again prompt calls for a more aggressive RBA that would lift the AUDNZD pair. So, incoming inflation data is very important.

The main takeaways

The main point to take from the RBA monetary policy statement is that the RBA still sees the need for further rate hikes, but it is uncertain about how tight the labor market is, how households will manage with higher rates, and the actual level inflation will settle at. Furthermore, the RBA is uncertain about the path of the global economy and how other central banks’ hiking actions will impact it. So, moving forward to look for AUD moves keep an eye on labour data, inflation data, Chinese data, and US monetary policy.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.