Powell legal challenge could be bearish for the Greenback

The December employment report did not change in the least the narrative about the US labor market: steady growth and a “low fire, low hire” labour market. The most helpful data point was a tick down in the unemployment rate, which unexpectedly fell to 4.4% (from 4.6%). This confirms that this unusual economy is nowhere near a traditional recession.

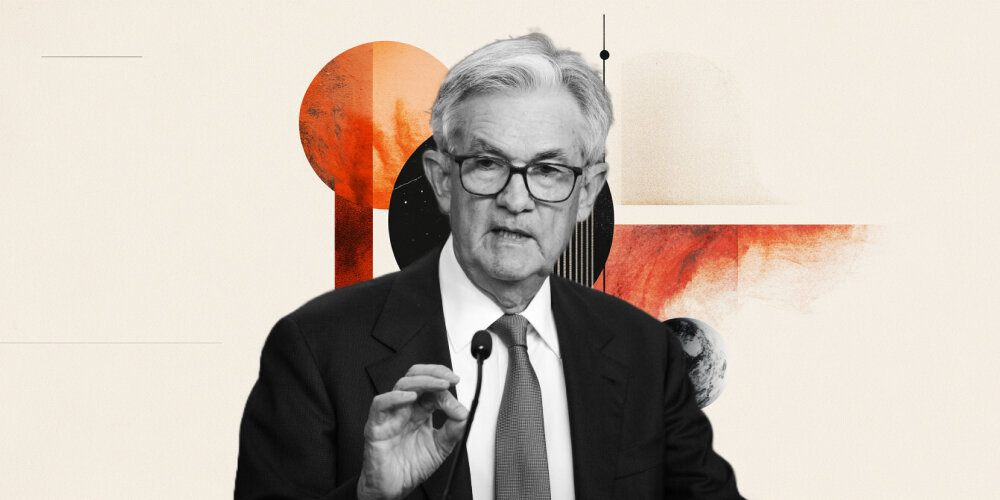

This week's inflation data is perhaps the most important report in months. Much of the consensus around the path of Federal Reserve cuts has been built on the expectations that inflation is headed down, however gently, and needs to be confirmed by this week's data. Investors will, of course, also be keeping abreast of the news surrounding the Powell legal challenge.

With Powell’s term set to end soon, and following Trump’s incessant verbal attacks, this seems more about leverage than any clear evidence of criminality, and even some Republicans have expressed their concerns.

The broader fear is that the move could continue to erode Fed autonomy, which may raise long-term inflation expectations and be bearish for the greenback.

Author

Matthew Ryan, CFA

Ebury

Matthew is Global Head of Market Strategy at FX specialist Ebury, where he has been part of the strategy team since 2014. He provides fundamental FX analysis for a wide range of G10 and emerging market currencies.