Powell Preview: Rethink because of the war? Not so fast, Fed set to remain on track, dollar to rise

- Fed Chair Powell is set to testify as fighting goes on in Ukraine.

- The bank is projected to raise interest rates in its upcoming meeting, but the scale is unclear.

- Conveying a "business as usual" message could boost the dollar.

Will the war halt the Federal Reserve's plans to raise rates? That is the question for markets, which are awaiting a critical testimony from Fed Chair Jerome Powell. The world's most powerful central banker has been deliberating whether to increase borrowing costs by the standard 25 bps or by a double dose of 50 bps. Russia's invasion of Ukraine cast fresh doubts.

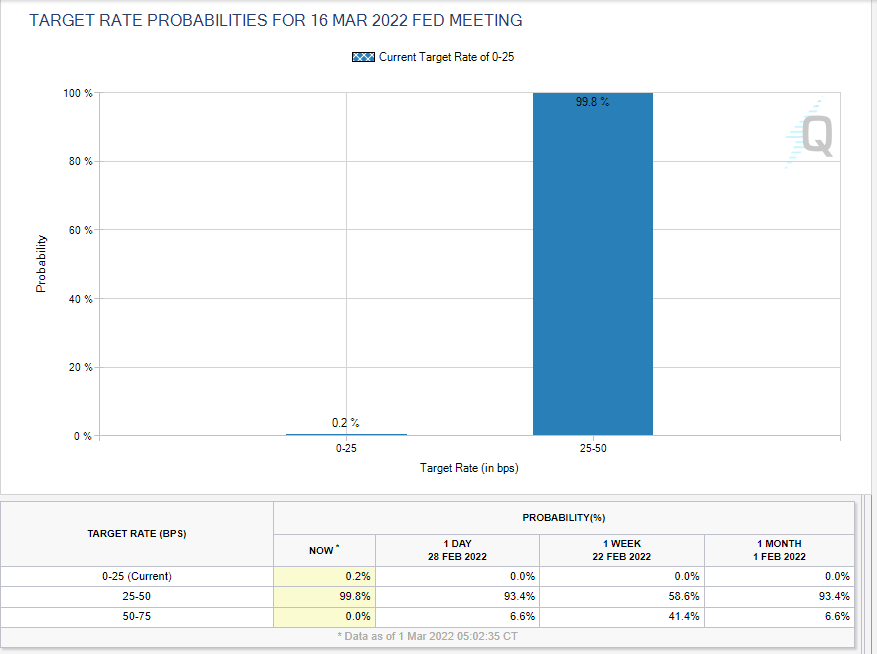

Bond markets have substantially shifted their expectations regarding the Fed – from a roughly 50-50 chance of a big move to curb US inflation – amid a steaming-hot job market – to allowing for the possibility of no move at all.

Source: CME Group

Fed background

The Fed is set to convene in roughly two weeks and deliver its first pandemic era rate hike. Powell's testimony on Capitol Hill is his last opportunity to shape market expectations ahead of that meeting, as the Fed soon enters its "blackout period."

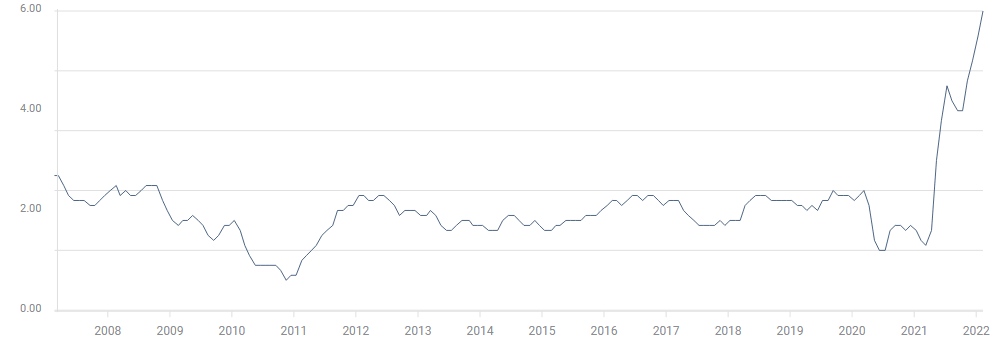

Annual inflation has hit 7.5% in January while core prices – followed more closely by the bank – are up 6%, showing how elevated energy costs and supply-chain issues have turned into broader price rises. The bank is behind the curve.

Source: FXStreet

According to the latest Nonfarm Payrolls report, another reason for higher prices is that employees have more money in their pockets after a yearly increase of 5.7% in Average Hourly Earnings. It also showed a bustling labor market.

All in all, the Fed is nearing its goal of full employment, while price stability seems to need some reining in. Apart from tapering down its bond-buying scheme, officials at the Fed have signaled to raise rates – even by a double-dose of 50 bps.

And then came Russia. President Vladimir Putin's decision to invade Ukraine has raised fears of a global slowdown. Western sanctions seemed weak at first, but then seemed to bite. The Russian ruble was left in rubble, down to less than one US cent, losing a quarter of its value in a single day.

If the world is busy with war, it could slow activity and even trigger a recession – thus prompting the Fed to refrain from tighter policy. On the other hand, if Russia cuts off energy supplies to Europe, Americans would also pay higher prices. As seen in recent months, imported inflation can creep into the costs of everything.

What will Powell signal?

At this point, there is no evidence of immediate harm to the US economy, which is firing on all cylinders. Uncertainty about Russia could cause the Fed to refrain from a double-dose hike – which was far from a certainty – but still continue raising rates. The Fed's focus is now on inflation, not on supporting the economy after covid.

Therefore, there is a good chance that Powell will acknowledge the risks coming from the conflict, but just add it to a long list of uncertainties and continue with his plans. A message that the Fed remains on track to raise rates as planned.

Such a "business as usual" message would boost the Fed's chances of more aggressive action down the road and support the dollar. The greenback has given back some of its gains against major pairs and is losing ground to commodity currencies, amid cooling expectations. Powell can change that.

Final thoughts

Powell is facing lawmakers who hear complaints about rising inflation from their constituents and also from the media. They will likely put pressure on Powell to act to push prices lower, regardless of the war.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.