RBA minutes: Don’t get ahead of the Fed!

If there is one thing the RBA wants to avoid it is this: outpacing the Fed in any recovery. However, the latest RBA minutes show the central bank needs to accept that the AUD is set to get stronger. The RBA repeated in the minutes that they expect to have to give ‘very significant’ monetary support for sometime. As some suspected the RBA have also revealed why they extended their bond purchase program. It was to do with keeping the AUD weak. They said in the minutes, as a little tell, that if the central bank had allowed QE to end in April the AUD would have risen.

Well, the AUD has risen anyway. The RBA will have to accept AUD strength.

There is a long line of central banks who have had to accept that it is very hard to fight market forces. The Swiss National Bank and the Reserve Bank of New Zealand in recent history have realised currency ‘wars’ can only be fought for so long. In the end, it is probably better not to even attempt starting them. The SNB’s attempt at the 1.2000 EURCHF peg is the stand out example. Just take a look at the chart when the SNB removed the peg in January 2015. The PBOC wisely stepped aside from any rumoured battle last year.

Balancing act

The RBA has a delicate balancing act to perform. The RBA can’t afford to get ahead of other central banks as it will send the AUD rocketing higher. So, if the RBA started tapering bond purchases or bringing interest rate rises forward it would ignite the AUD. The problem with that is it will then damage both its export and its jobs market. So, expect it to keep on with the mantra that there will be ‘no interest rates hike until 2024’ and they will want to toe the global party line of ‘no tapering!’. The RBA will keep trying to stay behind the major central banks as a smaller player on the field.

AUD/JPY

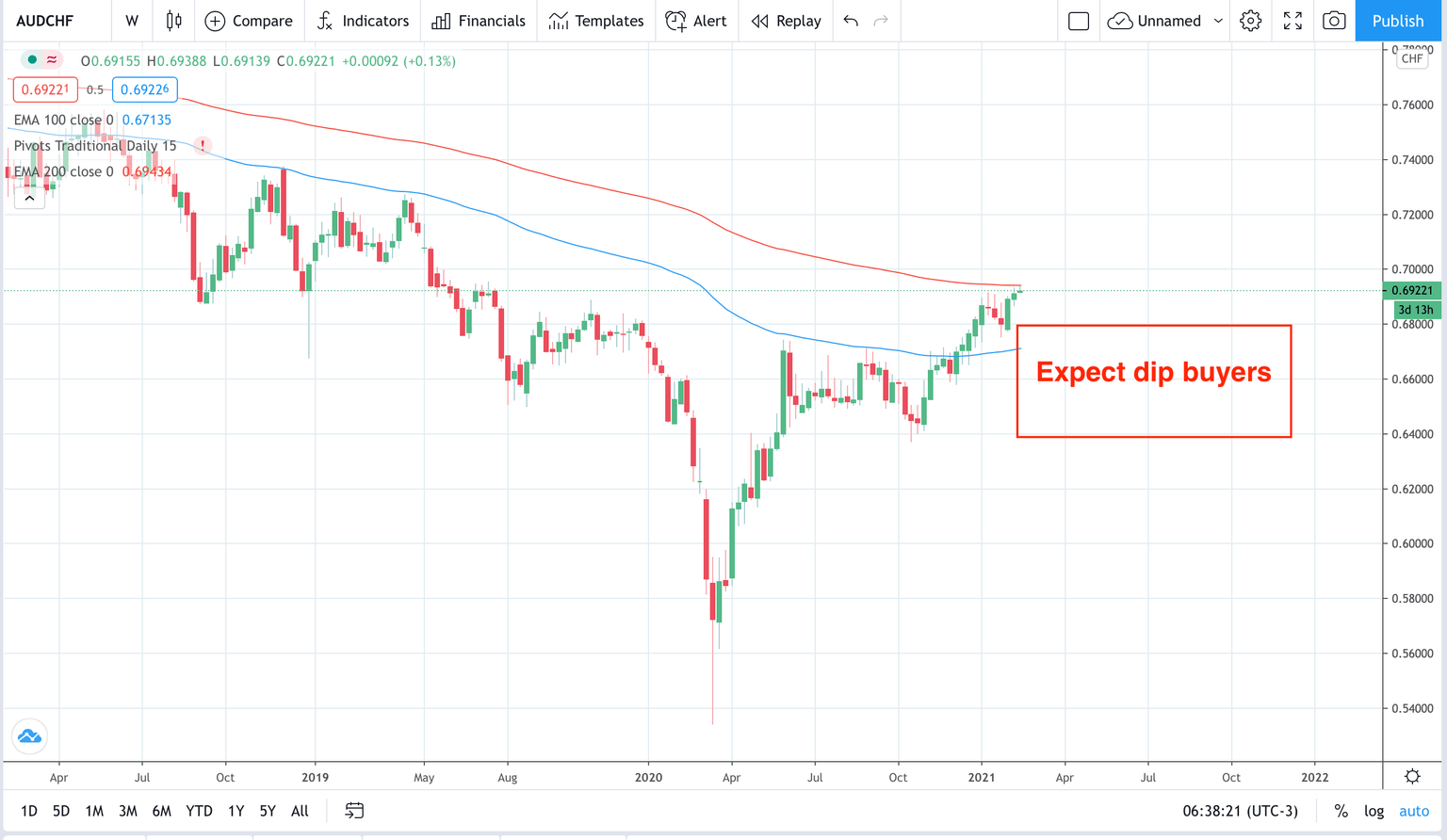

Meanwhile, this means that the reflation narrative of buying the AUDJPY dip remains the base case. The same is true for the AUDCHF as well.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.