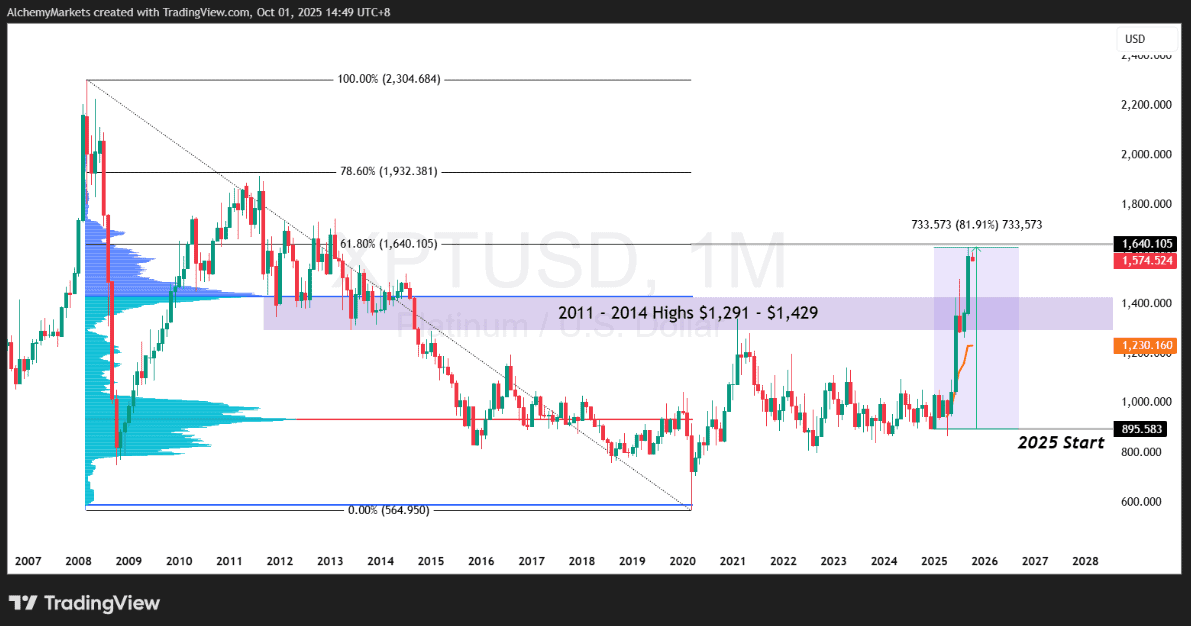

Platinum emerges as 2025’s power play, soaring 81%

I’ll admit it — I was so focused on gold’s steady grind that I nearly missed platinum’s breakout. While gold and silver drew all the attention, platinum quietly became the star. XPTUSD is up 81.91% this year, surpassing silver (+64.32%) and gold (+37.81%).

At this point, platinum is sitting right into the 61.8% retracement at $1,640. Beneath it, the critical levels to track are:

-

$1,230 – Anchored VWAP from Jan 2025 (must hold to keep the rally intact).

-

$1,429 – 2011–2014 highs / VAH of the last major down-leg.

These levels matter right now — if platinum fails to hold them, the move risks unwinding fast.

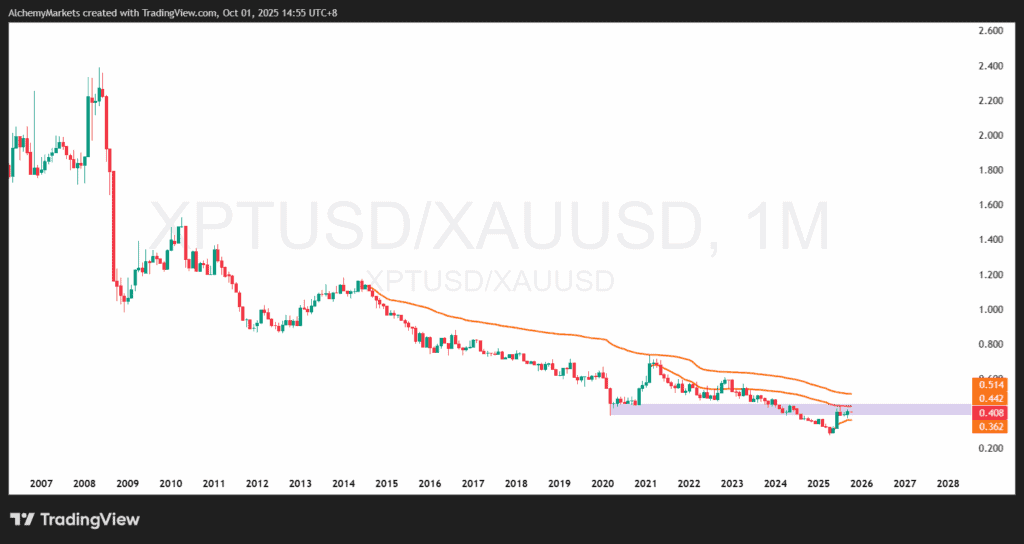

Platinum vs Gold: The ratio story

The big shift hasn’t just been on absolute price. Since May, platinum has exploded higher relative to gold.

But this ratio is now pressing into a heavy resistance zone at $0.389–$0.461. Three anchored VWAPs define the challenge:

-

$0.362 – From May 2025, when outperformance began. Needs to hold as base.

-

$0.442 – From March 2021 decline. Acts as immediate cap.

-

$0.514 – From the 2014 decline. Long-term resistance still overhead.

The issue now is whether platinum can sustain this surge against gold, or if the ratio stalls at these anchored levels.

The overbought warning

Momentum indicators are stretched across the board:

-

Platinum: Daily RSI 77 · Weekly 73 · Monthly 79.

-

Gold: Daily 80 · Weekly 90 · Monthly 92.

-

Silver: Daily 83 · Weekly 87 · Monthly 81.

All three metals are in overheated territory, which raises the risk of sharp pullbacks.

Why Platinum rallied so hard

The strength of this move comes from multiple forces working together:

-

Supply deficit: WPIC projects a 966,000-ounce shortfall in 2025.

-

China stockpiling: Imports far above industrial need suggest strategic hoarding.

-

Relative value: Trading at less than half of gold’s price, platinum drew contrarian flows.

-

Industrial use cases: Catalyst substitution, hydrogen fuel cells, and jewellery demand added fuel.

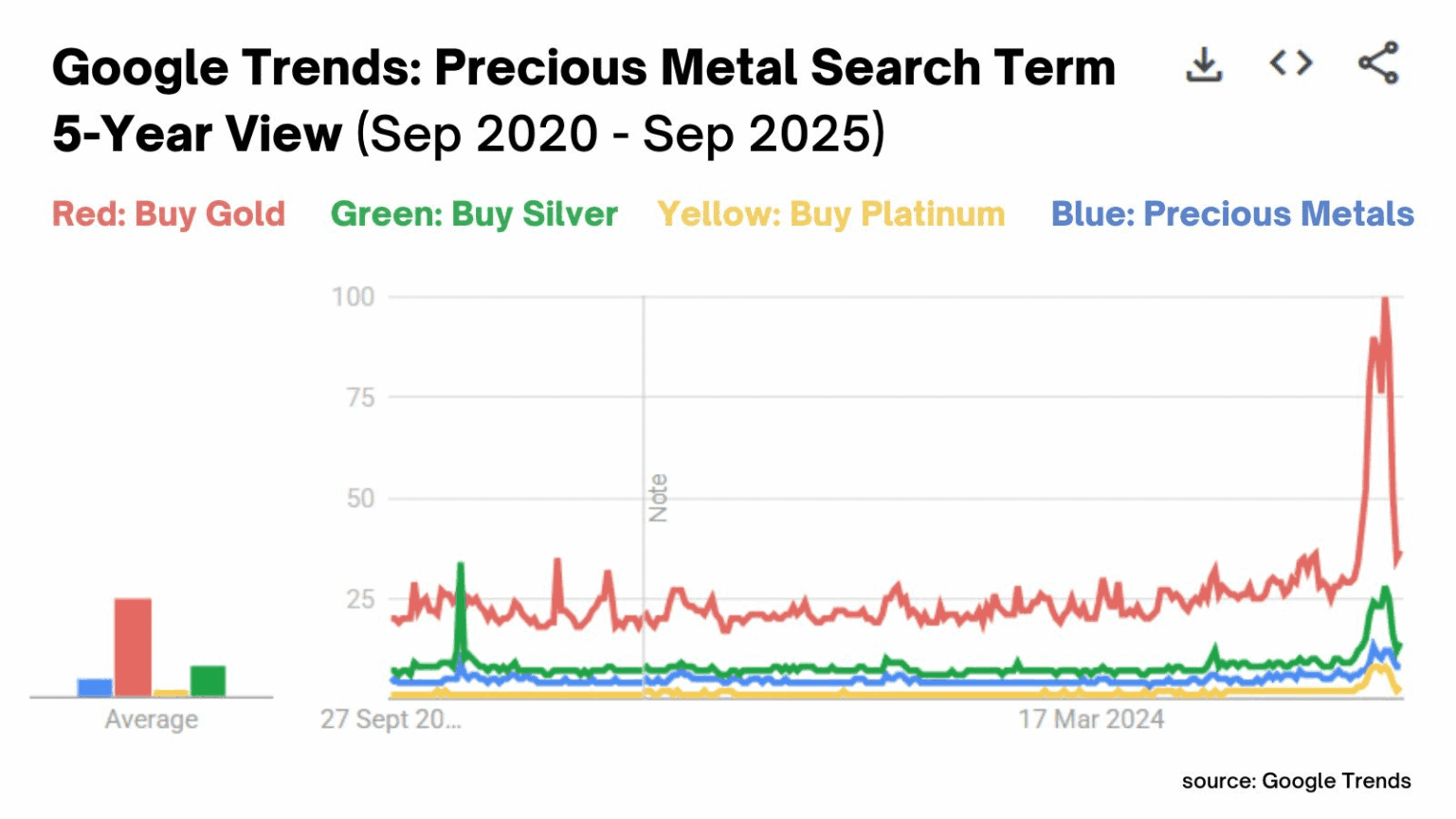

Rising hype in search trends

It isn’t just institutions and industry. Retail curiosity is exploding too. Google Trends shows searches for “buy gold,” “buy silver,” “buy platinum,” and “precious metals” at multi-year highs.

Platinum’s run has clearly caught broader attention, which often signals late-cycle exuberance.

Takeaway

Platinum has been 2025’s powerhouse — undervalued for years, then suddenly ripping past gold and silver. But with the 61.8% Fib level overhead and RSI flashing overbought, this is not the time to chase.

If platinum holds its anchored VWAPs and ratio base, the rally can extend. If not, this breakout risks turning into another missed opportunity that fades as quickly as it arrived.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.